Question: Please look at the instructions and answer them all Assignment: Journal Entries On October 1 Ali Jay established her own music story known as Ali's

Please look at the instructions and answer them all

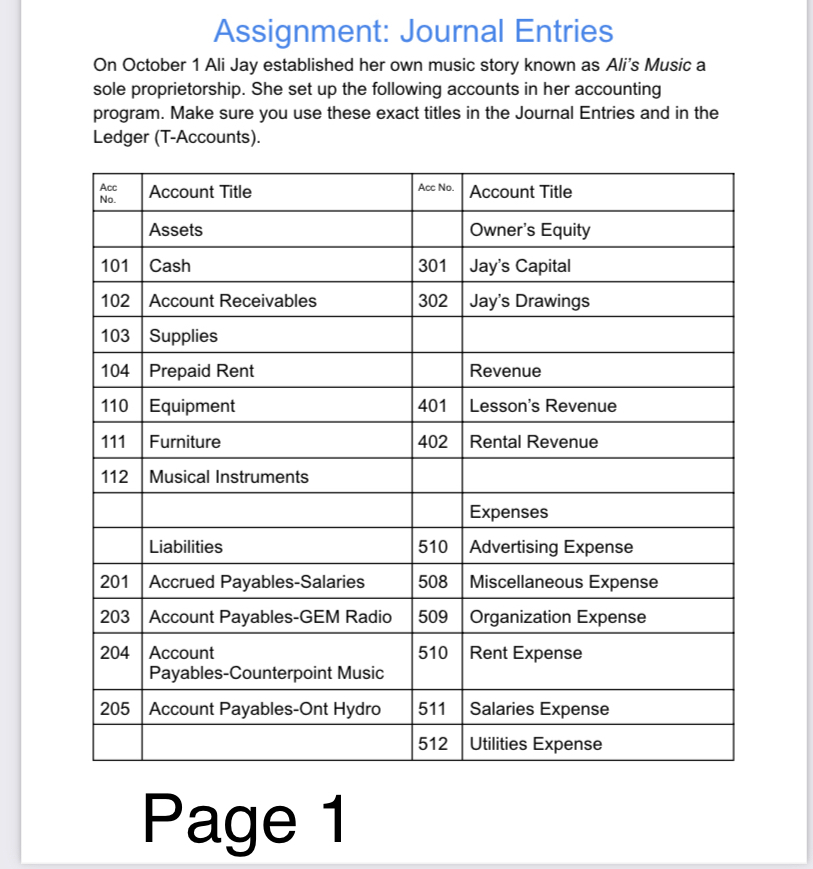

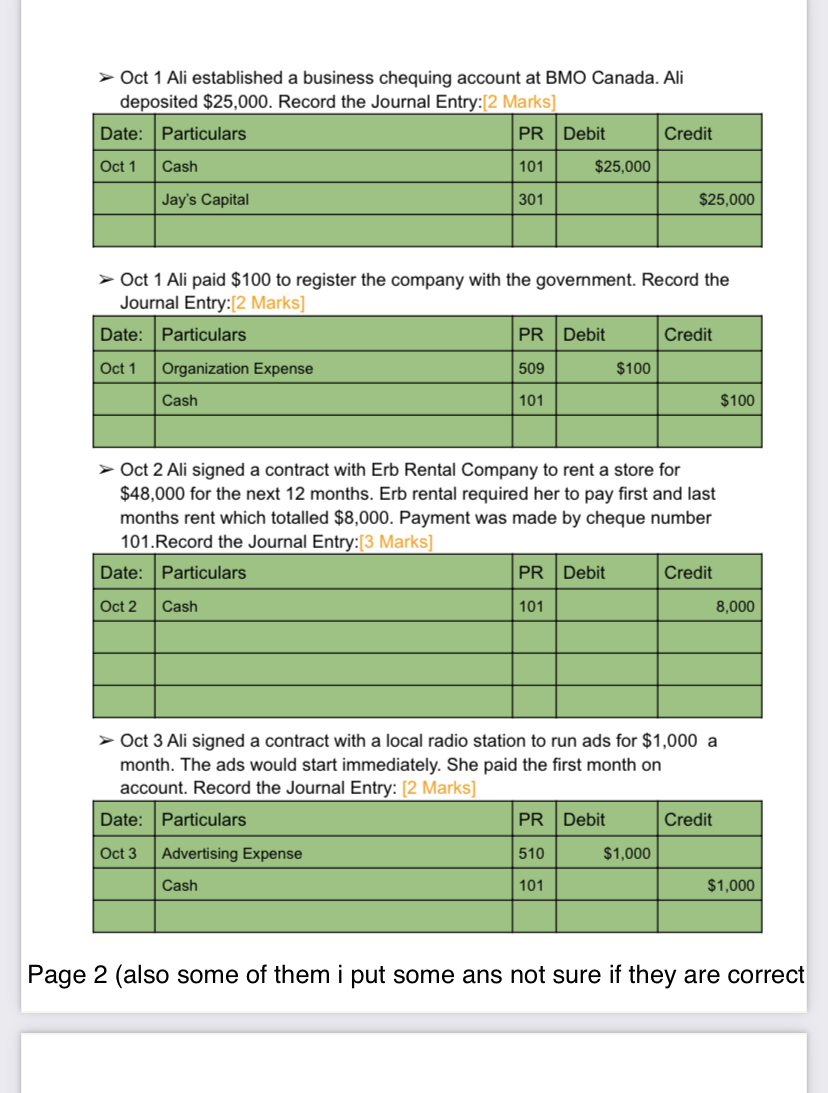

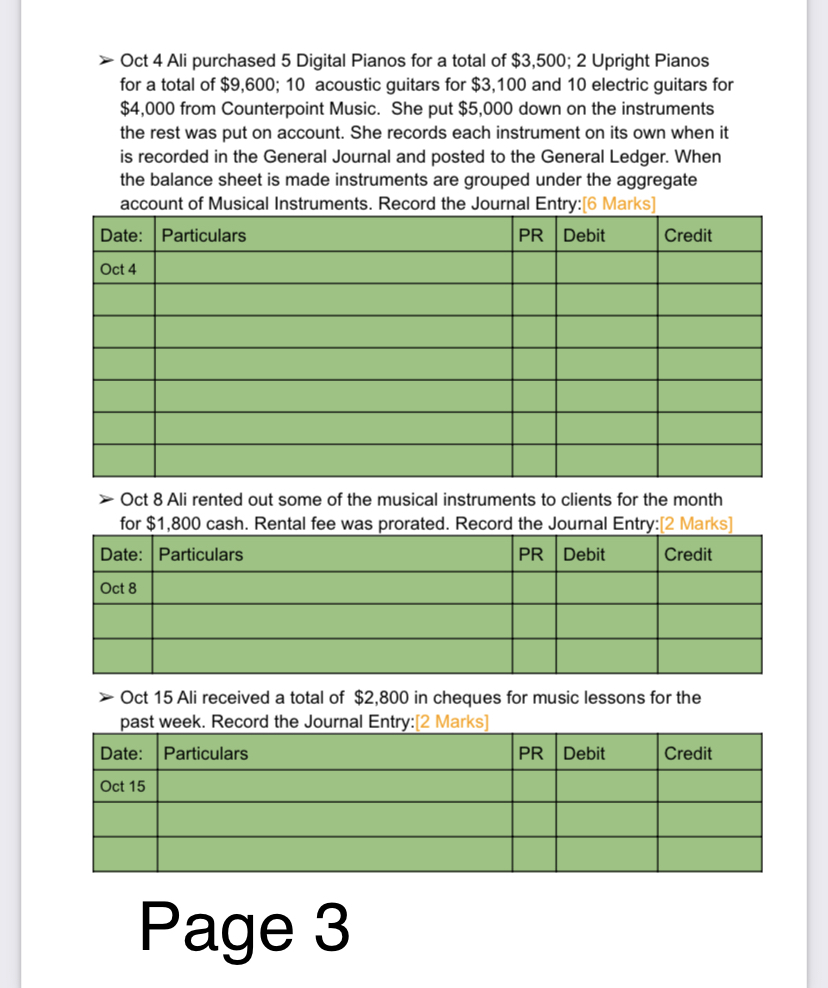

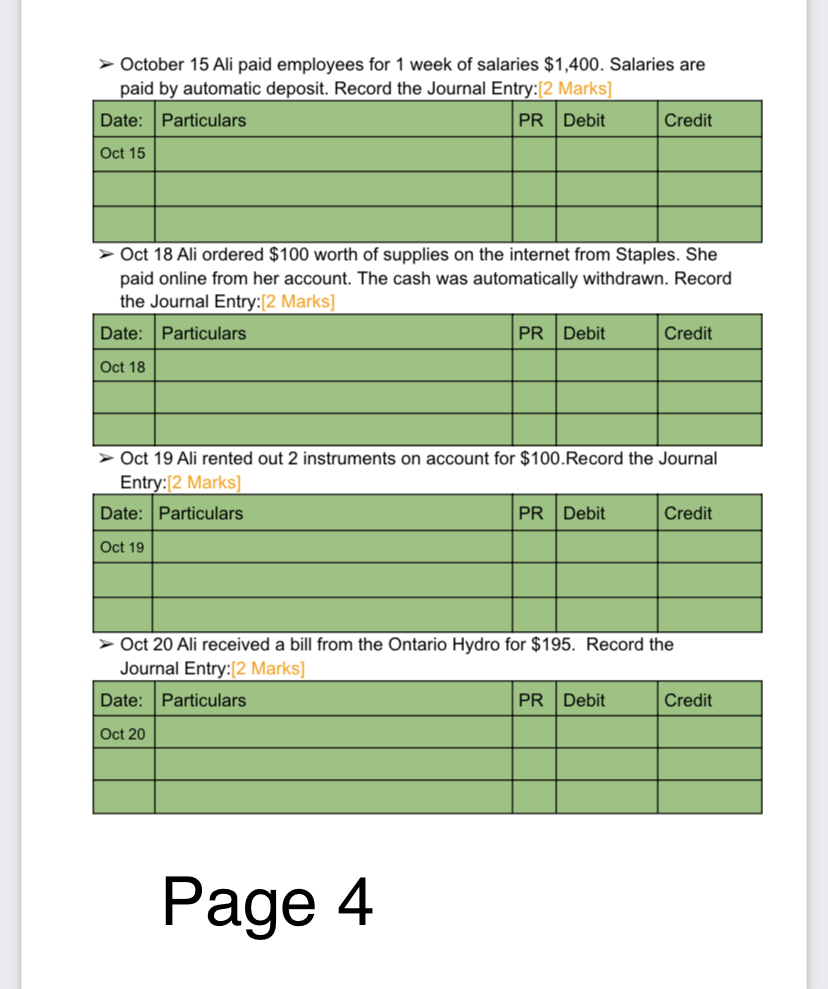

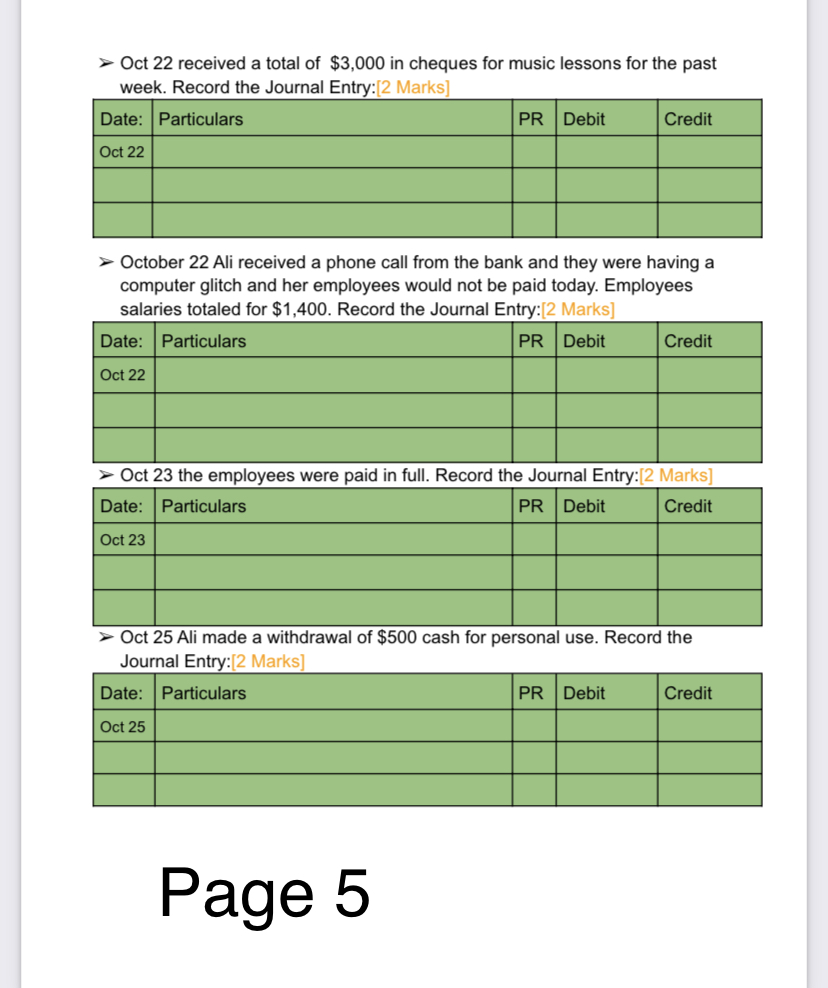

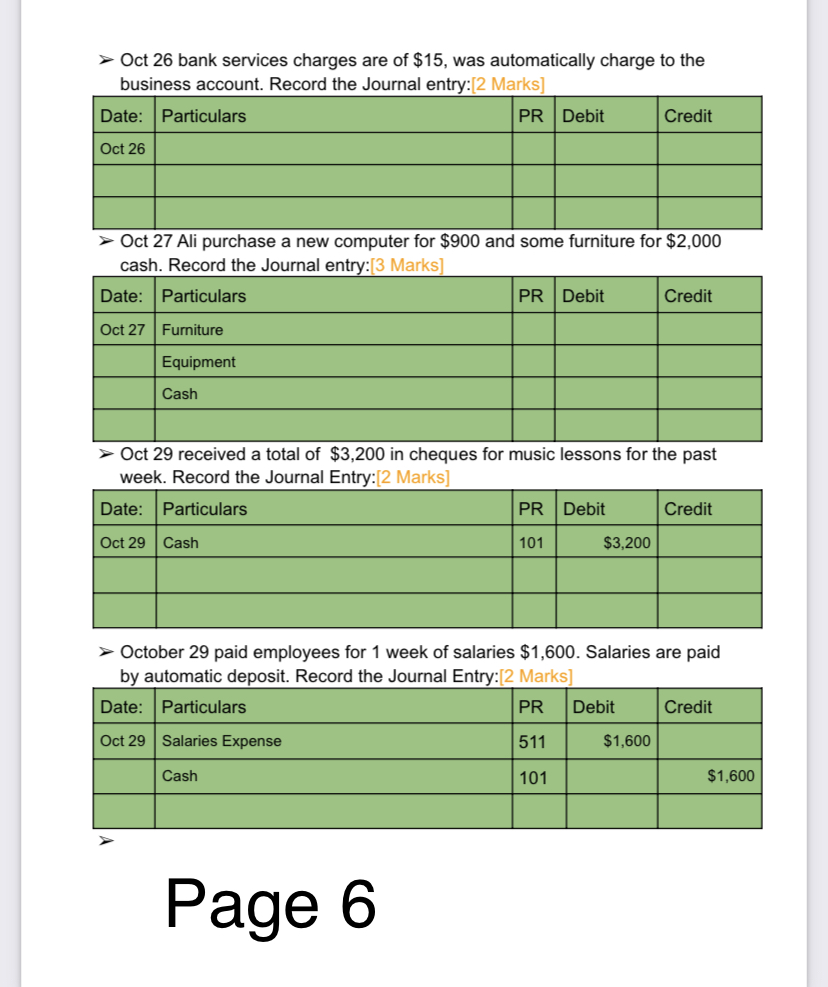

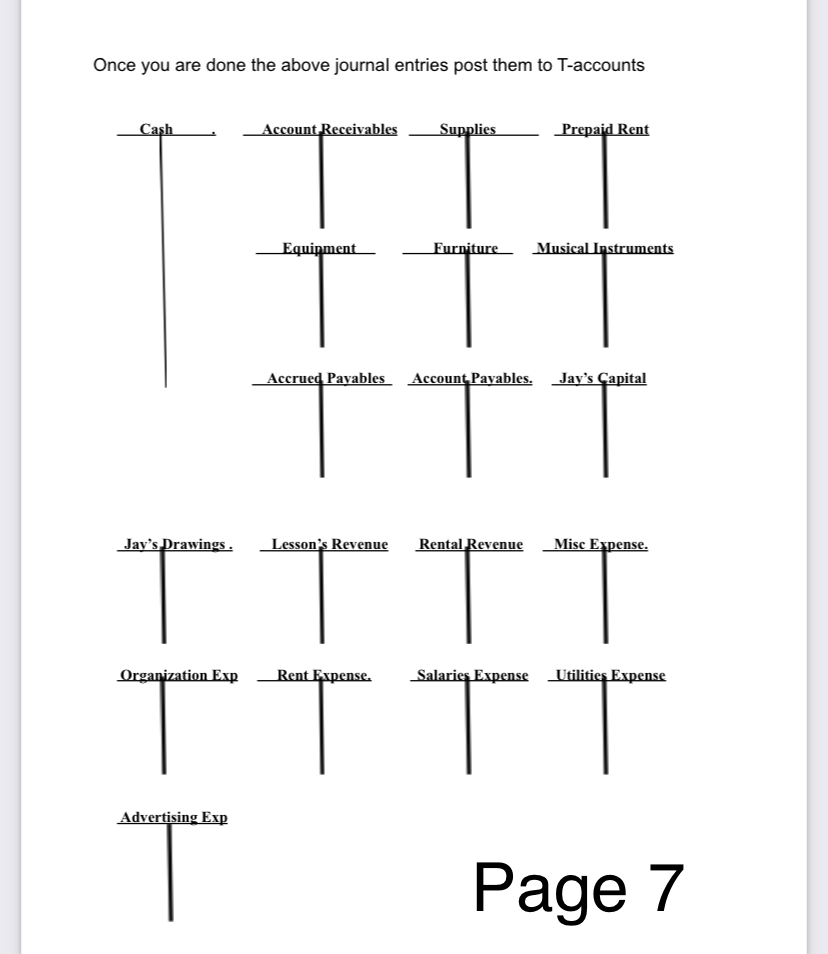

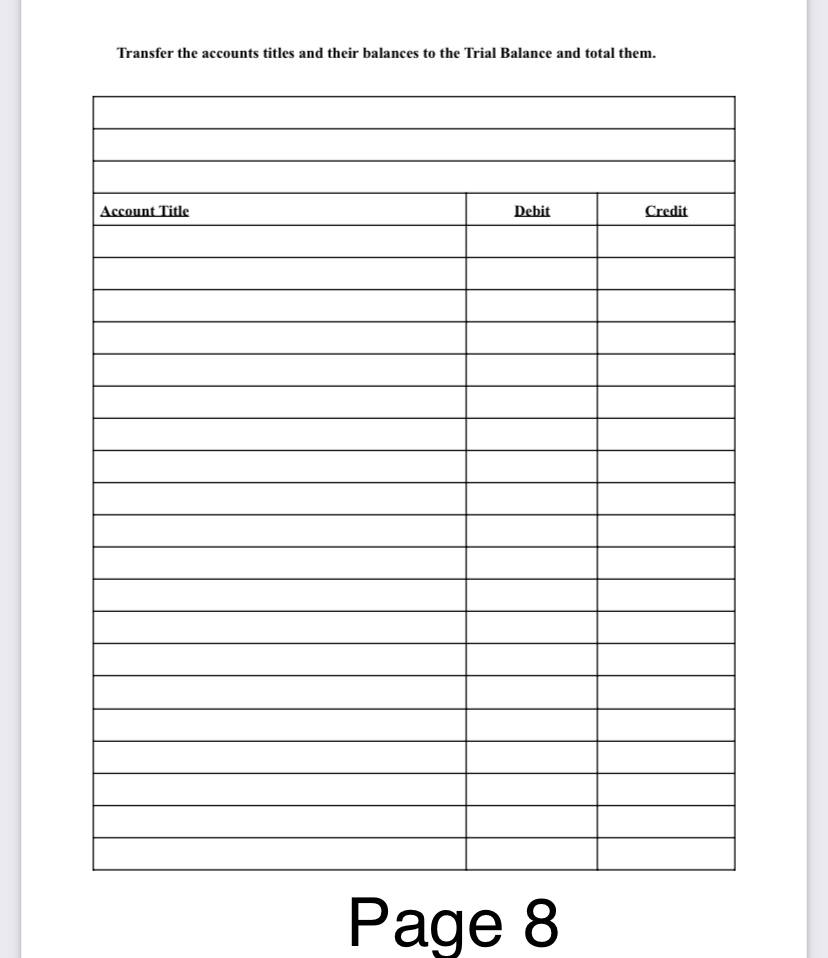

Assignment: Journal Entries On October 1 Ali Jay established her own music story known as Ali's Music a sole proprietorship. She set up the following accounts in her accounting program. Make sure you use these exact titles in the Journal Entries and in the Ledger (T-Accounts). Acc Account Title Acc No. No . Account Title Assets Owner's Equity 101 Cash 301 Jay's Capital 102 Account Receivables 302 Jay's Drawings 103 Supplies 104 Prepaid Rent Revenue 110 Equipment 401 Lesson's Revenue 111 Furniture 402 Rental Revenue 112 Musical Instruments Expenses Liabilities 510 Advertising Expense 201 Accrued Payables-Salaries 508 Miscellaneous Expense 203 Account Payables-GEM Radio 509 Organization Expense 204 Account 510 Rent Expense Payables-Counterpoint Music 205 Account Payables-Ont Hydro 511 Salaries Expense 512 Utilities Expense Page 1> Oct 1 Ali established a business chequing account at BMO Canada. Ali deposited $25,000. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 1 Cash 101 $25,000 Jay's Capital 301 $25,000 > Oct 1 Ali paid $100 to register the company with the government. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 1 Organization Expense 509 $100 Cash 101 $100 > Oct 2 Ali signed a contract with Erb Rental Company to rent a store for $48,000 for the next 12 months. Erb rental required her to pay first and last months rent which totalled $8,000. Payment was made by cheque number 101.Record the Journal Entry:[3 Marks] Date: Particulars PR Debit Credit Oct 2 Cash 101 8,000 > Oct 3 Ali signed a contract with a local radio station to run ads for $1,000 a month. The ads would start immediately. She paid the first month on account. Record the Journal Entry: [2 Marks] Date: Particulars PR Debit Credit Oct 3 Advertising Expense 510 $1,000 Cash 101 $1,000 Page 2 (also some of them i put some ans not sure if they are correct)- Oct 4 Ali purchased 5 Digital Pianos for a total of 53.500; 2 Upright Pianos for a total of seem; in acoustic guitars for $3.100 and 10 electric guitars for $4,000 from Counterpoint Music. She put $5.000 down on the instruments the rest was put on acmunt. She records each instrument on its own when it is recorded in the General Journal and posted to the General Ledger. When the balance sheet is made instruments are grouped under the aggregate account of Musicai Instruments. Record the Journal Entryzl Marks] 2- Oct 8 Ali rented out some of the musical instruments to clients for the month for $1,800 cash. Rental fee was ted. Record the Journal E :[2 Marks] 3- Oct 15 Ali received a total of $2,800 in cheques for music lessons for the tweek. Record the Journal En :[2 Marks] Page 3 October 15 Ali paid employees for 1 week of salaries $1,400. Salaries are paid by automatic deposit. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 15 > Oct 18 Ali ordered $100 worth of supplies on the internet from Staples. She paid online from her account. The cash was automatically withdrawn. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 18 > Oct 19 Ali rented out 2 instruments on account for $100.Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 19 - Oct 20 Ali received a bill from the Ontario Hydro for $195. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 20 Page 4> Oct 22 received a total of $3,000 in cheques for music lessons for the past week. Record the Journal Entry:[2 Marks] Date: |Particulars PR Debit Credit Oct 22 > October 22 Ali received a phone call from the bank and they were having a computer glitch and her employees would not be paid today. Employees salaries totaled for $1,400. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 22 > Oct 23 the employees were paid in full. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 23 > Oct 25 Ali made a withdrawal of $500 cash for personal use. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 25 Page 5> Oct 26 bank services charges are of $15, was automatically charge to the business account. Record the Journal entry:[2 Marks] Date: Particulars PR Debit Credit Oct 26 > Oct 27 Ali purchase a new computer for $900 and some furniture for $2,000 cash. Record the Journal entry:[3 Marks] Date: Particulars PR Debit Credit Oct 27 Furniture Equipment Cash > Oct 29 received a total of $3,200 in cheques for music lessons for the past week. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 29 Cash 101 $3,200 > October 29 paid employees for 1 week of salaries $1,600. Salaries are paid by automatic deposit. Record the Journal Entry:[2 Marks] Date: Particulars PR Debit Credit Oct 29 Salaries Expense 511 $1,600 Cash 101 $1,600 Page 6Once you are done the above journal entries post them to T-accounts Cash Account Receivables Supplies Prepaid Rent Equipment Furniture Musical Instruments Accrued Payables Account Payables. Jay's Capital Jay's Drawings . Lesson's Revenue Rental Revenue Misc Expense. Organization Exp Rent Expense. Salaries Expense Utilities Expense Advertising Exp Page 7Transfer the accounts titles and their balances to the Trial Balance and total them. Account Title Debit Credit Page 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts