Question: please make sure to give the correct answer For each of the following employees, calculate the Social Security tax for the weekly pay period described

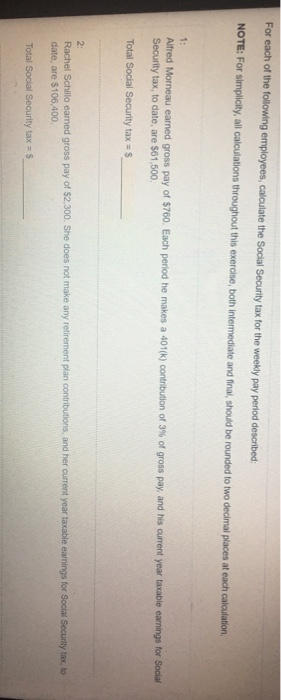

For each of the following employees, calculate the Social Security tax for the weekly pay period described NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation Alfred Morneau earned gross pay of $760. Each period he makes a 401(k) contribution of 3% of gross pay, and his current year taxable earnings for Social Security tax, to date, are $61,500 Total Social Security tax = $ Rachel Schillo eamed gross pay of $2,300. She does not make any retirement plan contributions, and her current year taxable earnings for Social Security tax, to date, are $106,400. Total Social Security tax = $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts