Question: Please make sure to include detailed step-by-step calculations. If possible, describe your thought process in each step so I can learn the methodology for future

Please make sure to include detailed step-by-step calculations. If possible, describe your thought process in each step so I can learn the methodology for future problems. Will leave a thumbs up if answer is detailed! Thank you :)

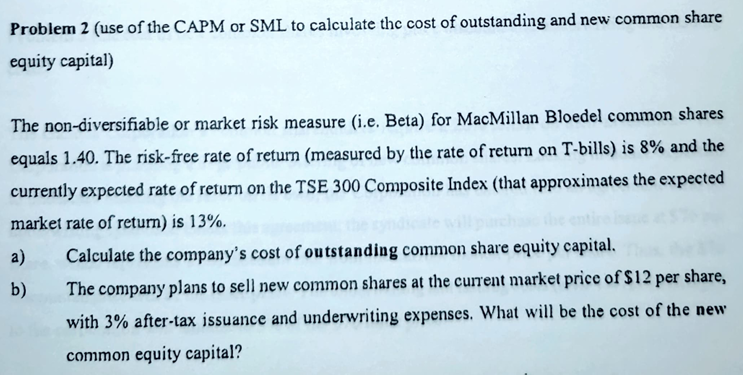

Problem 2 (use of the CAPM or SML to calculate the cost of outstanding and new common share equity capital) The non-diversifiable or market risk measure (i.e. Beta) for MacMillan Bloedel common shares equals 1.40. The risk-free rate of return (measured by the rate of return on T-bills) is 8% and the currently expected rate of retum on the TSE 300 Composite Index (that approximates the expected market rate of return) is 13%. a) Calculate the company's cost of outstanding common share equity capital. b) The company plans to sell new common shares at the current market price of $12 per share, with 3% after-tax issuance and underwriting expenses. What will be the cost of the new common equity capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts