Question: Please look at the attached screenshot for the question ABC is an Australian firm. It looks to establish operations in NZ. It expects the following

Please look at the attached screenshot for the question

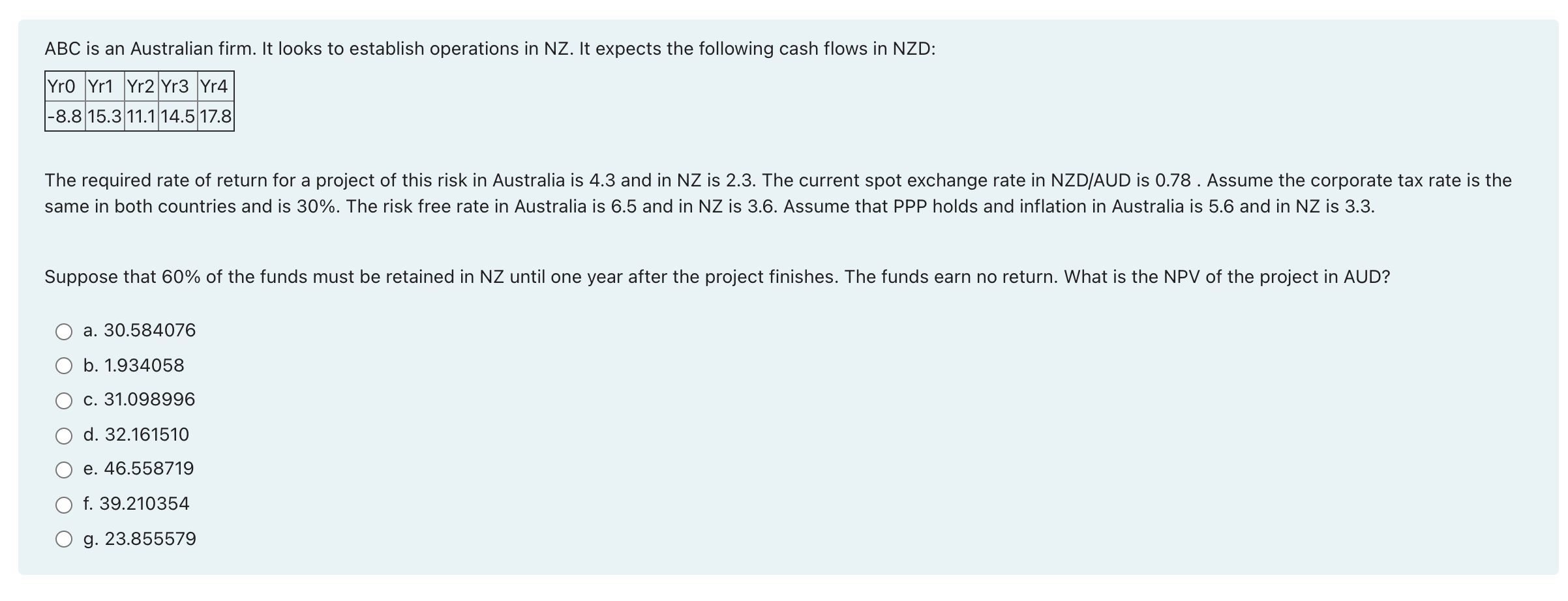

ABC is an Australian firm. It looks to establish operations in NZ. It expects the following cash flows in NZD: Yro Yr1 Yr2 Yr3 Yr4 |-8.8 15.3 11.1 14.5 17.8 The required rate of return for a project of this risk in Australia is 4.3 and in NZ is 2.3. The current spot exchange rate in NZD/AUD is 0.78. Assume the corporate tax rate is the same in both countries and is 30%. The risk free rate in Australia is 6.5 and in NZ is 3.6. Assume that PPP holds and inflation in Australia is 5.6 and in NZ is 3.3. Suppose that 60% of the funds must be retained in NZ until one year after the project finishes. The funds earn no return. What is the NPV of the project in AUD? a. 30.584076 b. 1.934058 c. 31.098996 d. 32.161510 e. 46.558719 f. 39.210354 g. 23.855579 ABC is an Australian firm. It looks to establish operations in NZ. It expects the following cash flows in NZD: Yro Yr1 Yr2 Yr3 Yr4 |-8.8 15.3 11.1 14.5 17.8 The required rate of return for a project of this risk in Australia is 4.3 and in NZ is 2.3. The current spot exchange rate in NZD/AUD is 0.78. Assume the corporate tax rate is the same in both countries and is 30%. The risk free rate in Australia is 6.5 and in NZ is 3.6. Assume that PPP holds and inflation in Australia is 5.6 and in NZ is 3.3. Suppose that 60% of the funds must be retained in NZ until one year after the project finishes. The funds earn no return. What is the NPV of the project in AUD? a. 30.584076 b. 1.934058 c. 31.098996 d. 32.161510 e. 46.558719 f. 39.210354 g. 23.855579

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts