Question: PLEASE MAKE A TABLE JUST LIKE THE ONE ON THE QUESTION. Haver Company currently pays an outside supplier $45 per unit for a part for

PLEASE MAKE A TABLE JUST LIKE THE ONE ON THE QUESTION.

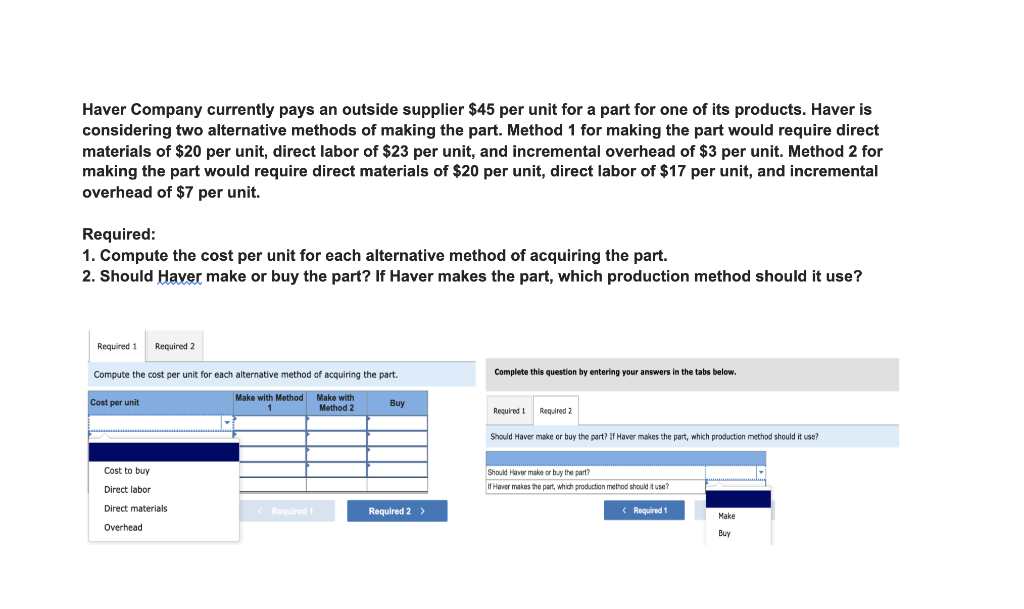

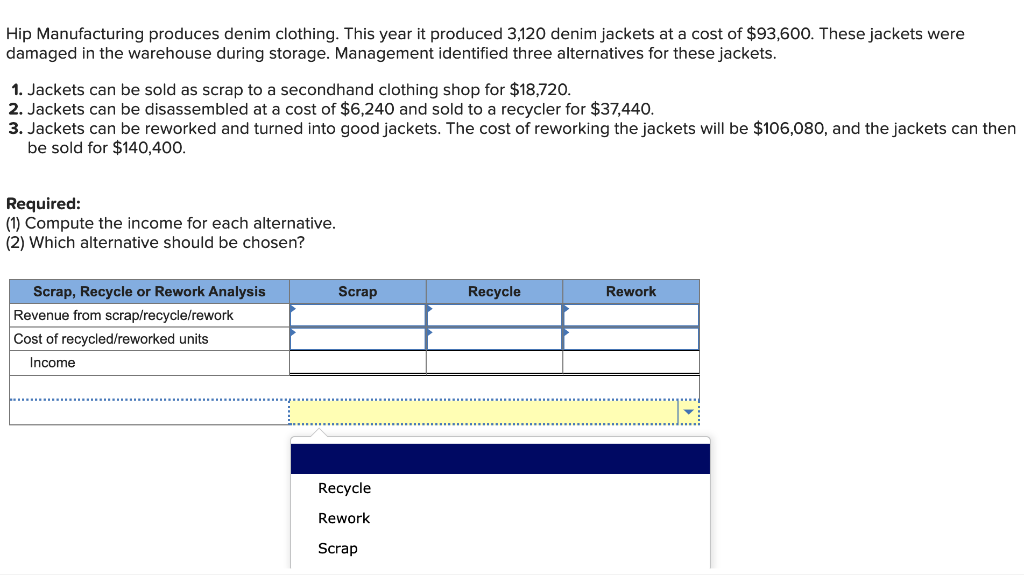

Haver Company currently pays an outside supplier $45 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $20 per unit, direct labor of $23 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $20 per unit, direct labor of $17 per unit, and incremental overhead of $7 per unit. Required: 1. Compute the cost per unit for each alternative method of acquiring the part. 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Required 1 Required 2 Compute the cost per unit for each alternative method of acquiring the part. Complete this question by entering your answers in the tabs below. Cost per unit Make with Method Make with 1 Method 2 Buy Required 1 Required 2 Should Haver make or buy the part? If Haver makes the part, which production method should it use? Cost to buy Should Haver make or by the part? If Haver makes the part, which production method should it use? Direct labor Required Direct materials Overhead Required 2 > (Required 1 Make Buy Hip Manufacturing produces denim clothing. This year it produced 3,120 denim jackets at a cost of $93,600. These jackets were damaged in the warehouse during storage. Management identified three alternatives for these jackets. 1. Jackets can be sold as scrap to a secondhand clothing shop for $18,720. 2. Jackets can be disassembled at a cost of $6,240 and sold to a recycler for $37,440. 3. Jackets can be reworked and turned into good jackets. The cost of reworking the jackets will be $106,080, and the jackets can then be sold for $140,400. Required: (1) Compute the income for each alternative. (2) Which alternative should be chosen? Scrap Recycle Rework Scrap, Recycle or Rework Analysis Revenue from scrap/recycle/rework Cost of recycled/reworked units Income Recycle Rework Scrap

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts