Question: please make sure the answer is right this time 5 parts Cooke Company has provided the following budget information for the first quarter of 2024

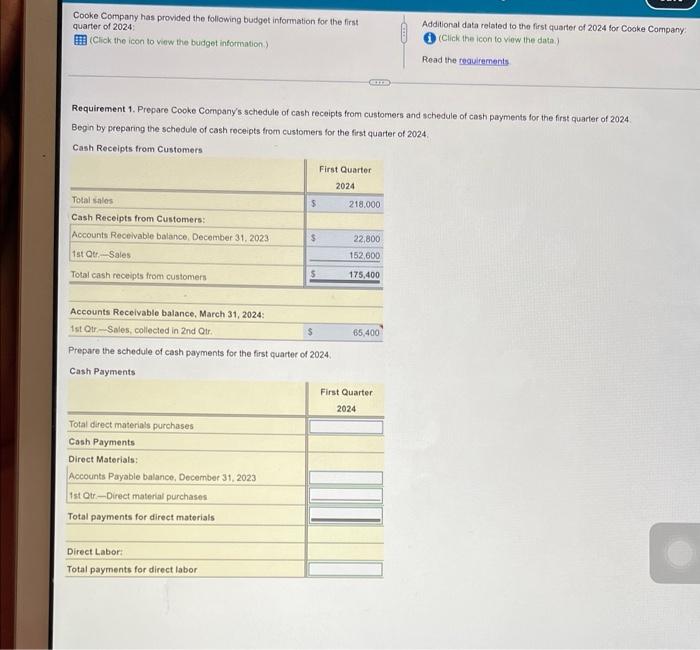

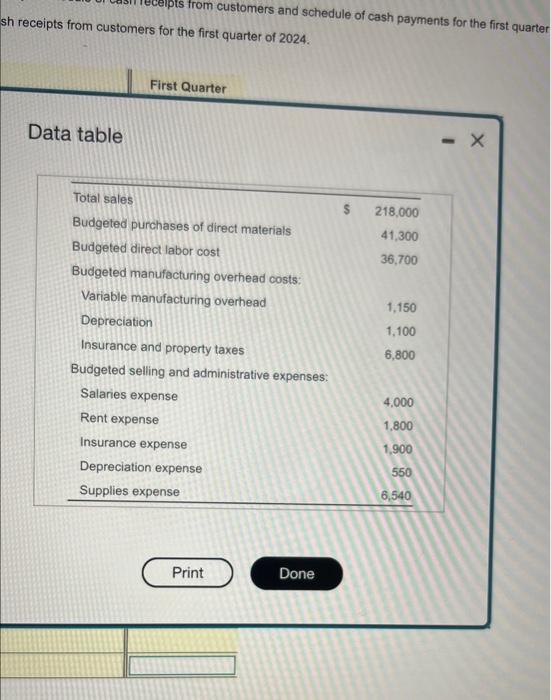

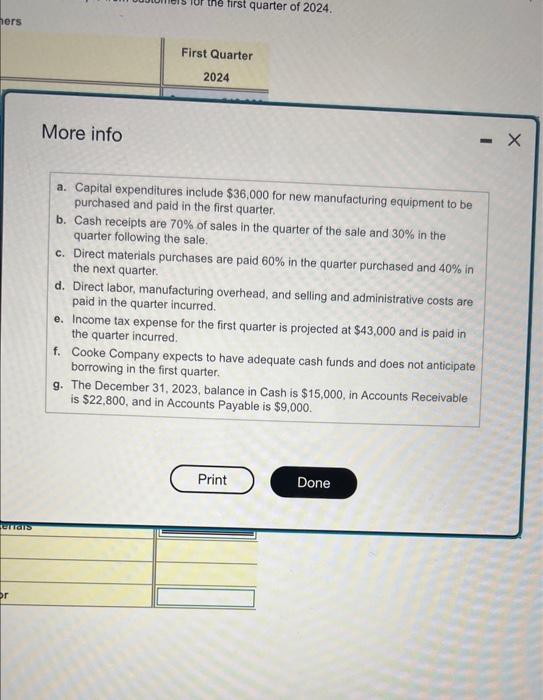

Cooke Company has provided the following budget information for the first quarter of 2024 (Click the icon to view the budget information.) Total sales Cash Receipts from Customers: Accounts Receivable balance, December 31, 2023 Requirement 1. Prepare Cooke Company's schedule of cash receipts from customers and schedule of cash payments for the first quarter of 2024 Begin by preparing the schedule of cash receipts from customers for the first quarter of 2024. Cash Receipts from Customers 1st Qtr-Sales. Total cash receipts from customers Accounts Receivable balance, March 31, 2024: 1st Qtr-Sales, collected in 2nd Qtr. Total direct materials purchases Cash Payments Direct Materials: Accounts Payable balance, December 31, 2023 1st Qtr-Direct material purchases Total payments for direct materials $ Direct Labor: Total payments for direct labor $ $ Prepare the schedule of cash payments for the first quarter of 2024. Cash Payments (IS) First Quarter 2024 218,000 22,800 152,600 175,400 65,400 Additional data related to the first quarter of 2024 for Cooke Company: (Click the icon to view the data.) Read the requirements First Quarter 2024 pts from customers and schedule of cash payments for the first quarter sh receipts from customers for the first quarter of 2024. Data table First Quarter Total sales Budgeted purchases of direct materials Budgeted direct labor cost Budgeted manufacturing overhead costs: Variable manufacturing overhead Depreciation Insurance and property taxes Budgeted selling and administrative expenses: Salaries expense Rent expense Insurance expense Depreciation expense Supplies expense Print Done $ 218,000 41,300 36,700 1,150 1,100 6,800 4,000 1,800 1,900 550 6,540 - X hers erials or More info first quarter of 2024. First Quarter 2024 a. Capital expenditures include $36,000 for new manufacturing equipment to be purchased and paid in the first quarter. b. Cash receipts are 70% of sales in the quarter of the sale and 30% in the quarter following the sale. c. Direct materials purchases are paid 60% in the quarter purchased and 40% in the next quarter. d. Direct labor, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred. e. Income tax expense for the first quarter is projected at $43,000 and is paid in the quarter incurred. f. Cooke Company expects to have adequate cash funds and does not anticipate borrowing in the first quarter. g. The December 31, 2023, balance in Cash is $15,000, in Accounts Receivable is $22,800, and in Accounts Payable is $9,000. Print Done - X Requirements 1. Prepare Cooke Company's schedule of cash receipts from customers and schedule of cash payments for the first quarter of 2024. 2. Prepare Cooke Company's cash budget for the first quarter of 2024. ecember 31, 2023 hases Print Done -

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts