Question: Please make a spreadsheet that implements a five-step binomial option pricing model (a five-step tree has six terminal nodes). The ASU Index is currently at

Please make a spreadsheet that implements a five-step binomial option pricing model (a five-step tree has six terminal nodes).

The ASU Index is currently at 650. At each time-step it can either rise of fall by 10 percent. The risk-free interest rate is five percent per year. Each time step is one month. Use your spreadsheet to calculate prices (premiums) for a European call, American call, European put, and American put, all with a strike price of 650 and a total time to expiration of five months.

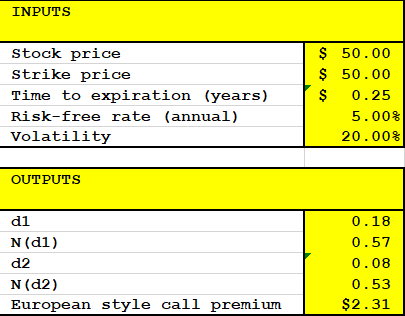

INEVIT'S stock price 50 . 00 Strike PRICE 50. 00 Time to Expiration ( years ) 5 0. 25 Risk - FREE rate (annual ) 5 . 00 3 Volatility 20. 003 OUTPUTS 0. 18 N [ d] ] 0. 57 O. OB N ( d2 ) 0. 53 FUII ONEALL STYLE CALL BEENLL LLLL $2 . 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts