Question: PLEASE MAKE CORRECTIONS AS NEEDED AND FILL IN BLANKS The following events occurred in June: - June 1 : Owner contributed $ 5 0

PLEASE MAKE CORRECTIONS AS NEEDED AND FILL IN BLANKS

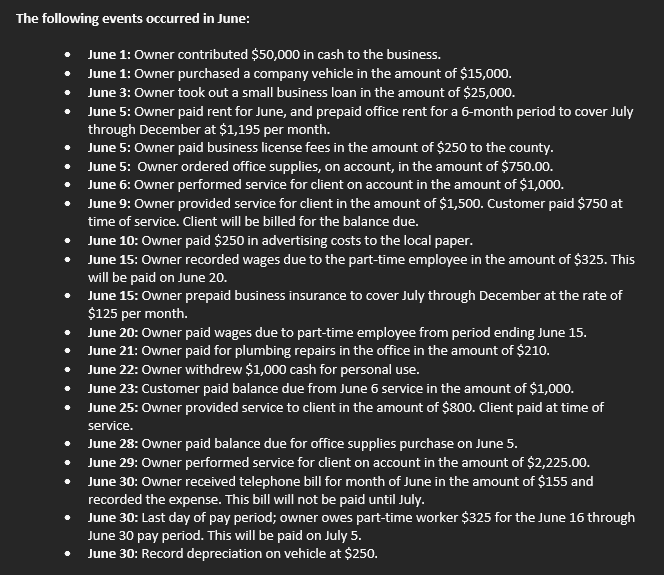

The following events occurred in June:

June : Owner contributed $ in cash to the business.

June : Owner purchased a company vehicle in the amount of $

June : Owner took out a small business loan in the amount of $

June : Owner paid rent for June, and prepaid office rent for a month period to cover July through December at $ per month.

June : Owner paid business license fees in the amount of $ to the county.

June : Owner ordered office supplies, on account, in the amount of $

June : Owner performed service for client on account in the amount of $

June : Owner provided service for client in the amount of $ Customer paid $ at time of service. Client will be billed for the balance due.

June : Owner paid $ in advertising costs to the local paper.

June : Owner recorded wages due to the parttime employee in the amount of $ This will be paid on June

June : Owner prepaid business insurance to cover July through December at the rate of $ per month.

June : Owner paid wages due to parttime employee from period ending June

June : Owner paid for plumbing repairs in the office in the amount of $

June : Owner withdrew $ cash for personal use.

June : Customer paid balance due from June service in the amount of $

June : Owner provided service to client in the amount of $ Client paid at time of service.

June : Owner paid balance due for office supplies purchase on June

June : Owner performed service for client on account in the amount of $

June : Owner received telephone bill for month of June in the amount of $ and recorded the expense. This bill will not be paid until July.

June : Last day of pay period; owner owes parttime worker $ for the June through June pay period. This will be paid on July

June : Record depreciation on vehicle at $

A Company

Income Statement

For Month ending XX

Revenues Total Revenues $

Operating Expenses:

Total Operating Expenses: Net Income

Company Name

Statement of Owner's Equity

Period Ending XX

:sssunuoN

XXOZ & un s

s

A Company Closing Entries Month ending XX Date Accounts Debit Credit Jun Close revenues Jun Close Expenses Jun Close Income Summary Jun Close Owners Draw

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock