Question: Please look at the dropdown options and fill out the yellow boxes. This is a screenshot of the question so I am not sure why

Please look at the dropdown options and fill out the yellow boxes. This is a screenshot of the question so I am not sure why you can't see at. Please zoom in if necessary. Thank you.

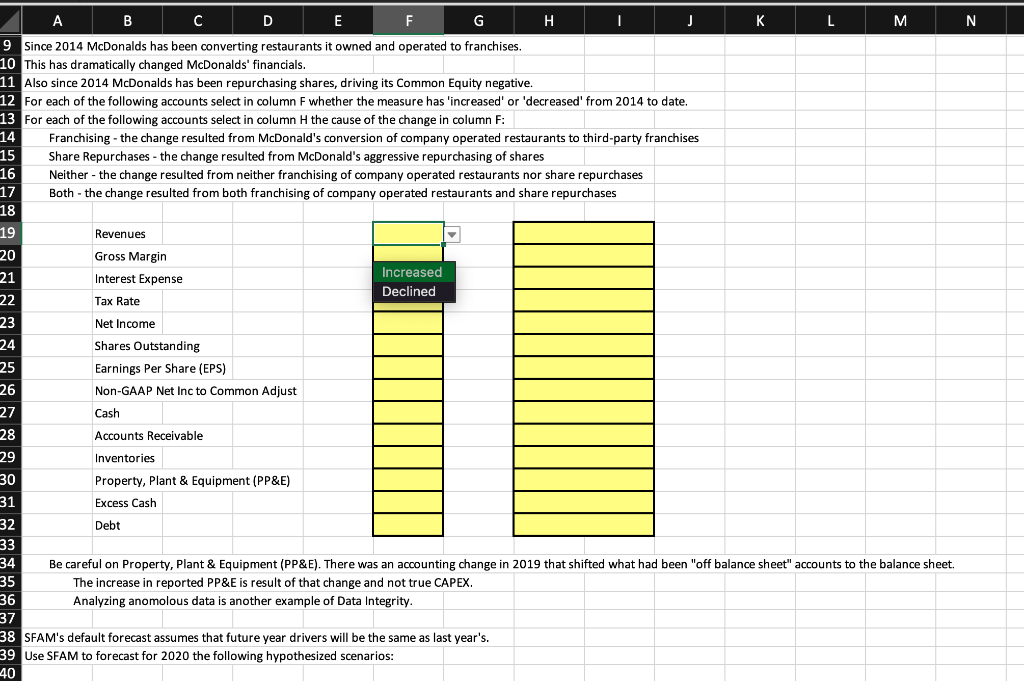

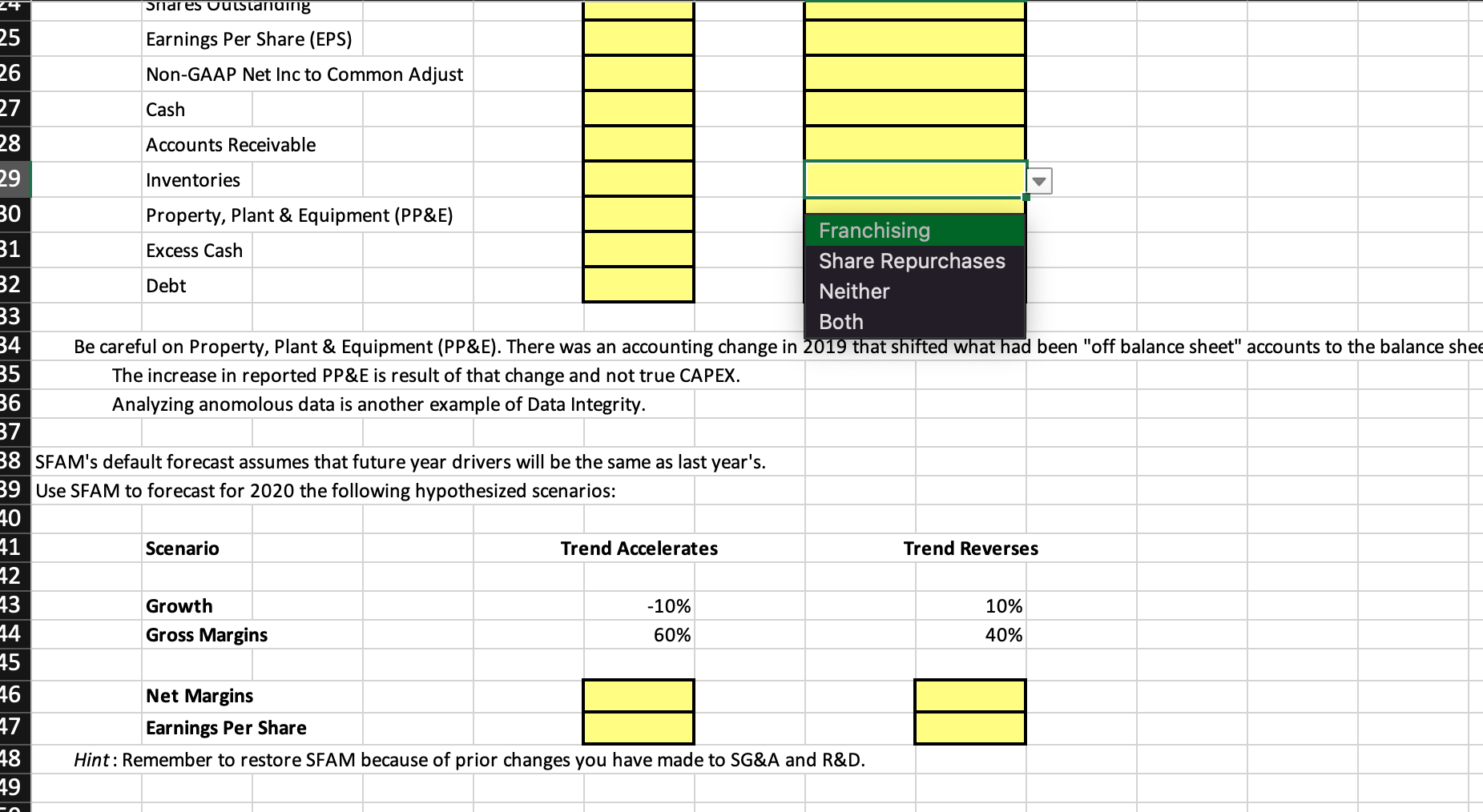

N A B D E F G H I J K L M 9 Since 2014 McDonalds has been converting restaurants it owned and operated to franchises, 10 This has dramatically changed McDonalds' financials. 11 Also since 2014 McDonalds has been repurchasing shares, driving its Common Equity negative. 12 For each of the following accounts select in column F whether the measure has 'increased' or 'decreased' from 2014 to date. 13 For each of the following accounts select in column H the cause of the change in column F: 14 Franchising - the change resulted from McDonald's conversion of company operated restaurants to third-party franchises 15 Share Repurchases - the change resulted from McDonald's aggressive repurchasing of shares 16 Neither - the change resulted from neither franchising of company operated restaurants nor share repurchases 17 Both - the change resulted from both franchising of company operated restaurants and share repurchases 18 19 Revenues 20 Gross Margin 21 Interest Expense Increased Declined 22 Tax Rate 23 Net Income 24 Shares Outstanding 25 Earnings Per Share (EPS) 26 Non-GAAP Net Inc to Common Adjust 27 Cash 28 Accounts Receivable 29 Inventories 30 Property, Plant & Equipment (PP&E) 31 Excess Cash 32 Debt 33 34 Be careful on Property, Plant & Equipment (PP&E). There was an accounting change in 2019 that shifted what had been "off balance sheet" accounts to the balance sheet. 35 The increase in reported PP&E is result of that change and not true CAPEX. 36 Analyzing anomolous data is another example of Data Integrity. 37 38 SFAM's default forecast assumes that future year drivers will be the same as last year's. 39 Use SFAM to forecast for 2020 the following hypothesized scenarios: 40 24 Snares Uutstanding 25 Earnings Per Share (EPS) 26 Non-GAAP Net Inc to Common Adjust 27 Cash 28 Accounts Receivable 29 Inventories 30 Property, Plant & Equipment (PP&E) Franchising 31 Excess Cash Share Repurchases 32 Debt Neither 33 Both 34 Be careful on Property, Plant & Equipment (PP&E). There was an accounting change in 2019 that shifted what had been "off balance sheet" accounts to the balance shee 35 The increase in reported PP&E is result of that change and not true CAPEX. 36 Analyzing anomolous data is another example of Data Integrity. 37 38 SFAM's default forecast assumes that future year drivers will be the same as last year's. 39 Use SFAM to forecast for 2020 the following hypothesized scenarios: 10 41 Scenario Trend Accelerates Trend Reverses 42 43 Growth -10% 10% 44 Gross Margins 60% 40% 45 46 Net Margins 47 Earnings Per Share 48 Hint: Remember to restore SFAM because of prior changes you have made to SG&A and R&D. 49 HBHB6RB9 N A B D E F G H I J K L M 9 Since 2014 McDonalds has been converting restaurants it owned and operated to franchises, 10 This has dramatically changed McDonalds' financials. 11 Also since 2014 McDonalds has been repurchasing shares, driving its Common Equity negative. 12 For each of the following accounts select in column F whether the measure has 'increased' or 'decreased' from 2014 to date. 13 For each of the following accounts select in column H the cause of the change in column F: 14 Franchising - the change resulted from McDonald's conversion of company operated restaurants to third-party franchises 15 Share Repurchases - the change resulted from McDonald's aggressive repurchasing of shares 16 Neither - the change resulted from neither franchising of company operated restaurants nor share repurchases 17 Both - the change resulted from both franchising of company operated restaurants and share repurchases 18 19 Revenues 20 Gross Margin 21 Interest Expense Increased Declined 22 Tax Rate 23 Net Income 24 Shares Outstanding 25 Earnings Per Share (EPS) 26 Non-GAAP Net Inc to Common Adjust 27 Cash 28 Accounts Receivable 29 Inventories 30 Property, Plant & Equipment (PP&E) 31 Excess Cash 32 Debt 33 34 Be careful on Property, Plant & Equipment (PP&E). There was an accounting change in 2019 that shifted what had been "off balance sheet" accounts to the balance sheet. 35 The increase in reported PP&E is result of that change and not true CAPEX. 36 Analyzing anomolous data is another example of Data Integrity. 37 38 SFAM's default forecast assumes that future year drivers will be the same as last year's. 39 Use SFAM to forecast for 2020 the following hypothesized scenarios: 40 24 Snares Uutstanding 25 Earnings Per Share (EPS) 26 Non-GAAP Net Inc to Common Adjust 27 Cash 28 Accounts Receivable 29 Inventories 30 Property, Plant & Equipment (PP&E) Franchising 31 Excess Cash Share Repurchases 32 Debt Neither 33 Both 34 Be careful on Property, Plant & Equipment (PP&E). There was an accounting change in 2019 that shifted what had been "off balance sheet" accounts to the balance shee 35 The increase in reported PP&E is result of that change and not true CAPEX. 36 Analyzing anomolous data is another example of Data Integrity. 37 38 SFAM's default forecast assumes that future year drivers will be the same as last year's. 39 Use SFAM to forecast for 2020 the following hypothesized scenarios: 10 41 Scenario Trend Accelerates Trend Reverses 42 43 Growth -10% 10% 44 Gross Margins 60% 40% 45 46 Net Margins 47 Earnings Per Share 48 Hint: Remember to restore SFAM because of prior changes you have made to SG&A and R&D. 49 HBHB6RB9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts