Question: Please make answer choice clear and simple PROBLEM 2 In year 2008, Janet's firm is using a two stage dividend discount model (DDM) to find

Please make answer choice clear and simple

Please make answer choice clear and simple

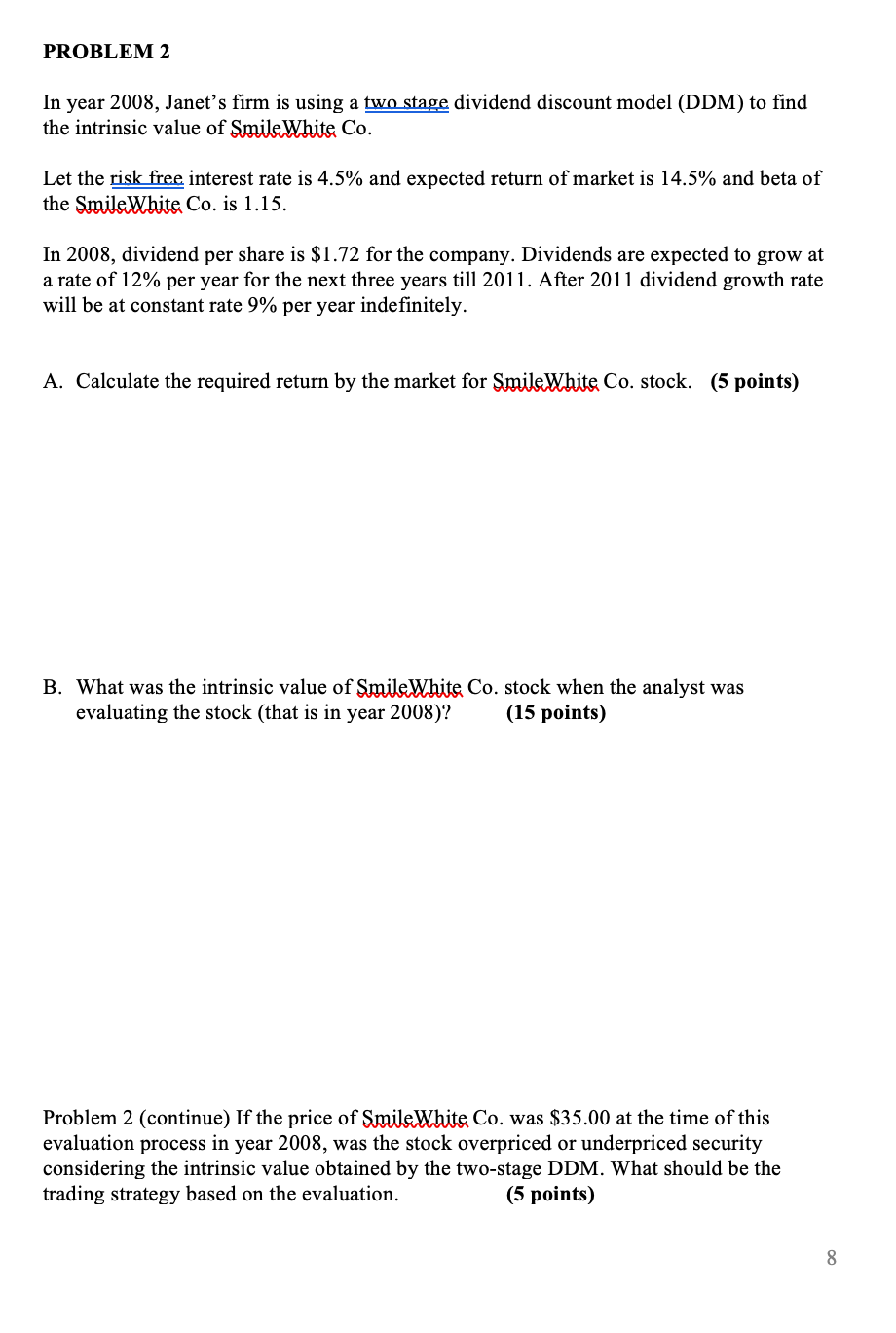

PROBLEM 2 In year 2008, Janet's firm is using a two stage dividend discount model (DDM) to find the intrinsic value of Smile White Co. Let the risk free interest rate is 4.5% and expected return of market is 14.5% and beta of the Smile White Co. is 1.15. In 2008, dividend per share is $1.72 for the company. Dividends are expected to grow at a rate of 12% per year for the next three years till 2011. After 2011 dividend growth rate will be at constant rate 9% per year indefinitely. A. Calculate the required return by the market for SmileWhite Co. stock. (5 points) B. What was the intrinsic value of Smile White Co. stock when the analyst was evaluating the stock (that is in year 2008)? (15 points) Problem 2 (continue) If the price of SmileWhite Co. was $35.00 at the time of this evaluation process in year 2008, was the stock overpriced or underpriced security considering the intrinsic value obtained by the two-stage DDM. What should be the trading strategy based on the evaluation. (5 points) 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts