Question: please make sure each step is written and hand writting is clear to read You are a portfolio manager at Bill's Asset Management. Your research

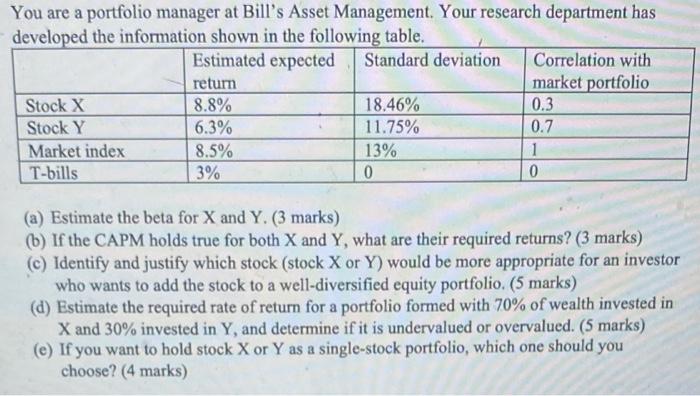

You are a portfolio manager at Bill's Asset Management. Your research department has developed the information shown in the following table. Estimated expected Standard deviation Correlation with retum market portfolio Stock X 8.8% 18.46% 0.3 Stock Y 6.3% 11.75% 0.7 Market index 8.5% 13% 1 T-bills 3% 0 0 (a) Estimate the beta for X and Y. (3 marks) (b) If the CAPM holds true for both X and Y, what are their required returns? (3 marks) (c) Identify and justify which stock (stock X or Y) would be more appropriate for an investor who wants to add the stock to a well-diversified equity portfolio. (5 marks) (d) Estimate the required rate of return for a portfolio formed with 70% of wealth invested in X and 30% invested in Y, and determine if it is undervalued or overvalued. (5 marks) (e) If you want to hold stock X or Y as a single-stock portfolio, which one should you choose? (4 marks) You are a portfolio manager at Bill's Asset Management. Your research department has developed the information shown in the following table. Estimated expected Standard deviation Correlation with retum market portfolio Stock X 8.8% 18.46% 0.3 Stock Y 6.3% 11.75% 0.7 Market index 8.5% 13% 1 T-bills 3% 0 0 (a) Estimate the beta for X and Y. (3 marks) (b) If the CAPM holds true for both X and Y, what are their required returns? (3 marks) (c) Identify and justify which stock (stock X or Y) would be more appropriate for an investor who wants to add the stock to a well-diversified equity portfolio. (5 marks) (d) Estimate the required rate of return for a portfolio formed with 70% of wealth invested in X and 30% invested in Y, and determine if it is undervalued or overvalued. (5 marks) (e) If you want to hold stock X or Y as a single-stock portfolio, which one should you choose? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts