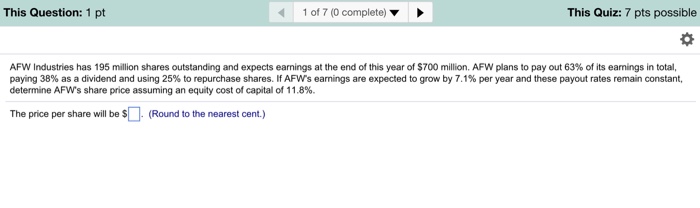

Question: Please make sure it is rigt, keep getting the wrong answer. Industries has 195 million shares outstanding and expects earnings at the end of the

Industries has 195 million shares outstanding and expects earnings at the end of the year of $700 million. AFW plans to pay out 63% of Its earnings In total, paying 38% as a dividend and using 25% to repurchase shares. If AFWs earnings are expected to grow by 7.1% per year and these payout rates remain constant, determine AFWs share price assuming an equity cost of capital of 11.8%. The price per share will be $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts