Question: please make correct and i will upvote Expert Q&A Done trail ti please make correct and I will upvote o 8.5 31, 2019, is shown

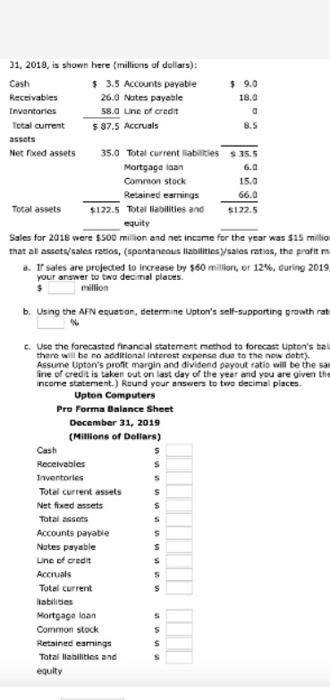

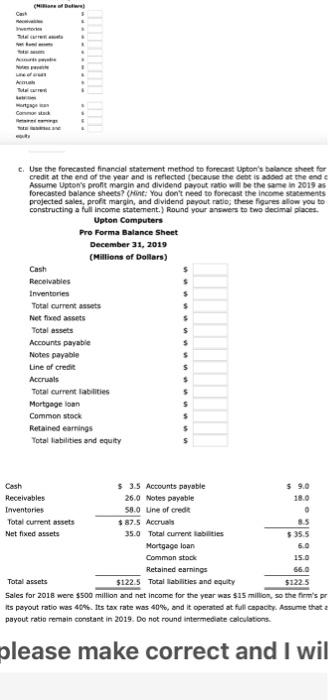

Expert Q&A Done trail ti please make correct and I will upvote o 8.5 31, 2019, is shown here millions of dollars): Cash $ 3.5 Accounts payable $ 9.0 Receivables 26.0 Nates payable 18.0 Inventaries 58. Une of credit Total current $ 87.5 Accruals assets Net Fixed assets 35.0 Total current abilities $ 35.5 Mortgage loan Common stock 15.0 Retained earnings 66.0 Total assets $122.5 Total Habilities and $122.5 equity Sales for 2018 were $500 milion and net income for the year was $15 millio that al assets/sales ratios, (spontaneous fiabilities/sales ratios, the profit m a. I sales are projected to increase by $60 million, or 12%, during 2019 your answer to the decimal places million b. Using the AFN egueton, determine Upton's self-supporting growth rat C. Use the forecasted financial statement method to forecast Upton's tal there will be no additional interest expense due to the now debt). Assume Upton's profit margin and dividend payout ratio will be the sa line of credit is taken out on last day of the year and you are given the income statement.) Round your answers to the decimal places. Upton Computers Pro Forma Balance Sheet December 31, 2019 (Millions of Dollars) Cash Receivables $ Inventories Total current assets $ Net foed assets s Total assets s Accounts payable s Nates payable $ Line of credit s Accruals 5 Total current s Habilities Mortgage loan Common stock $ Retained eamings s Total liabilities and S equity Cast A The Com c. Use the forecasted financial statement method to forecast Upton's balance sheet for credit at the end of the year and is reflected because the debt is added at the end Assume Upton's profit margin and dividend payout ratio will be the same in 2015 as forecasted balance sheets? Ce: You don't need to forecast the income statements projected sales, profit margin, and dividend payout at these figures allow you to constructing a full income statement.) Round your answers to two decimal places Upton Computers Pro Forma Balance Sheet December 31, 2019 (Millions of dollars) Cash Receivables $ Inventories $ Total current assets $ Net fixed assets $ Total assets $ Accounts payable $ Notes payable $ Line of credit s Accruals $ Total current abilities $ Mortgage loan s Common stock Retained earnings Total liabilities and equity Cash $ 3.5 Accounts payable $ 9.0 Receivables 26.0 Notes payable 18.0 Inventories 58.0 Une of credit O Total current assets $87.5 Accruals 8.5 Net fixed assets 35.0 Total current les $35.5 Mortgage loan 60 Common stock 15.0 Retained earnings 56.0 Total assets $122.5 Total abilities and equity $1225 Sales for 2018 were $500 million and net income for the year was $15 million, so the firm's pr its payout ratio was 40. Its tax rate was 40%, and it operated at full capacity. Assume that a payout ratio remain constant in 2019. Do not round intermediate calculations please make correct and I wil Expert Q&A Done trail ti please make correct and I will upvote o 8.5 31, 2019, is shown here millions of dollars): Cash $ 3.5 Accounts payable $ 9.0 Receivables 26.0 Nates payable 18.0 Inventaries 58. Une of credit Total current $ 87.5 Accruals assets Net Fixed assets 35.0 Total current abilities $ 35.5 Mortgage loan Common stock 15.0 Retained earnings 66.0 Total assets $122.5 Total Habilities and $122.5 equity Sales for 2018 were $500 milion and net income for the year was $15 millio that al assets/sales ratios, (spontaneous fiabilities/sales ratios, the profit m a. I sales are projected to increase by $60 million, or 12%, during 2019 your answer to the decimal places million b. Using the AFN egueton, determine Upton's self-supporting growth rat C. Use the forecasted financial statement method to forecast Upton's tal there will be no additional interest expense due to the now debt). Assume Upton's profit margin and dividend payout ratio will be the sa line of credit is taken out on last day of the year and you are given the income statement.) Round your answers to the decimal places. Upton Computers Pro Forma Balance Sheet December 31, 2019 (Millions of Dollars) Cash Receivables $ Inventories Total current assets $ Net foed assets s Total assets s Accounts payable s Nates payable $ Line of credit s Accruals 5 Total current s Habilities Mortgage loan Common stock $ Retained eamings s Total liabilities and S equity Cast A The Com c. Use the forecasted financial statement method to forecast Upton's balance sheet for credit at the end of the year and is reflected because the debt is added at the end Assume Upton's profit margin and dividend payout ratio will be the same in 2015 as forecasted balance sheets? Ce: You don't need to forecast the income statements projected sales, profit margin, and dividend payout at these figures allow you to constructing a full income statement.) Round your answers to two decimal places Upton Computers Pro Forma Balance Sheet December 31, 2019 (Millions of dollars) Cash Receivables $ Inventories $ Total current assets $ Net fixed assets $ Total assets $ Accounts payable $ Notes payable $ Line of credit s Accruals $ Total current abilities $ Mortgage loan s Common stock Retained earnings Total liabilities and equity Cash $ 3.5 Accounts payable $ 9.0 Receivables 26.0 Notes payable 18.0 Inventories 58.0 Une of credit O Total current assets $87.5 Accruals 8.5 Net fixed assets 35.0 Total current les $35.5 Mortgage loan 60 Common stock 15.0 Retained earnings 56.0 Total assets $122.5 Total abilities and equity $1225 Sales for 2018 were $500 million and net income for the year was $15 million, so the firm's pr its payout ratio was 40. Its tax rate was 40%, and it operated at full capacity. Assume that a payout ratio remain constant in 2019. Do not round intermediate calculations please make correct and I wil

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts