Question: please make sure the final answer is correct Q1 A) Use the human life value method to determine how much life insurance Briarn needs if

please make sure the final answer is correct

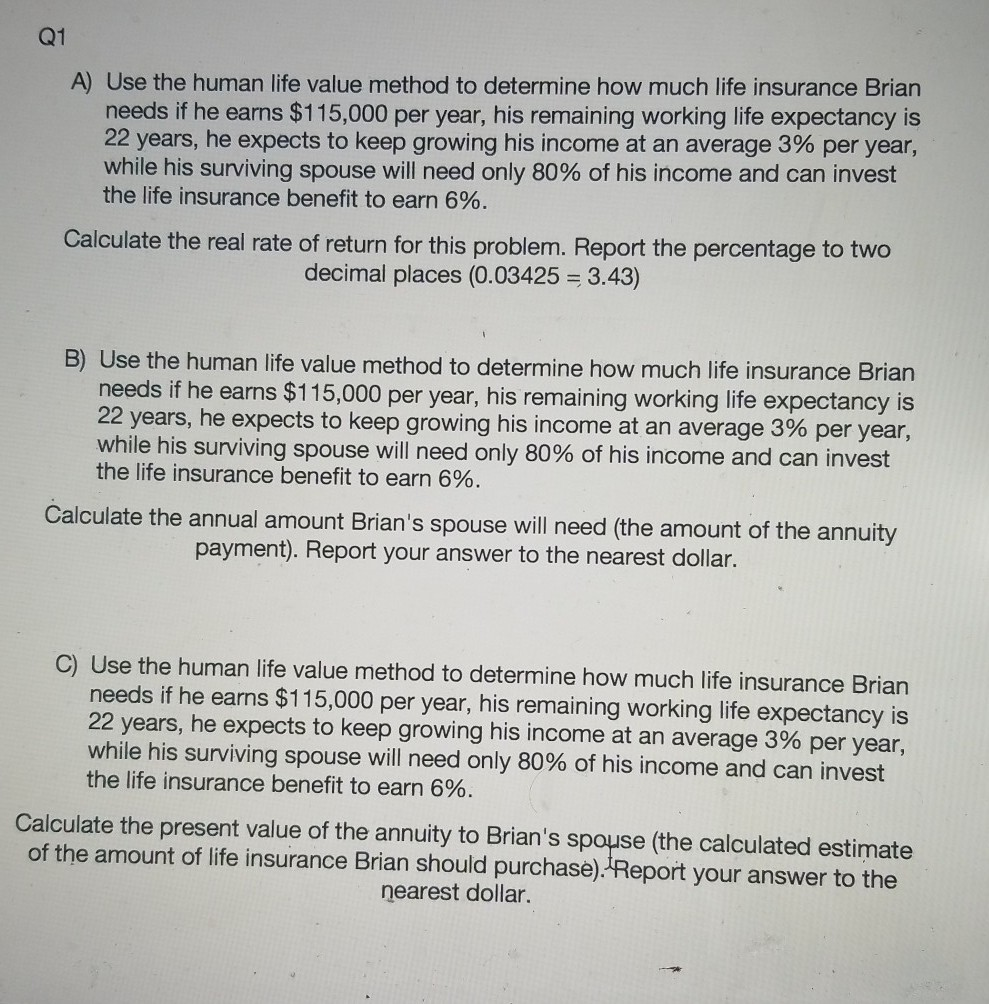

Q1 A) Use the human life value method to determine how much life insurance Briarn needs if he earns $115,000 per year, his remaining working life expectancy is 22 years, he expects to keep growing his income at an average 3% per year, while his surviving spouse will need only 80% of his income and can invest the life insurance benefit to earn 6%. Calculate the real rate of return for this problem. Report the percentage to two decimal places (0.03425 3.43) B) Use the human life value method to determine how much life insurance Brian needs if he earns $115,000 per year, his remaining working life expectancy is 22 years, he expects to keep growing his income at an average 3% per year, while his surviving spouse will need only 80% of his income and can invest the life insurance benefit to earn 6%. Calculate the annual amount Brian's spouse will need (the amount of the annuity payment). Report your answer to the nearest dollar. C) Use the human life value method to determine how much life insurance Brian needs if he earns $115,000 per year, his remaining working life expectancy is 22 years, he expects to keep growing his income at an average 3% per year, while his surviving spouse will need only 80% of his income and can invest the life insurance benefit to earn 6%. Calculate the present value of the annuity to Brian's spouse (the calculated estimate of the amount of life insurance Brian should purchase). Report your answer to the nearest dollar Q1 A) Use the human life value method to determine how much life insurance Briarn needs if he earns $115,000 per year, his remaining working life expectancy is 22 years, he expects to keep growing his income at an average 3% per year, while his surviving spouse will need only 80% of his income and can invest the life insurance benefit to earn 6%. Calculate the real rate of return for this problem. Report the percentage to two decimal places (0.03425 3.43) B) Use the human life value method to determine how much life insurance Brian needs if he earns $115,000 per year, his remaining working life expectancy is 22 years, he expects to keep growing his income at an average 3% per year, while his surviving spouse will need only 80% of his income and can invest the life insurance benefit to earn 6%. Calculate the annual amount Brian's spouse will need (the amount of the annuity payment). Report your answer to the nearest dollar. C) Use the human life value method to determine how much life insurance Brian needs if he earns $115,000 per year, his remaining working life expectancy is 22 years, he expects to keep growing his income at an average 3% per year, while his surviving spouse will need only 80% of his income and can invest the life insurance benefit to earn 6%. Calculate the present value of the annuity to Brian's spouse (the calculated estimate of the amount of life insurance Brian should purchase). Report your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts