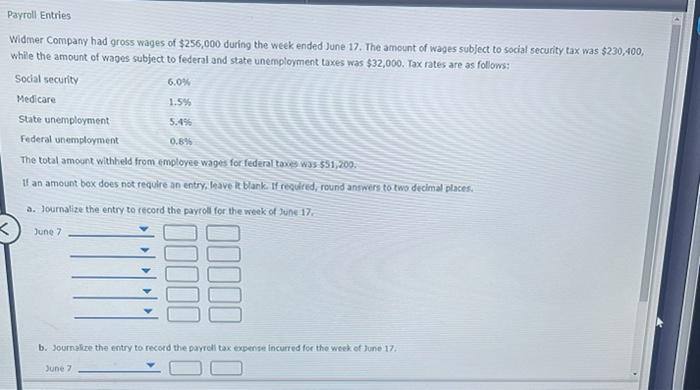

Question: please make sure the answer is showing, its one question , thanks Payroll Entries . 6.0% 1.5% Widmer Company had gross wages of $256,000 during

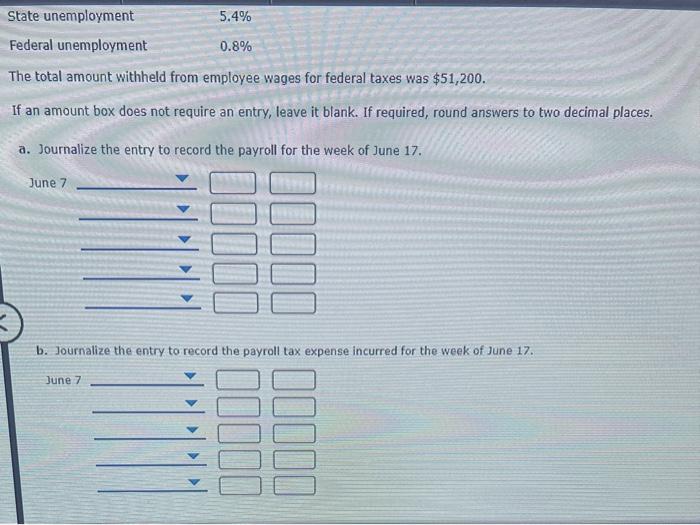

Payroll Entries . 6.0% 1.5% Widmer Company had gross wages of $256,000 during the week ended June 17. The amount of wages subject to social security tax was $230,400, while the amount of wages subject to federal and state unemployment taxes was $32,000. Tax rates are as follows: Social security Medicare State unemployment Federal unemployment The total amount withheld from employee wages for federal taxe was $51,200. If an amount bex does not require an entry, leave it blank. If required, round answers to two decimal places. a. Journalize the entry to record the payroll for the week of June 17 5.496 0.896 June 7 llll I b. Journalize the entry to record the payroll tax expense incurred for the week of June 17 June 7 State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $51,200. If an amount box does not require an entry, leave it blank. If required, round answers to two decimal places. a. Journalize the entry to record the payroll for the week of June 17. June 7 b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. June 7 l1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts