Question: Please look at the table headers closely. I have submitted this question twice already have received copy an pastes of previous question answers which were

Please look at the table headers closely. I have submitted this question twice already have received copy an pastes of previous question answers which were wrong. Look at the column "0.50/share common dividend" closely.

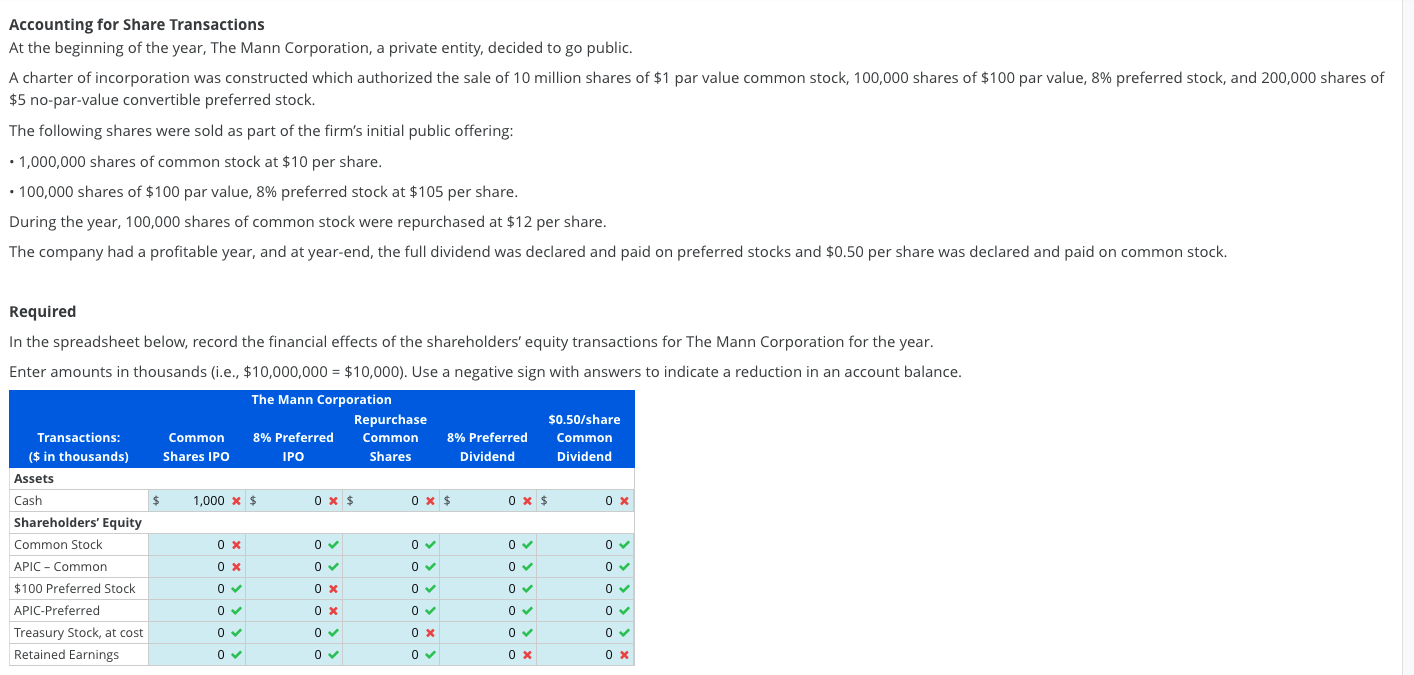

Accounting for Share Transactions At the beginning of the year, The Mann Corporation, a private entity, decided to go public. A charter of incorporation was constructed which authorized the sale of 10 million shares of $1 par value common stock, 100,000 shares of $100 par value, 8% preferred stock, and 200,000 shares of $5 no-par-value convertible preferred stock. The following shares were sold as part of the firm's initial public offering: 1,000,000 shares of common stock at $10 per share. 100,000 shares of $100 par value, 8% preferred stock at $105 per share. During the year, 100,000 shares of common stock were repurchased at $12 per share. The company had a profitable year, and at year-end, the full dividend was declared and paid on preferred stocks and $0.50 per share was declared and paid on common stock. Required In the spreadsheet below, record the financial effects of the shareholders' equity transactions for The Mann Corporation for the year. Enter amounts in thousands (i.e., $10,000,000 = $10,000). Use a negative sign with answers to indicate a reduction in an account balance. The Mann Corporation Repurchase $0.50/share Transactions: Common 8% Preferred 8 Common 8% Preferred Common ($ in thousands) Shares IPO IPO Shares Dividend Dividend Assets Cash 1,000 x $ 0 x $ 0X $ 0 x $ 0 x Shareholders' Equity Common Stock 0 07 0 0 APIC - Common 0 x 0 0 0 0 $100 Preferred Stock 0 0X O 0 O APIC-Preferred 0 OX 0 0 Treasury Stock, at cost 0 0 0 X 0 0 Retained Earnings 0 0 0 0 x 0 x ox 07 0 Accounting for Share Transactions At the beginning of the year, The Mann Corporation, a private entity, decided to go public. A charter of incorporation was constructed which authorized the sale of 10 million shares of $1 par value common stock, 100,000 shares of $100 par value, 8% preferred stock, and 200,000 shares of $5 no-par-value convertible preferred stock. The following shares were sold as part of the firm's initial public offering: 1,000,000 shares of common stock at $10 per share. 100,000 shares of $100 par value, 8% preferred stock at $105 per share. During the year, 100,000 shares of common stock were repurchased at $12 per share. The company had a profitable year, and at year-end, the full dividend was declared and paid on preferred stocks and $0.50 per share was declared and paid on common stock. Required In the spreadsheet below, record the financial effects of the shareholders' equity transactions for The Mann Corporation for the year. Enter amounts in thousands (i.e., $10,000,000 = $10,000). Use a negative sign with answers to indicate a reduction in an account balance. The Mann Corporation Repurchase $0.50/share Transactions: Common 8% Preferred 8 Common 8% Preferred Common ($ in thousands) Shares IPO IPO Shares Dividend Dividend Assets Cash 1,000 x $ 0 x $ 0X $ 0 x $ 0 x Shareholders' Equity Common Stock 0 07 0 0 APIC - Common 0 x 0 0 0 0 $100 Preferred Stock 0 0X O 0 O APIC-Preferred 0 OX 0 0 Treasury Stock, at cost 0 0 0 X 0 0 Retained Earnings 0 0 0 0 x 0 x ox 07 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts