Question: Please look at my answer and compare before you submit. Thank you. Problem 10-54 (LO 10-2, LO 10-3) (Algo) Convers Corporation (calendar year-end) acquired the

Please look at my answer and compare before you submit.

Thank you.

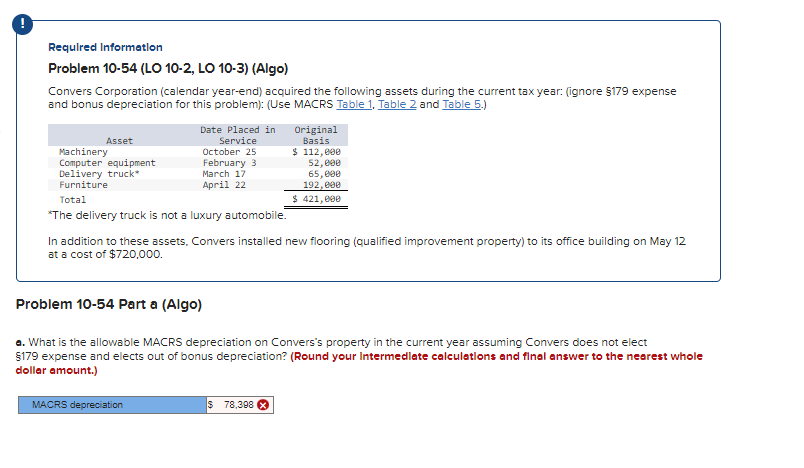

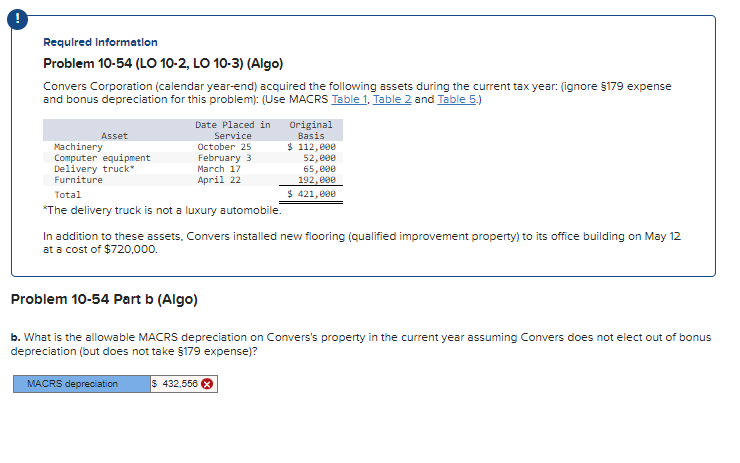

Problem 10-54 (LO 10-2, LO 10-3) (Algo) Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore S179 expense and bonus depreciation for this problem): (Use MACRS Table 1. and irle uenvery untis ilul a luxury duturtiunie. In addition to these assets, Convers installed new flooring (qualified improvement property) to its office building on May 12 at a cost of $720,000. Problem 10-54 Part a (Algo) a. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect 179 expense and elects out of bonus depreciation? (Round your Intermedlate calculetions and final answer to the nearest whole doller amount.) Requlred Informatlon Problem 10-54 (LO 10-2, LO 10-3) (Algo) Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore sifg expense and bonus depreciation for this problem): (Use MACRS Table 1 . Table 2 and - I ne deirvery truck is not a Iuxury automodie. In addition to these assets, Convers installed new flooring (qualified improvement property) to its office building on May 12 at a cost of $720,000. Poblem 10-54 Part b (Algo) T. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus lepreciation (but does not take 179 expense)? Problem 10-54 (LO 10-2, LO 10-3) (Algo) Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore S179 expense and bonus depreciation for this problem): (Use MACRS Table 1. and irle uenvery untis ilul a luxury duturtiunie. In addition to these assets, Convers installed new flooring (qualified improvement property) to its office building on May 12 at a cost of $720,000. Problem 10-54 Part a (Algo) a. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect 179 expense and elects out of bonus depreciation? (Round your Intermedlate calculetions and final answer to the nearest whole doller amount.) Requlred Informatlon Problem 10-54 (LO 10-2, LO 10-3) (Algo) Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore sifg expense and bonus depreciation for this problem): (Use MACRS Table 1 . Table 2 and - I ne deirvery truck is not a Iuxury automodie. In addition to these assets, Convers installed new flooring (qualified improvement property) to its office building on May 12 at a cost of $720,000. Poblem 10-54 Part b (Algo) T. What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not elect out of bonus lepreciation (but does not take 179 expense)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts