Question: Please look at the attached screenshot for the question Use these data for the following 3 You work for a firm whose home currency is

Please look at the attached screenshot for the question

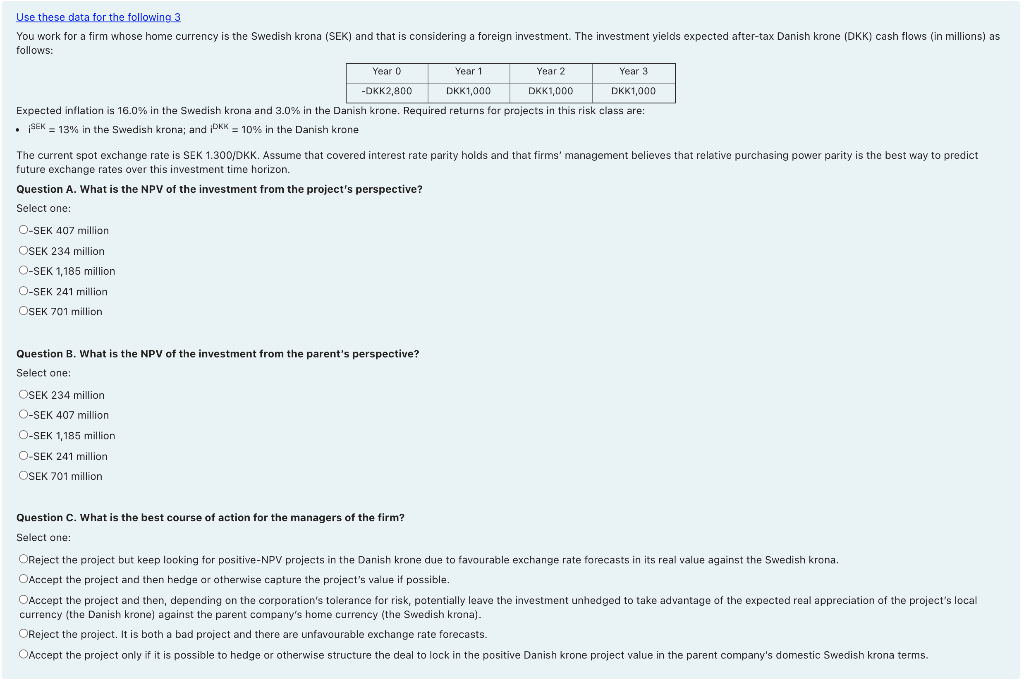

Use these data for the following 3 You work for a firm whose home currency is the Swedish Krona (SEK) and that is considering a foreign investment. The investment yields expected after-tax Danish Krone (DKK) cash flows (in millions) as follows: Year o Year 1 Year 2 Year 3 -DKK2,800 DKK1,000 DKK1,000 DKK1,000 Expected inflation is 16.0% in the Swedish krona and 3.0% in the Danish Krone. Required returns for projects in this risk class are: SEK = 13% in the Swedish krona; and iPKK = 10% in the Danish Krone best way to predict The current spot exchange rate is SEK 1.300/DKK. Assume that covered interest rate parity holds and that firms' management believes that relative purchasing power parity is future exchange rates over this investment time horizon. Question A. What is the NPV of the investment from the project's perspective? Select one: O-SEK 407 million OSEK 234 million O-SEK 1,185 million O-SEK 241 million OSEK 701 million Question B. What is the NPV of the investment from the parent's perspective? Select one: OSEK 234 million O-SEK 407 million O-SEK 1,185 million O-SEK 241 million OSEK 701 million Question C. What is the best course of action for the managers of the firm? Select one: OReject the project but keep looking for positive-NPV projects in the Danish krone due to favourable exchange rate forecasts in its real value against the Swedish krona. Accept the project and then hedge or otherwise capture the project's value if possible. OAccept the project and then, depending on the corporation's tolerance for risk, potentially leave the investment unhedged take advantage of the expected real appreciation of the project's local currency (the Danish krone) against the parent company's home currency (the Swedish krona). OReject the project. It is both a bad project and there are unfavourable exchange rate forecasts. OAccept the project only if it is possible to hedge or otherwise structure the deal to lock in the positive Danish Krone project value in the parent company's domestic Swedish krona terms

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts