Question: Please make a chart following the same format given. Thank you! The following accounts, with the balances indicated, appear in the ledger of Garcon Co.

Please make a chart following the same format given. Thank you!

Please make a chart following the same format given. Thank you!

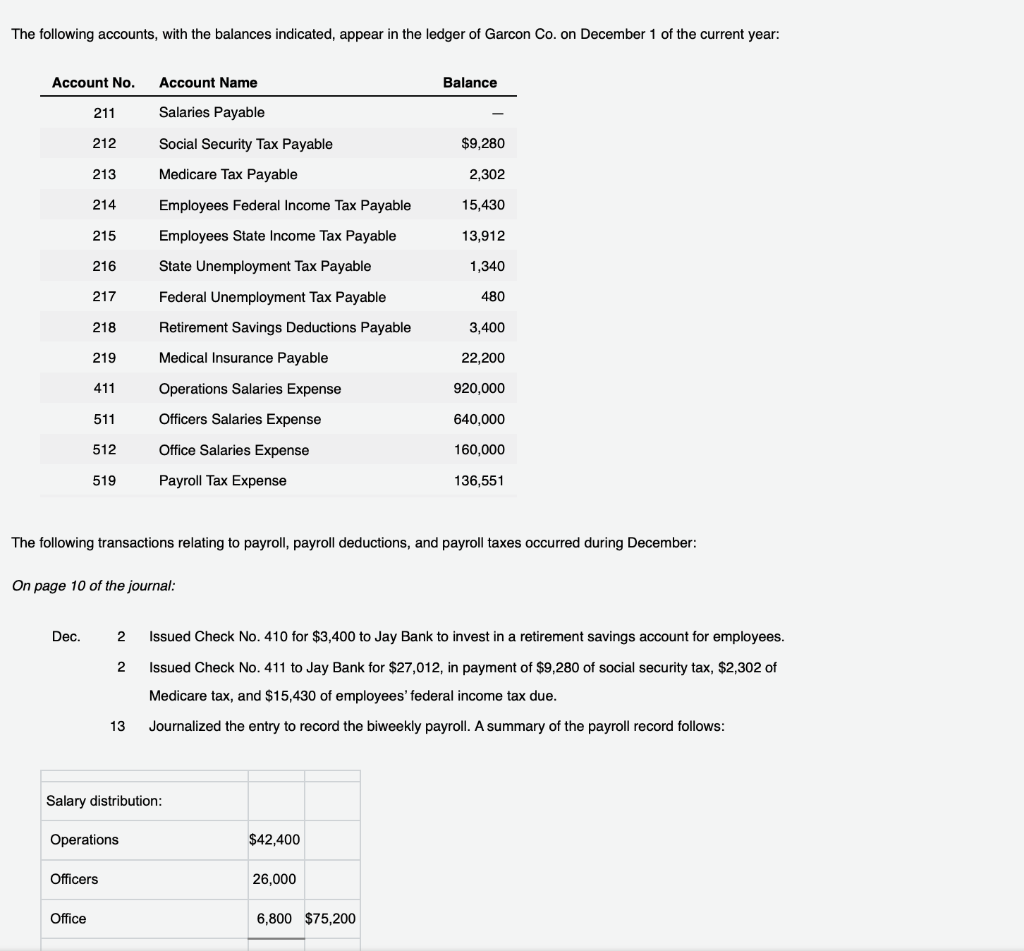

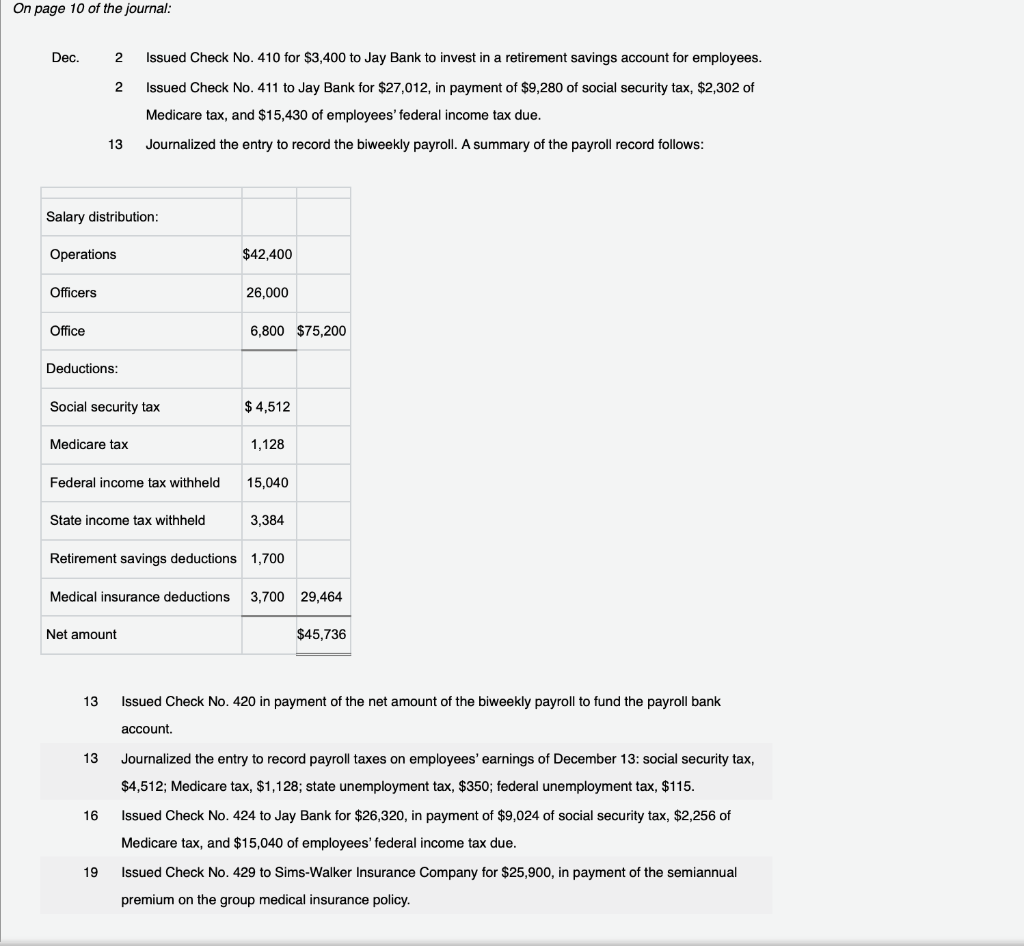

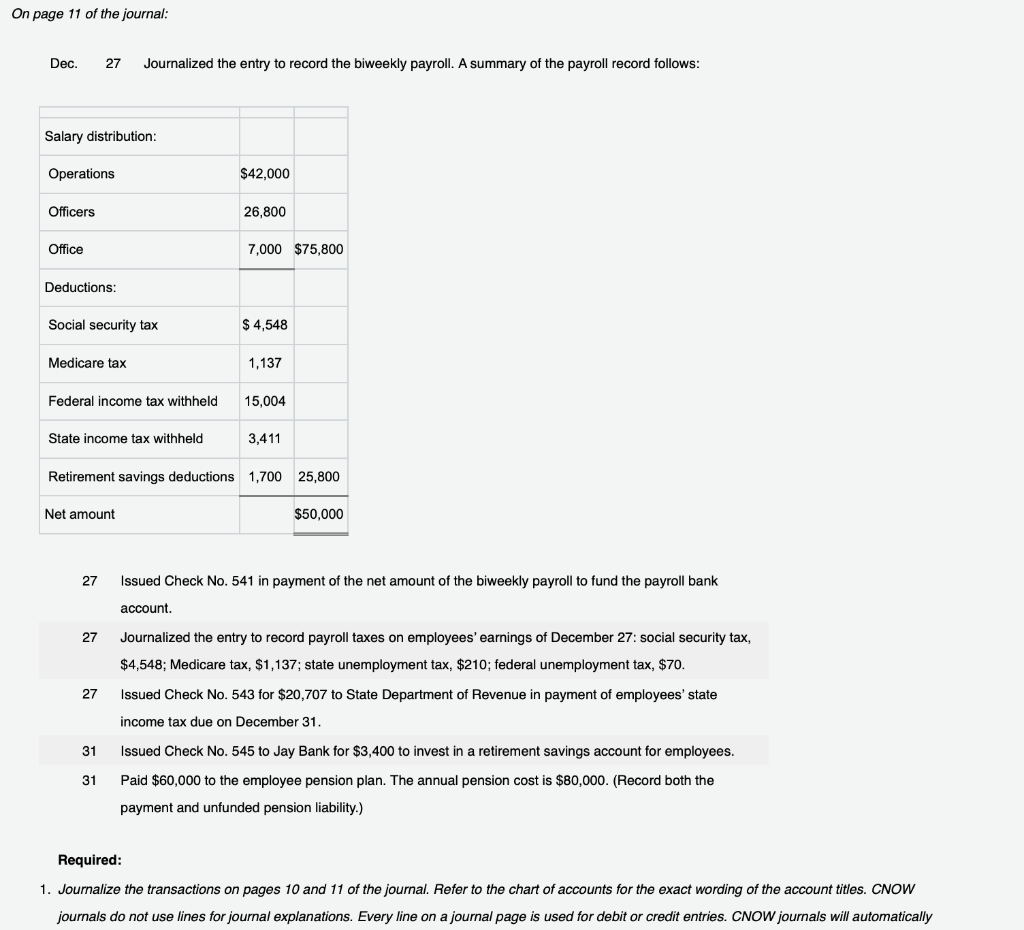

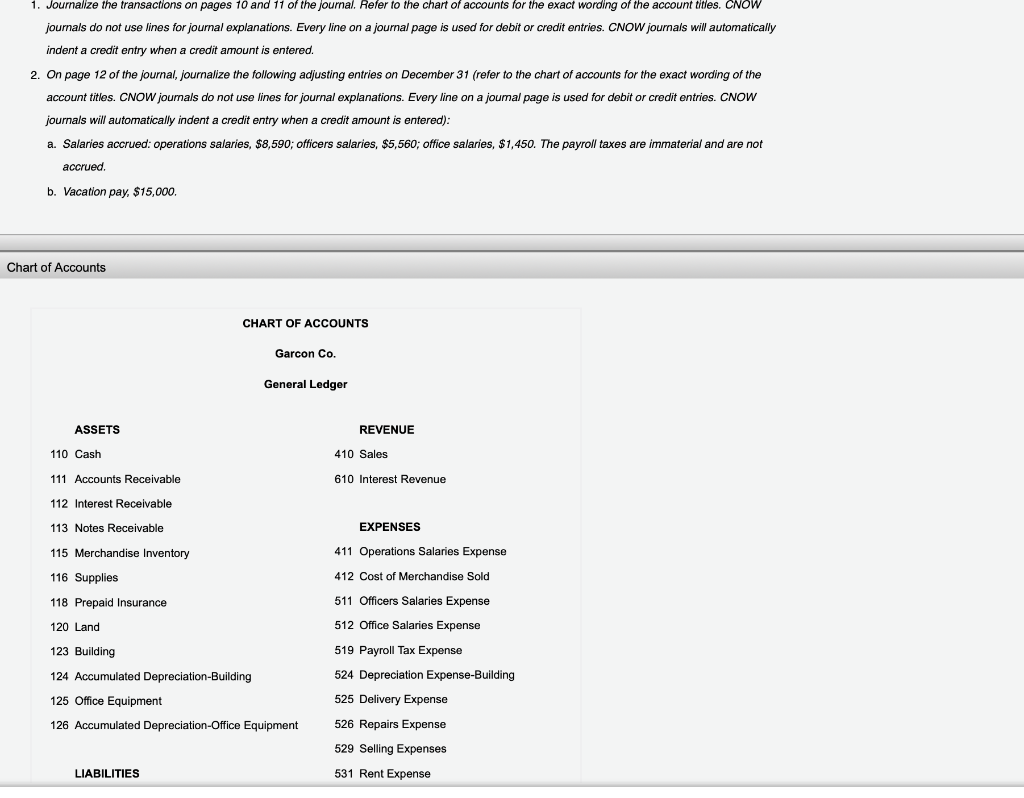

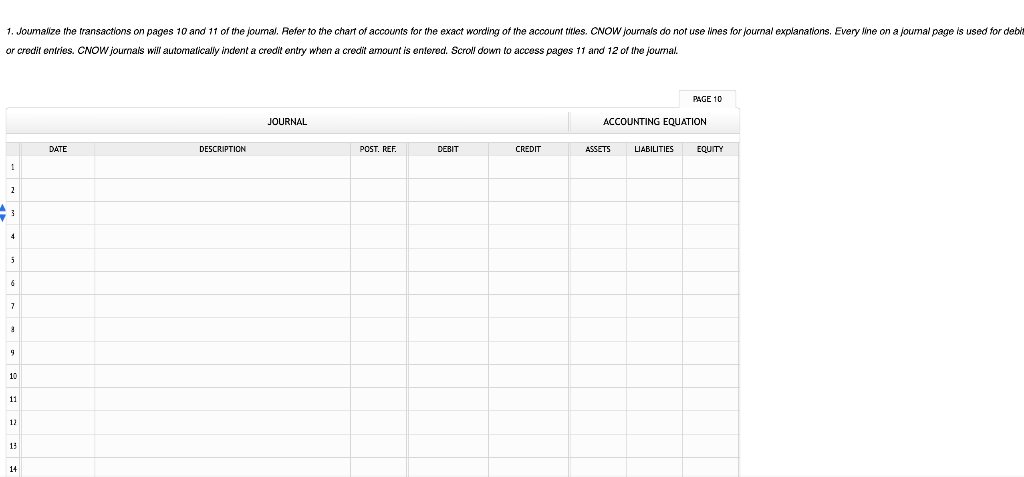

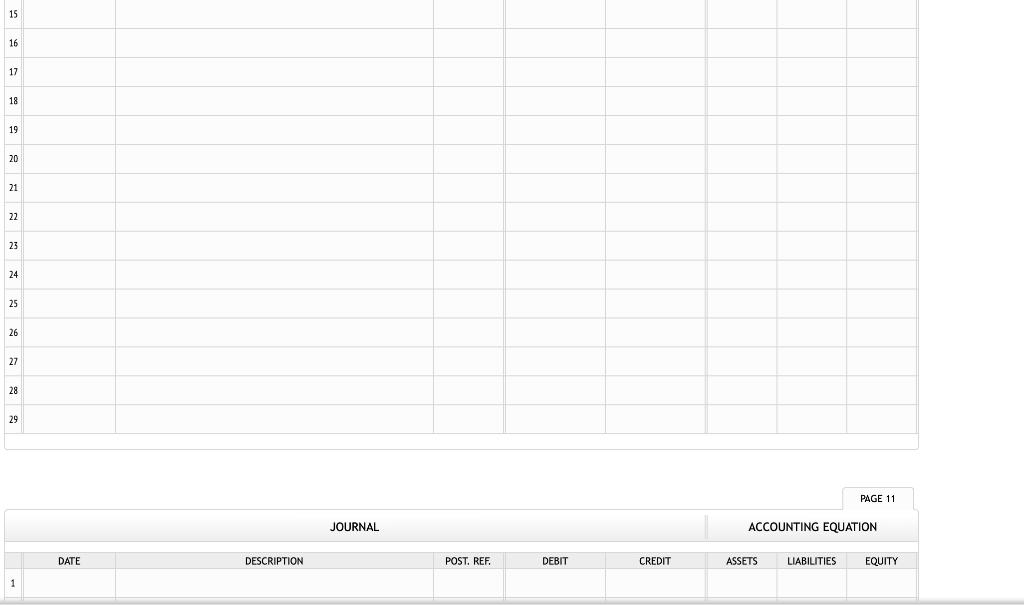

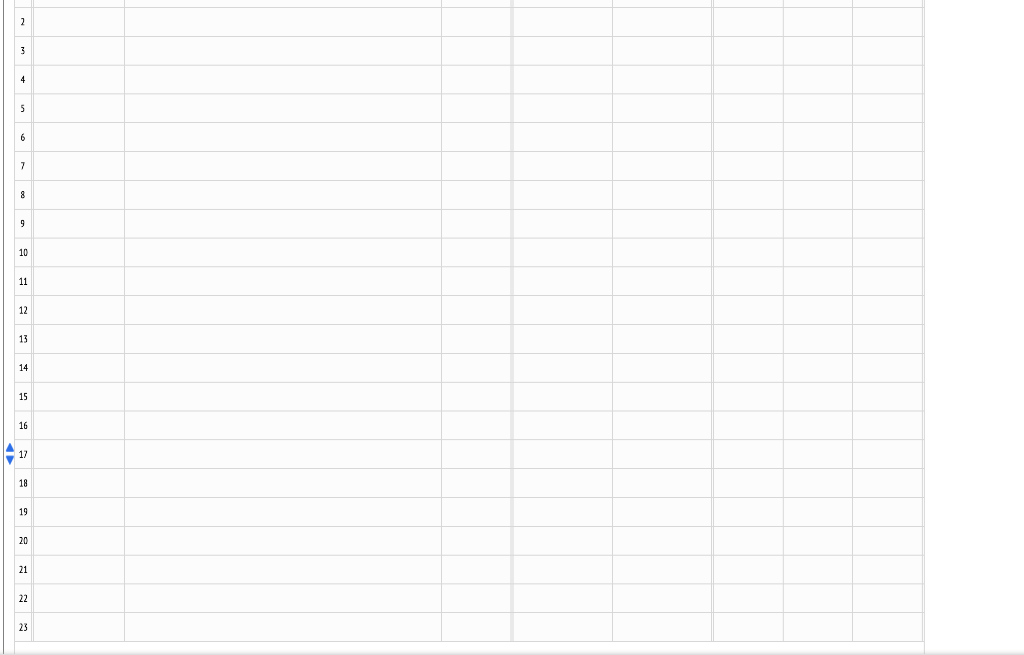

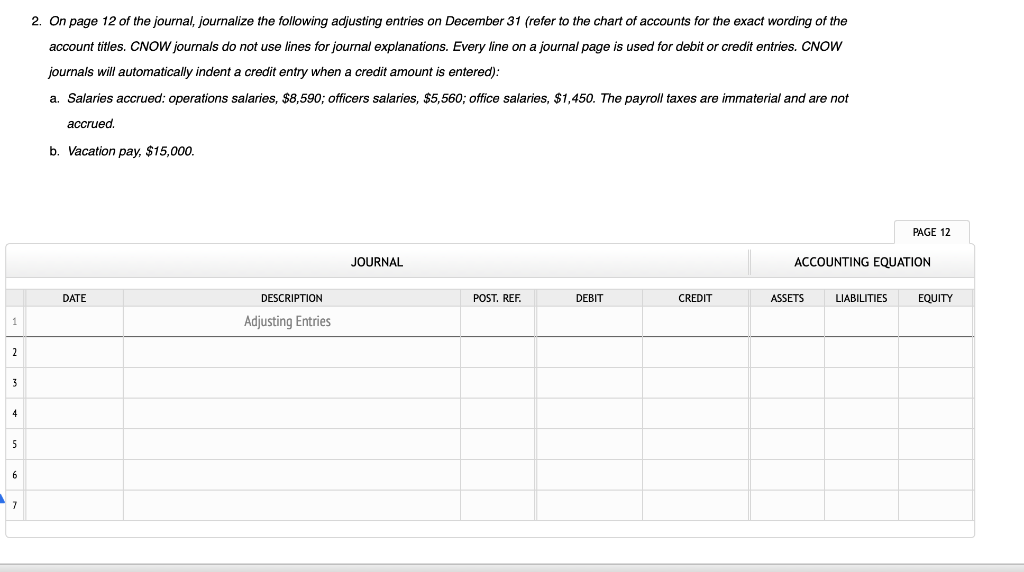

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: Account No. Account Name Balance 211 Salaries Payable Social Security Tax Payable 212 $9,280 213 Medicare Tax Payable 2,302 214 15,430 Employees Federal Income Tax Payable Employees State Income Tax Payable 215 13,912 216 1,340 217 480 State Unemployment Tax Payable Federal Unemployment Tax Payable Retirement Savings Deductions Payable Medical Insurance Payable 218 3,400 219 22,200 411 Operations Salaries Expense 920,000 511 Officers Salaries Expense 640,000 512 Office Salaries Expense 160,000 519 Payroll Tax Expense 136,551 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December: On page 10 of the journal: Dec. 2 2 Issued Check No. 410 for $3,400 to Jay Bank to invest in a retirement savings account for employees. Issued Check No. 411 to Jay Bank for $27,012, in payment of $9,280 of social security tax, $2,302 of Medicare tax, and $15,430 of employees' federal income tax due. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 13 Salary distribution: Operations $42,400 Officers 26,000 Office 6,800 $75,200 On page 10 of the journal: Dec. 2 2 Issued Check No. 410 for $3,400 to Jay Bank to invest in a retirement savings account for employees. Issued Check No. 411 to Jay Bank for $27,012, in payment of $9,280 of social security tax, $2,302 of Medicare tax, and $15,430 of employees' federal income tax due. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 13 Salary distribution: Operations $42,400 Officers 26,000 Office 6,800 $75,200 Deductions: Social security tax $ 4,512 Medicare tax 1,128 Federal income tax withheld 15,040 State income tax withheld 3,384 Retirement savings deductions 1,700 Medical insurance deductions 3,700 29,464 Net amount $45,736 13 Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13 16 Journalized the entry to record payroll taxes on employees' earnings of December 13: social security tax, $4,512; Medicare tax, $1,128; state unemployment tax, $350; federal unemployment tax, $115. Issued Check No. 424 to Jay Bank for $26,320, in payment of $9,024 of social security tax, $2,256 of Medicare tax, and $15,040 of employees' federal income tax due. Issued Check No. 429 to Sims-Walker Insurance Company for $25,900, in payment of the semiannual premium on the group medical insurance policy. 19 On page 11 of the journal: Dec. 27 Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Salary distribution: Operations $42,000 Officers 26,800 Office 7,000 $75,800 Deductions: Social security tax $ 4,548 Medicare tax 1,137 Federal income tax withheld 15,004 State income tax withheld 3,411 Retirement savings deductions 1,700 25,800 Net amount $50,000 27 Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27 Journalized the entry to record payroll taxes on employees' earnings of December 27: social security tax, $4,548; Medicare tax, $1,137; state unemployment tax, $210; federal unemployment tax, $70. Issued Check No. 543 for $20,707 to State Department of Revenue in payment of employees' state income tax due on December 31. 27 31 31 Issued Check No. 545 to Jay Bank for $3,400 to invest in a retirement savings account for employees. Paid $60,000 to the employee pension plan. The annual pension cost is $80,000. (Record both the payment and unfunded pension liability.) Required: 1. Journalize the transactions on pages 10 and 11 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically 1. Journalize the transactions on pages 10 and 11 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. 2. On page 12 of the journal, journalize the following adjusting entries on December 31 (refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. Salaries accrued: operations salaries, $8,590; officers salaries, $5,560; office salaries, $1,450. The payroll taxes are immaterial and are not accrued. b. Vacation pay, $15,000. Chart of Accounts CHART OF ACCOUNTS Garcon Co. General Ledger ASSETS REVENUE 110 Cash 410 Sales 111 Accounts Receivable 610 Interest Revenue 112 Interest Receivable 113 Notes Receivable EXPENSES 115 Merchandise Inventory 411 Operations Salaries Expense 116 Supplies 412 Cost of Merchandise Sold 511 Officers Salaries Expense 118 Prepaid Insurance 120 Land 512 Office Salaries Expense 519 Payroll Tax Expense 524 Depreciation Expense-Building 123 Building 124 Accumulated Depreciation-Building 125 Office Equipment 126 Accumulated Depreciation Office Equipment 525 Delivery Expense 526 Repairs Expense 529 Selling Expenses 531 Rent Expense LIABILITIES 1. Joumalize the transactions on pages 10 and 11 of the journal. Refer to the chart of accounts for the exact wording of the account titles. CNOW Journals do not use lines for journal explanations. Every line on a joumal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entored. Scroll down to access pages and 12 of the joumal. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 4 5 6 a 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 PAGE 11 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2. On page 12 of the journal, journalize the following adjusting entries on December 31 (refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered): a. Salaries accrued: operations salaries, $8,590; officers salaries, $5,560; office salaries, $1,450. The payroll taxes are immaterial and are not accrued. b. Vacation pay, $15,000. PAGE 12 JOURNAL ACCOUNTING EQUATION DATE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY DESCRIPTION Adjusting Entries 1 2 3 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts