Question: Please make a report under YOUR REPORT section: the 3 questions that are needed to answer were encircled. Product Costing at Fine Foods: Is It

Please make a report under YOUR REPORT section: the 3 questions that are needed to answer were encircled.

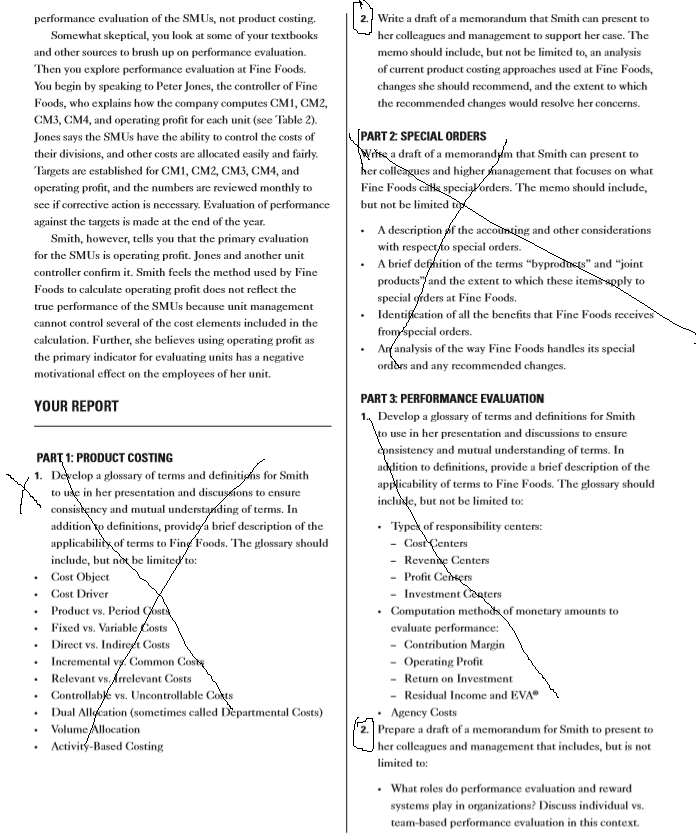

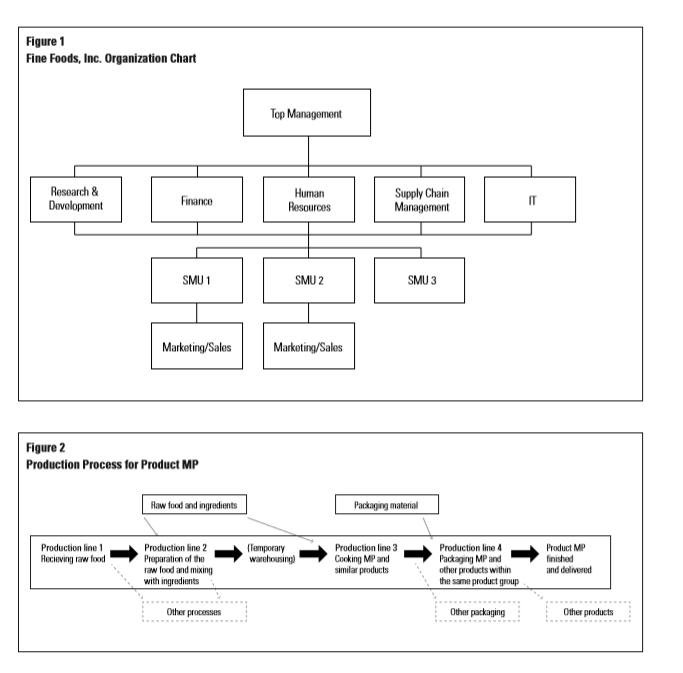

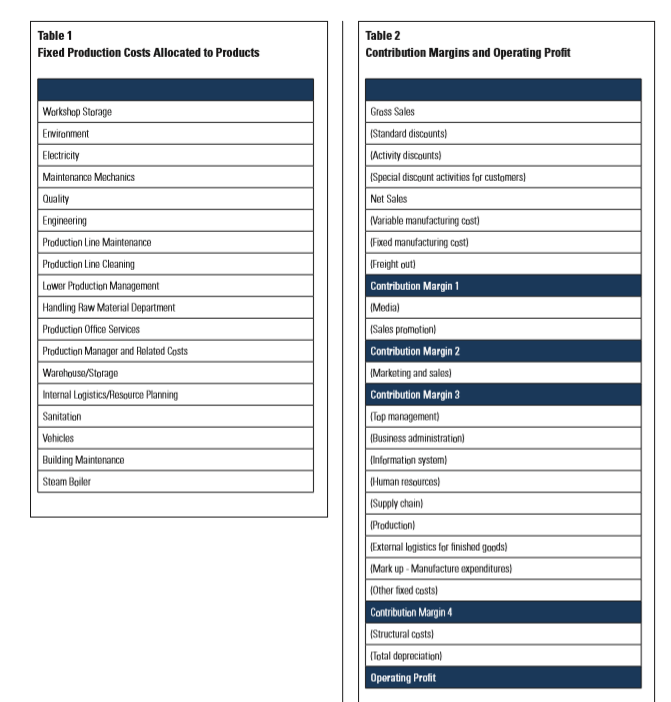

Product Costing at Fine Foods: Is It a Symptom or the Problem? David Axelsson is the accountant and controller for an expanding wholesaler, board member for a family business, and member and vice-chairman of the board of directors for a local bank Marcus Fogelkvist is the international research and development group controller for a large hard goods manufacturing mullinational company Gary M. Cunningham, Ph.D., is Professor Emeritus and Research Fellow at Gilvle University in Gitvle, Sweden INTRODUCTION Kay Smith is the manager of Strategic Marketing Unit Two (SMU2) at Fine Foods, Inc., a provider of branded, high- quality food products. Smith is unhappy with what she perceives to be unfair and inappropriate product costing for her unit, especially for what Fine Foods considers to be special orders. Smith's education, experience, and expertise as a food scientist and process engineer have earned her considerable respect at Fine Foods, but she has limited accounting knowledge, which holds her back from expressing her serious concerns. Therefore, Smith asked you, a recent accounting graduate, to develop a draft memorandum, a slide presentation, and a glossary of terms to help her make her casefood producers,for example, salad dressing packets are sold more forcefully to management. convenience shops, and similar outlets. Depending on the nature of the product and consumer preferences, products are sold frozen, refrigerated, canned, boxed, or packaged in other ways. Some items, such as individual packets of ketchup, mayonnaise, and mustard, are sold to fast food restaurants and similar outlets. The company also sells half- gallon containers-branded with the company logo-of salad dressings, ketchup, mustard, and similar items with a plastic pump so that restaurant customers can serve themselves at salad bars and similar places. Other products are sold, often in bulk, to institutional users, such as large food service groups, caterers, and the like. These products may or may not be branded. A small portion of sales is made to oth to producers of packaged fresh salad greens; Fine Foods does not deal with fresh products Fine Foods is owned by Great Plains Capital, a private equity firm. Great Plains Capital gives Fine Foods almost complete freedom and control over management, product selection, performance evaluation, and so forth. Because it is privately owned, external financial reporting is not mandatory, nor is there any obligation to use any set of financial accounting standards for internal reporting, Any external financial reporting is on a group or consolidated basis and performed by Great Plains Capital. FINE FOODS, INC. Fine Foods, Inc., rooted in the upper Midwest United States, produces a wide range of food products in a competitive industry, Almost all ofits products are sold under the Fine 'n' Fast brand name, which is widely recognized for its high quality and has a loyal customer following, Most products are packaged in sizes for end-consumption and are sold through supermarkets, Great Plains Capital also owns Fine Foods Canada, Ltd which sells products almost exclusively in Canada, with primary operations nearby in the prairie provinces. There is no mutual ownership or management connection between Fine Foods and Fine Foods Canada. Because the two companies produce many identical products using the Fine n' Fast brand, they do share recipes and process technology.orders at Fine Foods, especially in SMU2 Fine Foods also produces some products for Fine Foods Canada that do not have sufficient market size in Canada to justify separate production. Great Plains Capital also owns smaller companies with the Fine 'n' Fast name that are mostly importers of Fine 'n' Fast products in countries outside of the U.S. and Canada where high-quality, branded the product MP production process, which is typical of many North American food products have niche markets. 'hese products are produced by Fine Foods. come from other products, which means the product costs for product MP are not a major part of their cost of sales. After talking with Smith, you review what you learned in your accounting classes about product costing and special orders. With this knowledge, you set out to depth look at product costing and accounting for special conduct an in- THE PRODUCTION PROCESS In order to learn about product costing at Fine Foods, you decide that first you need to understand the physical flow of products through production lines. A simplified diagram of of the company's products, is shown in Figure 2 Basic raw food items begin production with preliminary Fine Foods is organized into three Strategic Marketing Units (SMUs) based on the markets they serve. SMU serves supermarkets and similar outlets. SMU2 serves mostly institutional customers who order in large volumes and often in bulk quantities. SMU2 also sells special orders from time to time that involve unbranded bulk products thatcooking and processing occurs. The prepared product is then are exported. SMU3 serves affiliated Fine Foods companiespackaged, frozen, stored temporarily (if necessary), and then in other countries, mostly for import into those countries; governmental organizations that sell food and have food service facilities, such as military organizations; and similar customers that have special contracting requirements. inspection, sorting, and so forth. The raw material then goes to the first stage of preparation, which can involve chopping and peeling, as well as some preliminary cooking. After possible temporary storage, additional ingredients are added such as seasonings, flavorings, and so on, and then the final shipped to the customer. PRODUCT COSTING The management of Fine Foods believes that it must allocate all costs to its products in order to get a true and accurate measure of each product's profitability. Here is a look at the product costing procedure that would apply to product MP as well as virtually all other products. Product Products sold by all three SMUs are manufactured by the same production facilities, including warchouses, food preparation and cooking facilities, and packaging facilities. The SMUs also share most headquarters activities, such as information technology, accounting and other administration, P human resources, and similar activities. SMU1 and SMU2 have their own marketing and sales departments, while SMU3 does not have separate departments for these tasks Figure 1 shows an organizational chart for Fine Foods. one of several different products that comes from the same initial raw material but are then processed and sold in different configurations and package sizes. Raw material, packaging material, and direct production salaries are added to determine what Fine Foods calls direct calculated costs. Electricity, steam, water, and warehouse costs are then allocated based on estimates and a mark-up to cover spoilage and other incalculable costs. This calculation gives an amount the company calls variable manufacturing costs. Material costs are determined based on the cost required for one unit of product, Direct salaries are determined by the amount of time normally required for one unit multiplied by the hourly labor cost. COST ALLOCATION Smith strongly and persistently tells you that she believes her unit is being treated unfairly in the way costs are allocated to products. In particular, she has a problem with the product cost allocation for special orders of product MP, a basic product that is widely consumed in North America. SMU2 is the only unit filling special orders, and almost all of the special orders are for product MP While all three units sell product MP it represents a significantly larger percentage of total sales for SMU2 than it does for the other two units. SMU1 and SMU3 do not perceive a product costing problem because a substantial portion of their sales Fine Foods allocates what it considers to be fixed production casts in a complicated process. A list of what Fine Foods considers to be fixed production costs is shown in Table 1 Costs for production management, steam boilers, and quality are shared by different factories. Estimates are made about usage of these activities, and costs are allocated to factories based on these estimates. If only one factory uses a service, the entire cost of the service is allocated to that factory. When these and other costs are assigned to factories, two approaches are used for further allocation to product groups (such as salad dressings, canned soups and vegetables, and puddings) and products: .All costs for steam boilers, building maintenance, SPECIAL ORDERS Because of Smith's concerns, you further explore what Fine Foods considers to be special orders. According to Smith, a special order is one in which the contract specifies that it can be rejected within one year before delivery, otherwise it is not special. Such special orders constitute 2% of total revenues for Fine loods. vehicles, and sanitation are allocated directly to products using net weight or gross weight. Remaining factory costs are first allocated to product groups. One allocation is a fixed percentage based on estimates that do not change for each product group Other costs are allocated based on the weight, labor time, and production time of the product produced. If the allocation of remaining factory costs is a fixed percentage, then allocation to products is based on production time. Virtually all of the special orders are for product MP and for a food distributor in Mexico. Product MP is not a normal part of the diet of Mexican people, but there is a niche market for it. The market is not large enough to motivate a Mexican food production company to produce the item, but Fine Foods is motivated to provide the items to Mexican food suppliers as so-called special orders because the company is already producing the product for a variety of customers in the U.S. and Canada. It is packaged unbranded for sale in Mexico because it will be used primarily by institutional food preparers; it is shipped frozen in 10-pound packages. .For special orders (virtually all product MP), the total freight out is accumulated for a month and then allocated based on the weight of product shipped. The estimated freight cost is included in the sales price. Similar procedures are followed for other products, for which Fine Foods pays the freight. The raw material used to make product MP can be kept in storage for a fairly long time under proper conditions, and there is always a ready stock on hand because it is used in many other products. Once product MP is produced, it can be kept frozen for up to one year. These factors provide a high degree of flexibility in scheduling production to meet such special orders. Production of product MP can be readily scheduled when there is idle production capacity. Sometimes requests for these special Media and sales promotion costs for SMU1 and SMU2 are allocated to product groups and to individual products based on weight of product sold. Fine Foods allocates what it calls other fixed costs in two ways: orders come unexpectedly; other times, SMU2 approaches the customer to indicate that idle capacity is planned. Typically, orders are in relatively large quantities. Sales and marketing costs, which are incurred only in SMU1 and SMU2, are allocated to products based on sales volume Costs for top management, business administration, information systems, human resources, supply management, and logistics are allocated in two steps. Costs are first allocated to cost centers based on number of employees, labor time, production time, or set percentages. Then costs are further allocated to products based on gross sales, amount of time spent on internal reviews, number of marketing campaigns, quantity sold number of orders, net weight of product delivered, or equally to each product. SMU2 accepts special orders when the contribution margin (CM1) is positive. Fine Foods defines CM1 as net sales minus variable manufacturing costs, fixed manufacturing costs, and freight out (see Table 2). Smith is convinced that decisions to accept the special orders are good for the company and contribute to Fine Foods' overall profitability, but she is frustrated at the impact on the results of her unit's operations. PERFORMANCE EVALUATION IN FINE FOODS Halfway through your projeet, you discuss it with friends and colleagues who are also recent accounting graduates. As you describe Smith's concerns with Fine Foods' product costing as well as your frustration with analyzing and developing recommendations, one friend interrupts to say that the product costing problem appears to be only a symptom of a larger issue. Your friend had recently covered the issue of symptoms vs. underlying problems in her management control class, and it seemed to her that the major issue is Smith is concerned that the amount of costs allocated to special orders for product MP is excessive and therefore causing her unit to be viewed less favorably than the other units. Among other things, she beleves allocations based on weight ae ufair because product MP is a relatively dense, bulky, and heavy product that, while profitable, has a relatively low profit per pound compared to other p ation of the SMUs, not product costing. Write a draft of a memorandum that Smith can present to her colleagues and management to support her case. The memo should include, but not be limited to, an analysis of current product costing approaches used at Fine Foods, changes she should recommend, and the extent to which the recommended changes would resolve her concerns. per 2. Somewhat skeptical, you look at some of your textbooks and other sources to brush up on performance evaluation. Then you explore performance evaluation at Fine Foods. You begin by speaking to Peter Jones, the controller of Fine Foods, who explains how the company computes CM1, CM2, CM3, CM4, and operating profit for each unit (see Table 2). Jones says the SMUs have the ability to control the costs of their divisions, and other costs are allocated easily and fairly. Targets are established for CM1, CM2, CM3, CM4, and operating profit, and the numbers are reviewed monthly to see if corrective action is necessary. Evaluation of performance but not be limited against the targets is made at the end of the year. PART 2 SPECIAL ORDERS a draft of a memorandym that Smih can present to r collengues and higher hanagement that focuses on what Fine Foods The memo should include, A description f the a ng and other considerations Smith, however, tells you that the primary evaluation for the SMUs is operating profit. Jones and another unit controller confirm it. Smith feels the method used by Fine Foods to calculate operating profit does not reflect the true performance of the SMUs because unit management cannot control several of the cost elements included in the calculation. Further, she believes using operating profit as the primary indicator for evaluating units has a negative motivational effect on the employees of her unit. special orders. ition of the terms bypr A brief productsand the extent to which these items-spply to special yrders at Fine Foods. Identi "and "joint of all the benefits that Fine Foods receives l orders. Arfanalysis of the way Fine Foods handles its special and any recommended changes. PART 3 PERFORMANCE EVALUATION YOUR REPORT Develop a glossary of terms and definitions for Smith in her presen tation and discussions to ensure pnsistency and mutual understanding of terms. In PART1: PRODUCT COSTING lition to definitions, provide a brief description of the applicability of terms to Fine Foods. The glossary should include, but not be limited to: a glossary of terms and definitihs for Smith to use in her presentation and d consistency and mutual un addition o definitions, p applicability of terms to Fing Foods. The glossary should include, bube limitey to: to ensure ing of terms. In a brief description of the of responsibility centers: enterS Revenne Centers .Cost Object Cost Driver Product vs. Period Cost Fixed vs. Variable Costs Direct vs. Indiregt Costs Incremental v. Common C Relevant vs. Arrelevant Costs Profit Ce - Investment Cbnters Computation methods of monetary amounts to evaluate performance: -Contribution Margin Operating Profit -Return on Investment - Residual Income and EVA Agency Costs . Controllable vs. Uncontrollable Costs Dual Allcation (sometimes called Departmental Costs) Volume 2. Prepare a draft of a memorandum for Smith to present to management that includes, but is not Activty-Based Costing her colleagues a limited to: nd n What roles do performance evaluation and reward systems play in organizations? Discuss individual vs. team-based performance evaluation in this context. Are these roles relevant for all types of organizations and employees?To what extent, if any, do these roles apply to Fine Foods? Discuss basic concepts of performance evaluation, particularly results control. Dis vs. nonfinancial performance in this context. What types of responsibility centers are the SMUs in Fine Foods? Are these appropriate types of cuss issues of financial ponsibility centers for Fine Foods? Why or why not .Identify potential agency costs that might occur within Fine Foods. Discuss performance measurement (monitoring and incentive systems as mechanisms to deerease agency costs at Fine Foods. Identify and discuss any recommendations to implement a reward system. Analyze the extent to which your recommendations would solve the issues that concern Smith and would decrease agency costs. Analyze the performance evaluation approaches at Fine Foods. Identify and discuss any changes you might recommend, and the extent to which these changes would resolve the issues Smith raised. PART 4: CONCLUSION AND RECOMMENDATIONS 1 Prepare a draft memorandum for Smith to present to her colleagues and to higher management that gives recommendations for changes and discusses their benefits for the company as a whole. Figure 1 Fine Foods, Inc. Organization Chart Top Management Resoarch 8 Dovelopment Human Resources Supply Chain Management Finance SMU 1 SMU 2 SMU3 Marketing/Sales Marketing/Sales Figure 2 Production Process for Product MP Raw food and ingredients Packaging material Production line Hecieving raw food Production line 2 Preparation of the raw food and mixing with ingredients Production line 3 Cooking MP and similar products Production line 4 Packaging MP and other products within the same product group Product MP and delivered Other packaging Other products Table 1 Fixed Production Costs Allocated to Products Table 2 Contribution Margins and Operating Profit Workshop Storage Erwitanment Electricity Maintenance Mechanics Quality Engineering Production Line Maintenance Production Line Cleaning Lower Production Managemert Handling Raw Material Department Production Office Services Production Manager and Related Costs Grass Sales IStandard discounts) Activity discounts) ISpecial discount activities for customers Net Sales Variable manufacturing cost) Foxed manufacturing Cost) Freight out) Contribution Margin 1 Media) Sales promotion) Contribution Margin 2 Marketing and sales) Contribution Margin 3 Top management) Business administration) Information systom Human resources) Supply chain) Production External logistics for finishad goods) Mark up-Manufacture expenditures) Other fixed costs Contribution Margin 4 Structural Costs) (Total daprociationl Operating Profit nternal Logistics/Resource Planning Sanitatian Vehicles Building Maintonanco Steam Boiler Product Costing at Fine Foods: Is It a Symptom or the Problem? David Axelsson is the accountant and controller for an expanding wholesaler, board member for a family business, and member and vice-chairman of the board of directors for a local bank Marcus Fogelkvist is the international research and development group controller for a large hard goods manufacturing mullinational company Gary M. Cunningham, Ph.D., is Professor Emeritus and Research Fellow at Gilvle University in Gitvle, Sweden INTRODUCTION Kay Smith is the manager of Strategic Marketing Unit Two (SMU2) at Fine Foods, Inc., a provider of branded, high- quality food products. Smith is unhappy with what she perceives to be unfair and inappropriate product costing for her unit, especially for what Fine Foods considers to be special orders. Smith's education, experience, and expertise as a food scientist and process engineer have earned her considerable respect at Fine Foods, but she has limited accounting knowledge, which holds her back from expressing her serious concerns. Therefore, Smith asked you, a recent accounting graduate, to develop a draft memorandum, a slide presentation, and a glossary of terms to help her make her casefood producers,for example, salad dressing packets are sold more forcefully to management. convenience shops, and similar outlets. Depending on the nature of the product and consumer preferences, products are sold frozen, refrigerated, canned, boxed, or packaged in other ways. Some items, such as individual packets of ketchup, mayonnaise, and mustard, are sold to fast food restaurants and similar outlets. The company also sells half- gallon containers-branded with the company logo-of salad dressings, ketchup, mustard, and similar items with a plastic pump so that restaurant customers can serve themselves at salad bars and similar places. Other products are sold, often in bulk, to institutional users, such as large food service groups, caterers, and the like. These products may or may not be branded. A small portion of sales is made to oth to producers of packaged fresh salad greens; Fine Foods does not deal with fresh products Fine Foods is owned by Great Plains Capital, a private equity firm. Great Plains Capital gives Fine Foods almost complete freedom and control over management, product selection, performance evaluation, and so forth. Because it is privately owned, external financial reporting is not mandatory, nor is there any obligation to use any set of financial accounting standards for internal reporting, Any external financial reporting is on a group or consolidated basis and performed by Great Plains Capital. FINE FOODS, INC. Fine Foods, Inc., rooted in the upper Midwest United States, produces a wide range of food products in a competitive industry, Almost all ofits products are sold under the Fine 'n' Fast brand name, which is widely recognized for its high quality and has a loyal customer following, Most products are packaged in sizes for end-consumption and are sold through supermarkets, Great Plains Capital also owns Fine Foods Canada, Ltd which sells products almost exclusively in Canada, with primary operations nearby in the prairie provinces. There is no mutual ownership or management connection between Fine Foods and Fine Foods Canada. Because the two companies produce many identical products using the Fine n' Fast brand, they do share recipes and process technology.orders at Fine Foods, especially in SMU2 Fine Foods also produces some products for Fine Foods Canada that do not have sufficient market size in Canada to justify separate production. Great Plains Capital also owns smaller companies with the Fine 'n' Fast name that are mostly importers of Fine 'n' Fast products in countries outside of the U.S. and Canada where high-quality, branded the product MP production process, which is typical of many North American food products have niche markets. 'hese products are produced by Fine Foods. come from other products, which means the product costs for product MP are not a major part of their cost of sales. After talking with Smith, you review what you learned in your accounting classes about product costing and special orders. With this knowledge, you set out to depth look at product costing and accounting for special conduct an in- THE PRODUCTION PROCESS In order to learn about product costing at Fine Foods, you decide that first you need to understand the physical flow of products through production lines. A simplified diagram of of the company's products, is shown in Figure 2 Basic raw food items begin production with preliminary Fine Foods is organized into three Strategic Marketing Units (SMUs) based on the markets they serve. SMU serves supermarkets and similar outlets. SMU2 serves mostly institutional customers who order in large volumes and often in bulk quantities. SMU2 also sells special orders from time to time that involve unbranded bulk products thatcooking and processing occurs. The prepared product is then are exported. SMU3 serves affiliated Fine Foods companiespackaged, frozen, stored temporarily (if necessary), and then in other countries, mostly for import into those countries; governmental organizations that sell food and have food service facilities, such as military organizations; and similar customers that have special contracting requirements. inspection, sorting, and so forth. The raw material then goes to the first stage of preparation, which can involve chopping and peeling, as well as some preliminary cooking. After possible temporary storage, additional ingredients are added such as seasonings, flavorings, and so on, and then the final shipped to the customer. PRODUCT COSTING The management of Fine Foods believes that it must allocate all costs to its products in order to get a true and accurate measure of each product's profitability. Here is a look at the product costing procedure that would apply to product MP as well as virtually all other products. Product Products sold by all three SMUs are manufactured by the same production facilities, including warchouses, food preparation and cooking facilities, and packaging facilities. The SMUs also share most headquarters activities, such as information technology, accounting and other administration, P human resources, and similar activities. SMU1 and SMU2 have their own marketing and sales departments, while SMU3 does not have separate departments for these tasks Figure 1 shows an organizational chart for Fine Foods. one of several different products that comes from the same initial raw material but are then processed and sold in different configurations and package sizes. Raw material, packaging material, and direct production salaries are added to determine what Fine Foods calls direct calculated costs. Electricity, steam, water, and warehouse costs are then allocated based on estimates and a mark-up to cover spoilage and other incalculable costs. This calculation gives an amount the company calls variable manufacturing costs. Material costs are determined based on the cost required for one unit of product, Direct salaries are determined by the amount of time normally required for one unit multiplied by the hourly labor cost. COST ALLOCATION Smith strongly and persistently tells you that she believes her unit is being treated unfairly in the way costs are allocated to products. In particular, she has a problem with the product cost allocation for special orders of product MP, a basic product that is widely consumed in North America. SMU2 is the only unit filling special orders, and almost all of the special orders are for product MP While all three units sell product MP it represents a significantly larger percentage of total sales for SMU2 than it does for the other two units. SMU1 and SMU3 do not perceive a product costing problem because a substantial portion of their sales Fine Foods allocates what it considers to be fixed production casts in a complicated process. A list of what Fine Foods considers to be fixed production costs is shown in Table 1 Costs for production management, steam boilers, and quality are shared by different factories. Estimates are made about usage of these activities, and costs are allocated to factories based on these estimates. If only one factory uses a service, the entire cost of the service is allocated to that factory. When these and other costs are assigned to factories, two approaches are used for further allocation to product groups (such as salad dressings, canned soups and vegetables, and puddings) and products: .All costs for steam boilers, building maintenance, SPECIAL ORDERS Because of Smith's concerns, you further explore what Fine Foods considers to be special orders. According to Smith, a special order is one in which the contract specifies that it can be rejected within one year before delivery, otherwise it is not special. Such special orders constitute 2% of total revenues for Fine loods. vehicles, and sanitation are allocated directly to products using net weight or gross weight. Remaining factory costs are first allocated to product groups. One allocation is a fixed percentage based on estimates that do not change for each product group Other costs are allocated based on the weight, labor time, and production time of the product produced. If the allocation of remaining factory costs is a fixed percentage, then allocation to products is based on production time. Virtually all of the special orders are for product MP and for a food distributor in Mexico. Product MP is not a normal part of the diet of Mexican people, but there is a niche market for it. The market is not large enough to motivate a Mexican food production company to produce the item, but Fine Foods is motivated to provide the items to Mexican food suppliers as so-called special orders because the company is already producing the product for a variety of customers in the U.S. and Canada. It is packaged unbranded for sale in Mexico because it will be used primarily by institutional food preparers; it is shipped frozen in 10-pound packages. .For special orders (virtually all product MP), the total freight out is accumulated for a month and then allocated based on the weight of product shipped. The estimated freight cost is included in the sales price. Similar procedures are followed for other products, for which Fine Foods pays the freight. The raw material used to make product MP can be kept in storage for a fairly long time under proper conditions, and there is always a ready stock on hand because it is used in many other products. Once product MP is produced, it can be kept frozen for up to one year. These factors provide a high degree of flexibility in scheduling production to meet such special orders. Production of product MP can be readily scheduled when there is idle production capacity. Sometimes requests for these special Media and sales promotion costs for SMU1 and SMU2 are allocated to product groups and to individual products based on weight of product sold. Fine Foods allocates what it calls other fixed costs in two ways: orders come unexpectedly; other times, SMU2 approaches the customer to indicate that idle capacity is planned. Typically, orders are in relatively large quantities. Sales and marketing costs, which are incurred only in SMU1 and SMU2, are allocated to products based on sales volume Costs for top management, business administration, information systems, human resources, supply management, and logistics are allocated in two steps. Costs are first allocated to cost centers based on number of employees, labor time, production time, or set percentages. Then costs are further allocated to products based on gross sales, amount of time spent on internal reviews, number of marketing campaigns, quantity sold number of orders, net weight of product delivered, or equally to each product. SMU2 accepts special orders when the contribution margin (CM1) is positive. Fine Foods defines CM1 as net sales minus variable manufacturing costs, fixed manufacturing costs, and freight out (see Table 2). Smith is convinced that decisions to accept the special orders are good for the company and contribute to Fine Foods' overall profitability, but she is frustrated at the impact on the results of her unit's operations. PERFORMANCE EVALUATION IN FINE FOODS Halfway through your projeet, you discuss it with friends and colleagues who are also recent accounting graduates. As you describe Smith's concerns with Fine Foods' product costing as well as your frustration with analyzing and developing recommendations, one friend interrupts to say that the product costing problem appears to be only a symptom of a larger issue. Your friend had recently covered the issue of symptoms vs. underlying problems in her management control class, and it seemed to her that the major issue is Smith is concerned that the amount of costs allocated to special orders for product MP is excessive and therefore causing her unit to be viewed less favorably than the other units. Among other things, she beleves allocations based on weight ae ufair because product MP is a relatively dense, bulky, and heavy product that, while profitable, has a relatively low profit per pound compared to other p ation of the SMUs, not product costing. Write a draft of a memorandum that Smith can present to her colleagues and management to support her case. The memo should include, but not be limited to, an analysis of current product costing approaches used at Fine Foods, changes she should recommend, and the extent to which the recommended changes would resolve her concerns. per 2. Somewhat skeptical, you look at some of your textbooks and other sources to brush up on performance evaluation. Then you explore performance evaluation at Fine Foods. You begin by speaking to Peter Jones, the controller of Fine Foods, who explains how the company computes CM1, CM2, CM3, CM4, and operating profit for each unit (see Table 2). Jones says the SMUs have the ability to control the costs of their divisions, and other costs are allocated easily and fairly. Targets are established for CM1, CM2, CM3, CM4, and operating profit, and the numbers are reviewed monthly to see if corrective action is necessary. Evaluation of performance but not be limited against the targets is made at the end of the year. PART 2 SPECIAL ORDERS a draft of a memorandym that Smih can present to r collengues and higher hanagement that focuses on what Fine Foods The memo should include, A description f the a ng and other considerations Smith, however, tells you that the primary evaluation for the SMUs is operating profit. Jones and another unit controller confirm it. Smith feels the method used by Fine Foods to calculate operating profit does not reflect the true performance of the SMUs because unit management cannot control several of the cost elements included in the calculation. Further, she believes using operating profit as the primary indicator for evaluating units has a negative motivational effect on the employees of her unit. special orders. ition of the terms bypr A brief productsand the extent to which these items-spply to special yrders at Fine Foods. Identi "and "joint of all the benefits that Fine Foods receives l orders. Arfanalysis of the way Fine Foods handles its special and any recommended changes. PART 3 PERFORMANCE EVALUATION YOUR REPORT Develop a glossary of terms and definitions for Smith in her presen tation and discussions to ensure pnsistency and mutual understanding of terms. In PART1: PRODUCT COSTING lition to definitions, provide a brief description of the applicability of terms to Fine Foods. The glossary should include, but not be limited to: a glossary of terms and definitihs for Smith to use in her presentation and d consistency and mutual un addition o definitions, p applicability of terms to Fing Foods. The glossary should include, bube limitey to: to ensure ing of terms. In a brief description of the of responsibility centers: enterS Revenne Centers .Cost Object Cost Driver Product vs. Period Cost Fixed vs. Variable Costs Direct vs. Indiregt Costs Incremental v. Common C Relevant vs. Arrelevant Costs Profit Ce - Investment Cbnters Computation methods of monetary amounts to evaluate performance: -Contribution Margin Operating Profit -Return on Investment - Residual Income and EVA Agency Costs . Controllable vs. Uncontrollable Costs Dual Allcation (sometimes called Departmental Costs) Volume 2. Prepare a draft of a memorandum for Smith to present to management that includes, but is not Activty-Based Costing her colleagues a limited to: nd n What roles do performance evaluation and reward systems play in organizations? Discuss individual vs. team-based performance evaluation in this context. Are these roles relevant for all types of organizations and employees?To what extent, if any, do these roles apply to Fine Foods? Discuss basic concepts of performance evaluation, particularly results control. Dis vs. nonfinancial performance in this context. What types of responsibility centers are the SMUs in Fine Foods? Are these appropriate types of cuss issues of financial ponsibility centers for Fine Foods? Why or why not .Identify potential agency costs that might occur within Fine Foods. Discuss performance measurement (monitoring and incentive systems as mechanisms to deerease agency costs at Fine Foods. Identify and discuss any recommendations to implement a reward system. Analyze the extent to which your recommendations would solve the issues that concern Smith and would decrease agency costs. Analyze the performance evaluation approaches at Fine Foods. Identify and discuss any changes you might recommend, and the extent to which these changes would resolve the issues Smith raised. PART 4: CONCLUSION AND RECOMMENDATIONS 1 Prepare a draft memorandum for Smith to present to her colleagues and to higher management that gives recommendations for changes and discusses their benefits for the company as a whole. Figure 1 Fine Foods, Inc. Organization Chart Top Management Resoarch 8 Dovelopment Human Resources Supply Chain Management Finance SMU 1 SMU 2 SMU3 Marketing/Sales Marketing/Sales Figure 2 Production Process for Product MP Raw food and ingredients Packaging material Production line Hecieving raw food Production line 2 Preparation of the raw food and mixing with ingredients Production line 3 Cooking MP and similar products Production line 4 Packaging MP and other products within the same product group Product MP and delivered Other packaging Other products Table 1 Fixed Production Costs Allocated to Products Table 2 Contribution Margins and Operating Profit Workshop Storage Erwitanment Electricity Maintenance Mechanics Quality Engineering Production Line Maintenance Production Line Cleaning Lower Production Managemert Handling Raw Material Department Production Office Services Production Manager and Related Costs Grass Sales IStandard discounts) Activity discounts) ISpecial discount activities for customers Net Sales Variable manufacturing cost) Foxed manufacturing Cost) Freight out) Contribution Margin 1 Media) Sales promotion) Contribution Margin 2 Marketing and sales) Contribution Margin 3 Top management) Business administration) Information systom Human resources) Supply chain) Production External logistics for finishad goods) Mark up-Manufacture expenditures) Other fixed costs Contribution Margin 4 Structural Costs) (Total daprociationl Operating Profit nternal Logistics/Resource Planning Sanitatian Vehicles Building Maintonanco Steam Boiler

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts