Question: Please make all the process Master Budget with Supporting Schedules You have just been hired as a management trainee by Cravat Sales Company, a nationwide

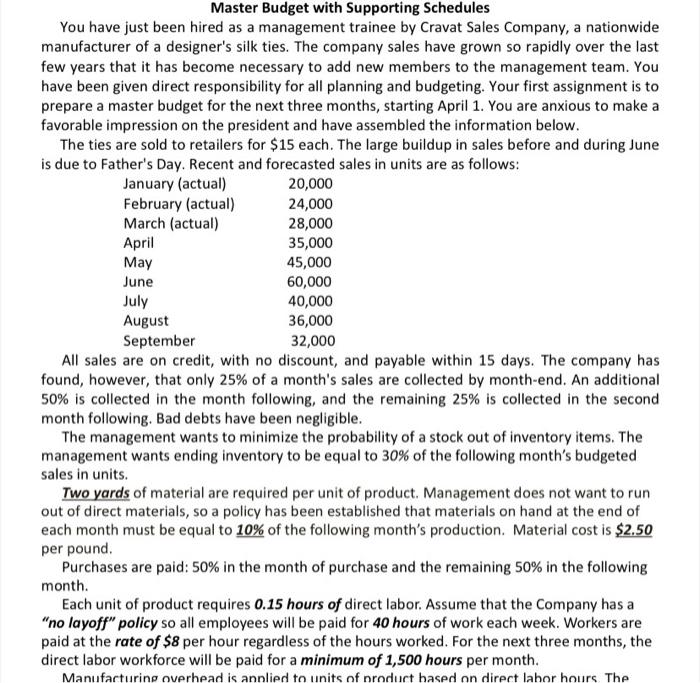

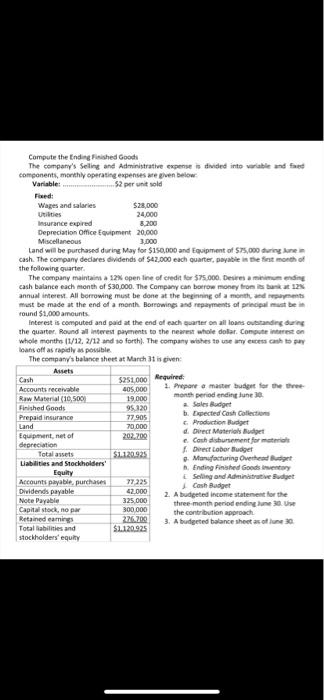

Master Budget with Supporting Schedules You have just been hired as a management trainee by Cravat Sales Company, a nationwide manufacturer of a designer's silk ties. The company sales have grown so rapidly over the last few years that it has become necessary to add new members to the management team. You have been given direct responsibility for all planning and budgeting. Your first assignment is to prepare a master budget for the next three months, starting April 1. You are anxious to make a favorable impression on the president and have assembled the information below. The ties are sold to retailers for $15 each. The large buildup in sales before and during June is due to Father's Day. Recent and forecasted sales in units are as follows: January (actual) 20,000 February (actual) 24,000 March (actual) 28,000 April 35,000 May 45,000 June 60,000 July 40,000 August 36,000 September 32,000 All sales are on credit, with no discount, and payable within 15 days. The company has found, however, that only 25% of a month's sales are collected by month-end. An additional 50% is collected in the month following, and the remaining 25% is collected in the second month following. Bad debts have been negligible. The management wants to minimize the probability of a stock out of inventory items. The management wants ending inventory to be equal to 30% of the following month's budgeted sales in units. Two yards of material are required per unit of product Management does not want to run out of direct materials, so a policy has been established that materials on hand at the end of each month must be equal to 10% of the following month's production. Material cost is $2,50 per pound. Purchases are paid: 50% in the month of purchase and the remaining 50% in the following month. Each unit of product requires 0.15 hours of direct labor. Assume that the Company has a "no layoff" policy so all employees will be paid for 40 hours of work each week. Workers are paid at the rate of $8 per hour regardless of the hours worked. For the next three months, the direct labor workforce will be paid for a minimum of 1,500 hours per month. Manufacturing overhead is anplied to units of product based on direct labor hours. The $28.000 Compute the Ending Finished Good The company's Selling and Administrative expense divided into variable and fed components, monthly operating expenses are gven below Variable: ...S2 per un sold Feed: Wages and salaries Utilities 24/000 Insurance expired 3.200 Depreciation Office Equipment 20.000 Miscellaneous 3.000 Land will be purchased during May for $150.000 and Equipment of $75,000 during one cash. The company declares dividends of $42.000 each Quarter, payable in the first month of the following quarter The company maintains a 12% open line of credit for 575.000. Deres a miding cash balance each month of $30,000. The Company can borrow money from its bankat 12% annual interest All borrowing must be done at the beginning of a month and pets must be made at the end of a month Borrowing and repayments of principal must be round $1,000 amounts Interest is computed and paid at the end of each cuarter on all loans outstanding during the quarter. Round all interest payments to the nearest whole dollar. Computer interest on whole months 11/12, 2/12 and so forth. The company wishes to use any excess cach to loans off as rapidly as posible The company's balance sheet at March 1 given Assets Cash Accounts receivable 405.000 2. Prepare a master budget for the three Raw Material (10,500 19.000 month period ending lune 30 Sales Budget Finished Goods 95320 Prepaid insurance 77 905 b. Directed Cash Collection Land 70.000 Production Budget Equipment, net of Direct Materials Budget 202,209 e. Cash disurement format depreciation Total assets $1.120.925 Dres Lobordiger Manufacturing Overhead Badget Liabilities and Stockholders' Ending Finished Goods Equity Selling and Administrative Budget Accounts payable, purchases 77225 Cash Budget Dividends payable 42.000 2. A budgeted income statement for the Note Payable 325 000 Capital stock, no three month period ending , 300 000 the contribution approach Retained earning 276.709 3. A budgeted balance sheet of 30 Total abilities and $1.120.925 stockholders' equity $251.000 quired

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts