Question: please make it to where it does not cut off on the sides and i can see it fully thank you! The contribution margin income

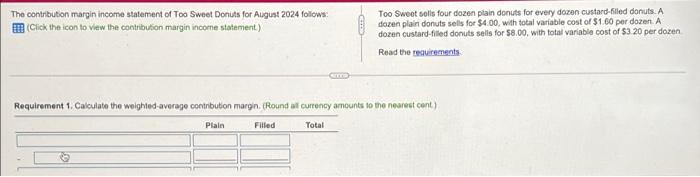

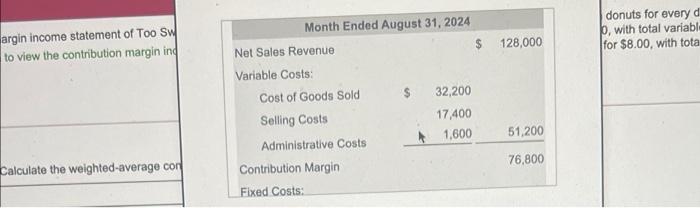

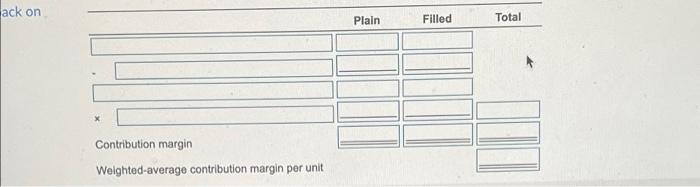

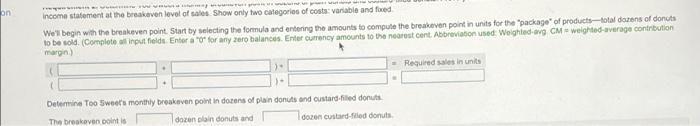

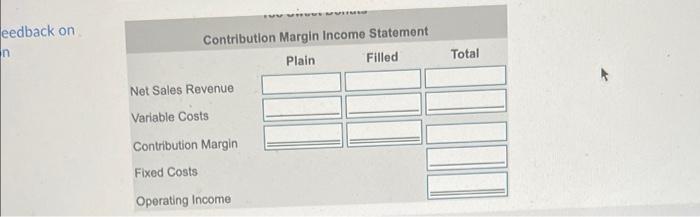

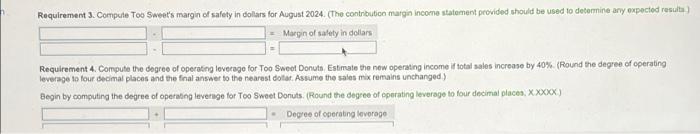

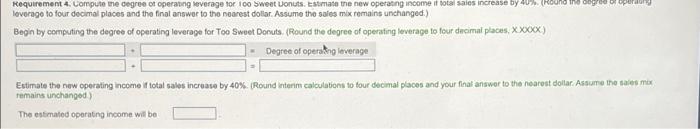

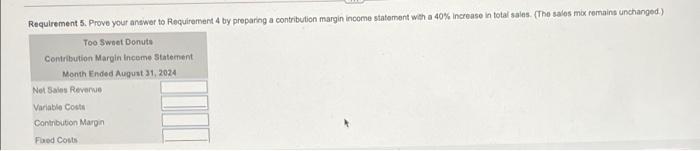

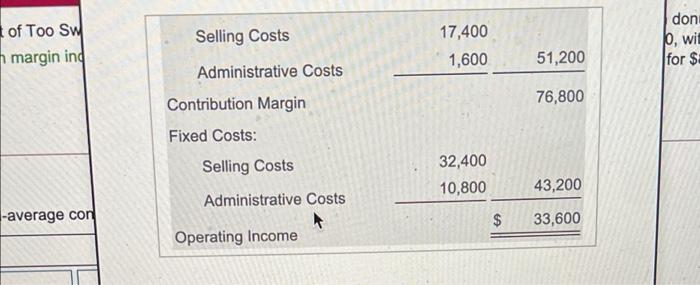

The contribution margin income statement of Too Sweet Donuts for August 2024 follows: (Click the icon to view the contribution margin income statement.) Too Sweet solis four dozen plain donuts for every dozen custard-filled donuts. A dozen plain donuts sells for $4.00, with total variable cost of $1.60 per dozen. A dozen custard-filled donuts sells for $8.00, with total variable cost of $3 20 per dozen Read the requirements GE Requirement 1. Calculate the weighted average contrbution margin. (Round al currency amounts to the nearest cont) Plain Filled Total argin income statement of Too SW to view the contribution margin in donuts for every d p, with total variable for $8.00, with tota 128,000 Month Ended August 31, 2024 Net Sales Revenue $ Variable Costs: Cost of Goods Sold 32,200 Selling Costs 17,400 1,600 Administrative Costs Contribution Margin Fixed Costs: 51,200 76,800 Calculate the weighted-average cor ack on Plain Filled Total x Contribution margin Weighted-average contribution margin per unit on Income statement at the breakeven level of sales Show only two categories of costs: variable and fed We'l begin with the breakeven point. Start by selecting the formula and entering the amounts to compute the breakeven point in units for the package of products-total dozens of donuts to be sold. (Complete all input fields Enter for any zero balances. Enter currency amounts to the nearest cent. Abbreviation used. Weighted avg CM weighted average contribution margin) ce = Required sales in units Determine Too Sweet's monthly breakeven point in dozens of plain donuts and custard-filled donuts The breskoven pointi dazon in donuts and dozen custard-led donuts eedback on n Total Contribution Margin Income Statement Plain Filled Net Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income Requirement 3. Compute To Sweet's margin of safety in dollars for August 2024. (The contribution margin Income statement provided should be used to determine arvy expected result Margin of safety in dollars Requirement 4. Compute the degree of operating loverage for Too Sweet Donuts Estimate the new operating income if total sales increase by 40% (Round the degree of operating leverage to four decimal places and the final answer to the nearest dollar. Assume the sales mix remains unchanged) Begin by computing the degree of operating leverage for Too Sweet Donuts. Round the degree of operating leverage to four decimal places, XXXX) Degree of operating lovorogo Requirement 4. Computo me degree of operating leverage for 100 Sweet Donuts. Estimate the new operating income if total sales increase by 4 (round the leverage to four decimal places and the final answer to the nearest dollar. Assume the sales mix remains unchanged.) Begin by computing the degree of operating leverage for Too Sweet Donuts. (Round the degree of operating leverage to four decimal places, XXXXX) - Degree of operang leverage 3 Estimate the new operating income total sales increase by 40%. Round interim calculations to four decimal places and your final answer to the nearest dollar. Assume the sales mer remains unchanged) The estimated operating income will be Requlrement 5. Prove your answer to Requirement 4 by preparing a contribution margin income statement wth a 40% Increase in total sales. The sales mix remains unchanged.) Too Sweet Donuts Contribution Margin income Statement Month Ended August 31, 2024 Not Sales Reverwe Variable Costa Contribution Margin Food Costs of Too SW n margin ind Selling Costs 17,400 1,600 don p, wit for $E 51,200 Administrative Costs Contribution Margin 76,800 Fixed Costs: Selling Costs 32,400 10,800 43,200 Administrative Costs -average con $ 33,600 Operating Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts