Question: please make sure the answer is right. Anne earns a gross yearly salary of $124,082. She has no dependent children and made the following tax

please make sure the answer is right.

please make sure the answer is right.

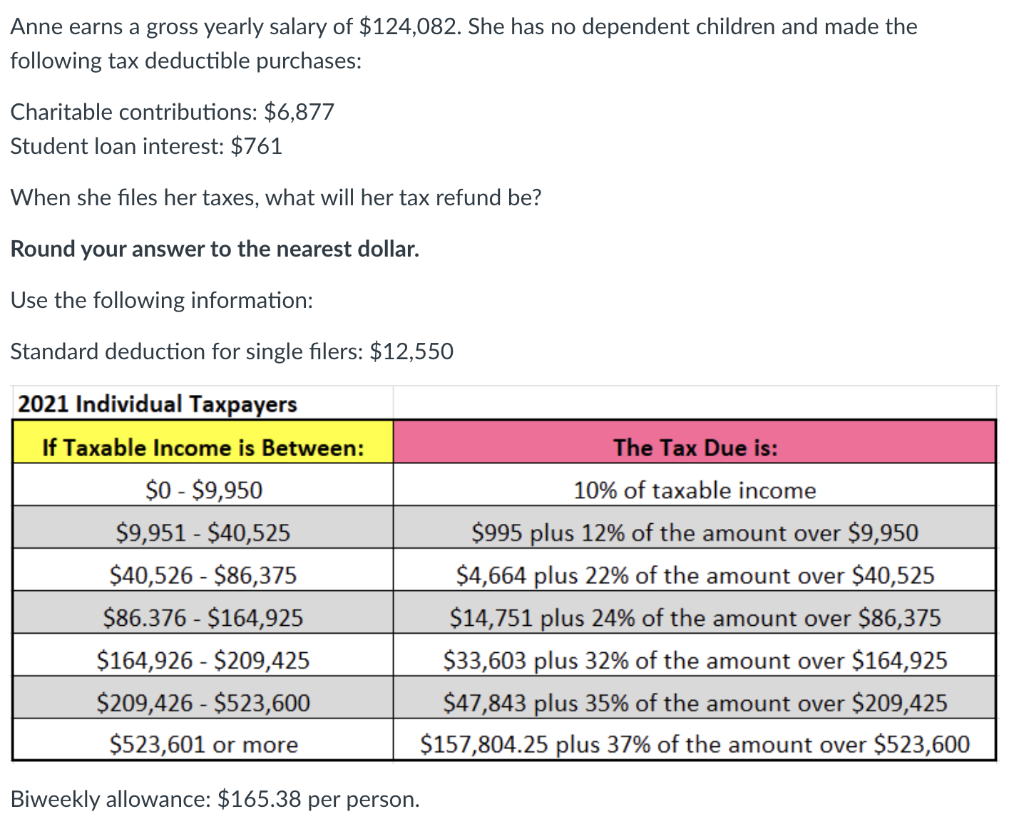

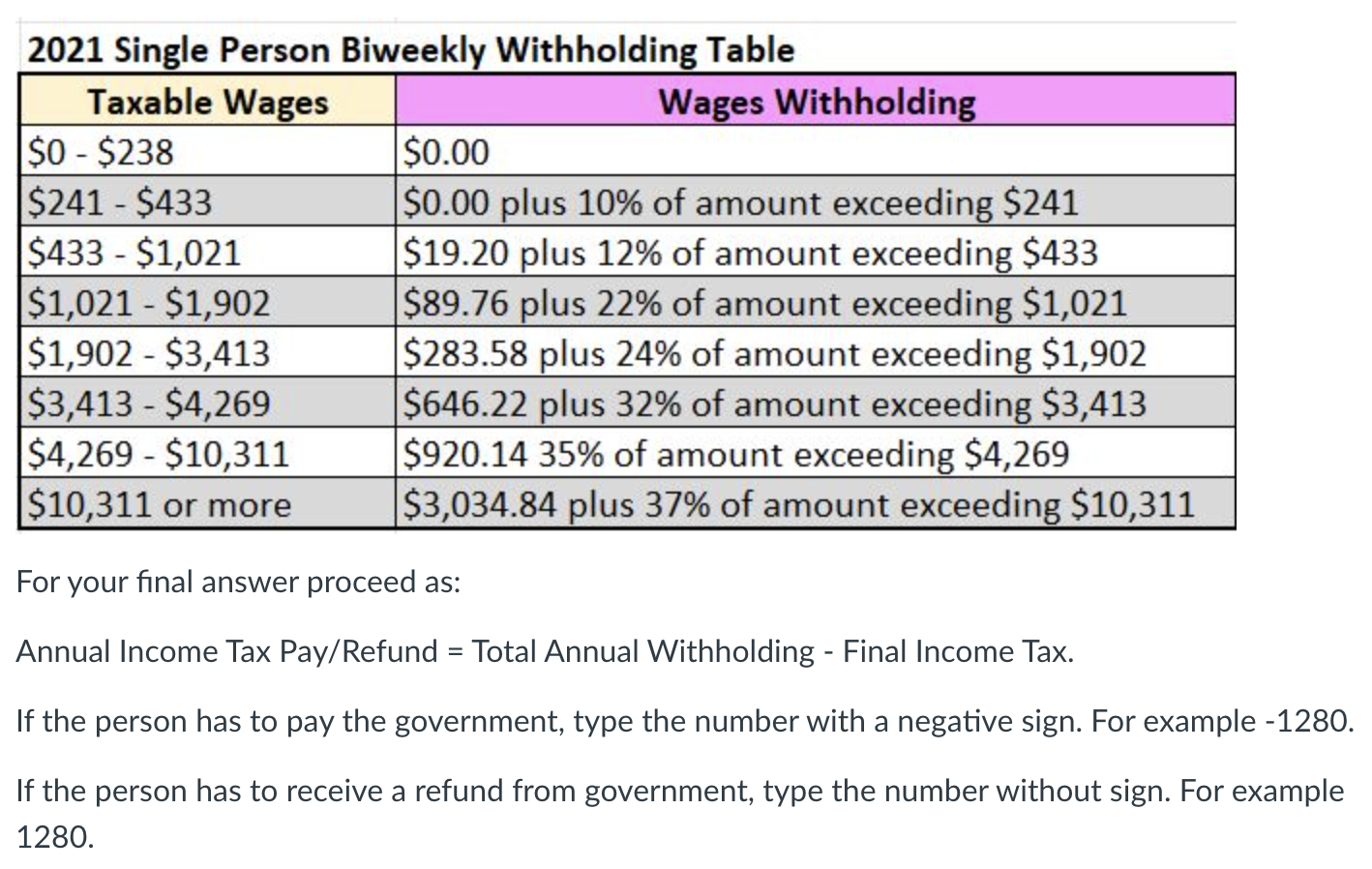

Anne earns a gross yearly salary of $124,082. She has no dependent children and made the following tax deductible purchases: Charitable contributions: $6,877 Student loan interest: $761 When she files her taxes, what will her tax refund be? Round your answer to the nearest dollar. Use the following information: Standard deduction for single filers: $12,550 2021 Individual Taxpayers If Taxable income is Between: $0 - $9,950 $9,951 - $40,525 $40,526 - $86,375 $86.376 - $164,925 $164,926 - $209,425 $209,426 - $523,600 $523,601 or more The Tax Due is: 10% of taxable income $995 plus 12% of the amount over $9,950 $4,664 plus 22% of the amount over $40,525 $14,751 plus 24% of the amount over $86,375 $33,603 plus 32% of the amount over $164,925 $47,843 plus 35% of the amount over $209,425 $157,804.25 plus 37% of the amount over $523,600 Biweekly allowance: $165.38 per person. 2021 Single Person Biweekly Withholding Table Taxable Wages Wages Withholding $0 - $238 $0.00 $241 - $433 $0.00 plus 10% of amount exceeding $241 $433 - $1,021 $19.20 plus 12% of amount exceeding $433 $1,021 - $1,902 $89.76 plus 22% of amount exceeding $1,021 $1,902 - $3,413 $283.58 plus 24% of amount exceeding $1,902 $3,413 - $4,269 $646.22 plus 32% of amount exceeding $3,413 $4,269 - $10,311 $920.14 35% of amount exceeding $4,269 $10,311 or more $3,034.84 plus 37% of amount exceeding $10,311 For your final answer proceed as: Annual Income Tax Pay/Refund = Total Annual Withholding - Final Income Tax. If the person has to pay the government, type the number with a negative sign. For example - 1280. If the person has to receive a refund from government, type the number without sign. For example 1280. Anne earns a gross yearly salary of $124,082. She has no dependent children and made the following tax deductible purchases: Charitable contributions: $6,877 Student loan interest: $761 When she files her taxes, what will her tax refund be? Round your answer to the nearest dollar. Use the following information: Standard deduction for single filers: $12,550 2021 Individual Taxpayers If Taxable income is Between: $0 - $9,950 $9,951 - $40,525 $40,526 - $86,375 $86.376 - $164,925 $164,926 - $209,425 $209,426 - $523,600 $523,601 or more The Tax Due is: 10% of taxable income $995 plus 12% of the amount over $9,950 $4,664 plus 22% of the amount over $40,525 $14,751 plus 24% of the amount over $86,375 $33,603 plus 32% of the amount over $164,925 $47,843 plus 35% of the amount over $209,425 $157,804.25 plus 37% of the amount over $523,600 Biweekly allowance: $165.38 per person. 2021 Single Person Biweekly Withholding Table Taxable Wages Wages Withholding $0 - $238 $0.00 $241 - $433 $0.00 plus 10% of amount exceeding $241 $433 - $1,021 $19.20 plus 12% of amount exceeding $433 $1,021 - $1,902 $89.76 plus 22% of amount exceeding $1,021 $1,902 - $3,413 $283.58 plus 24% of amount exceeding $1,902 $3,413 - $4,269 $646.22 plus 32% of amount exceeding $3,413 $4,269 - $10,311 $920.14 35% of amount exceeding $4,269 $10,311 or more $3,034.84 plus 37% of amount exceeding $10,311 For your final answer proceed as: Annual Income Tax Pay/Refund = Total Annual Withholding - Final Income Tax. If the person has to pay the government, type the number with a negative sign. For example - 1280. If the person has to receive a refund from government, type the number without sign. For example 1280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts