Question: PLEASE MAKE READABLE QUESTION THREE Stock S and Stock W lie on the security market line (see Table 1). Table 1 Stock S Expected Return

PLEASE MAKE READABLE

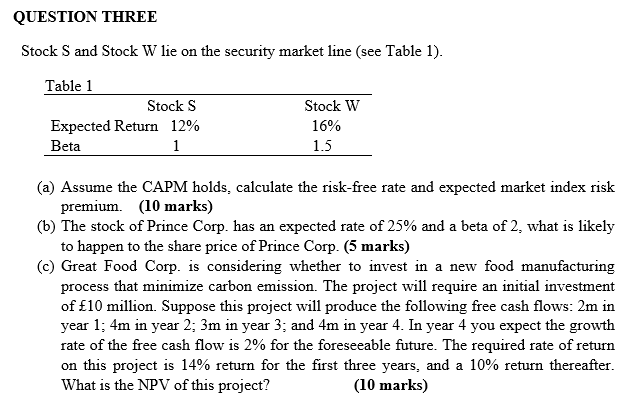

QUESTION THREE Stock S and Stock W lie on the security market line (see Table 1). Table 1 Stock S Expected Return 12% Beta 1 Stock W 16% 1.5 (a) Assume the CAPM holds, calculate the risk-free rate and expected market index risk premium. (10 marks) (b) The stock of Prince Corp. has an expected rate of 25% and a beta of 2, what is likely to happen to the share price of Prince Corp. (5 marks) (c) Great Food Corp. is considering whether to invest in a new food manufacturing process that minimize carbon emission. The project will require an initial investment of 10 million. Suppose this project will produce the following free cash flows: 2m in year 1; 4m in year 2; 3m in year 3; and 4m in year 4. In year 4 you expect the growth rate of the free cash flow is 2% for the foreseeable future. The required rate of return on this project is 14% return for the first three years, and a 10% return thereafter. What is the NPV of this project? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts