Question: Please make sure to show the work, I dont need only the answer. T hanks! Financial Statement Analysis: Tesla Q2 Earnings For attached Tesla's recent

Please make sure to show the work, I dont need only the answer. Thanks!

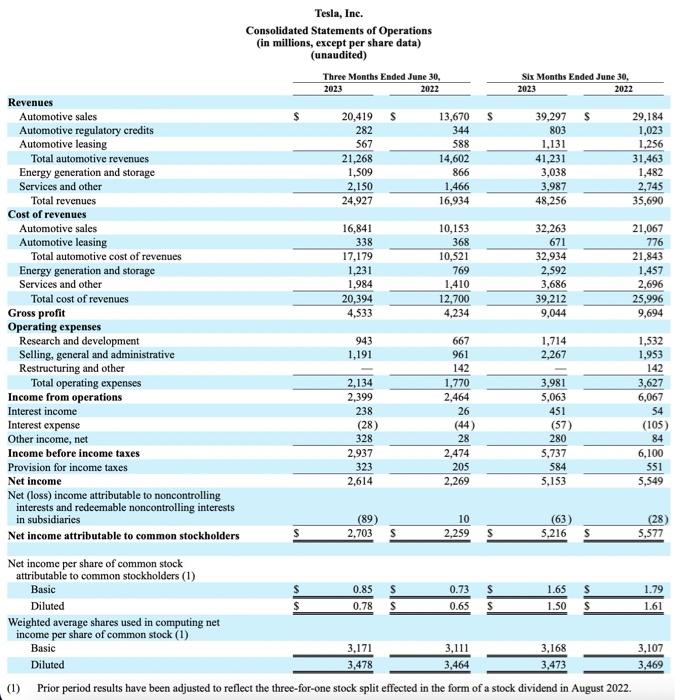

Financial Statement Analysis: Tesla Q2 Earnings For attached Tesla's recent quarterly earnings report, calculate the following ratios:

- Quarterly Revenue Growth

- Quarterly Earnings Growth

- Net Margin

- Debt/Asset Ratio

- Current Ratio

- Earnings Per Share

- P/E Ratio (Price/Earnings)

Based on your analysis on Tesla's Q2 earnings (financial statements), would you recommend to your friends whether to buy its stock?

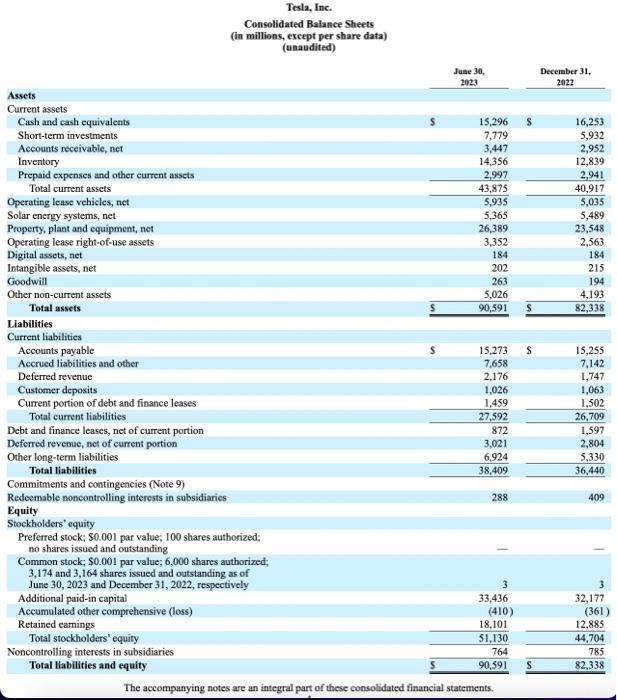

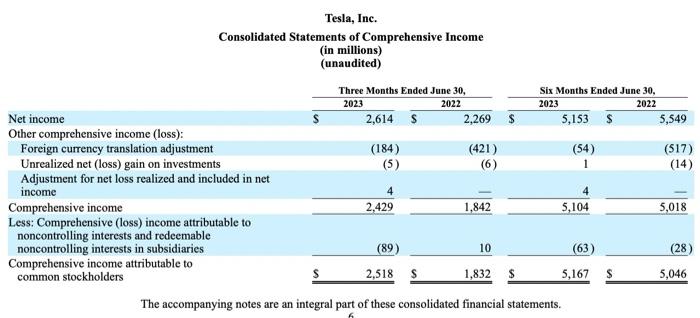

Tesla, Inc. Consolidated Statements of Comprehensive Income (in millions) (unaudited) The accompanying notes are an integral part of these consolidated financial statements. Tesla, Inc. Consolidated Statements of Operations (in millions, except per share data) Tesla, Inc. Consolidated Balance Sheets (in millions, except per share data) (unaudited) \begin{tabular}{|c|c|c|c|c|} \hline \multirow{2}{*}{ Assets } & \multicolumn{2}{|c|}{\begin{tabular}{c} Juase 30, \\ 2023 \end{tabular}} & \multicolumn{2}{|c|}{\begin{tabular}{c} December 31, \\ 2022 \end{tabular}} \\ \hline \multirow{2}{*}{\multicolumn{5}{|c|}{ Current assets }} \\ \hline & & & & \\ \hline Cash and cash equivalents & s & 15,296 & s & 16,253 \\ \hline Short-term investments & & 7,779 & & 5,932 \\ \hline Accounts receivable, net & & 3,447 & & 2,952 \\ \hline Inventory & & 14,356 & & 12,839 \\ \hline Prepaid expenses and other eurrent assets & & 2,997 & & 2,941 \\ \hline Total current assets & & 43,875 & & 40,917 \\ \hline Operating leuse vehicles, net & & 5,935 & & 5,035 \\ \hline Solar energy systems, net & & 5,365 & & 5,489 \\ \hline Property, plant and equipment, net & & 26,389 & & 23,548 \\ \hline Operating lease right-of-use assets & & 3,352 & & 2,563 \\ \hline Digital assets, net & & 184 & & 184 \\ \hline Intangible assets, net & & 202 & & 215 \\ \hline Goodwill & & 263 & & 194 \\ \hline Other non-current assets & & 5,026 & & 4,193 \\ \hline Total assets & 5 & 90,591 & & 82,338 \\ \hline \multicolumn{5}{|l|}{ Labilities } \\ \hline \multicolumn{5}{|l|}{ Current liabilities } \\ \hline Accounts payable & $ & 15,273 & \$ & 15,255 \\ \hline Accrued liabilities and other & & 7,658 & & 7,142 \\ \hline Deferred revenue & & 2,176 & & 1,747 \\ \hline Customer deposits & & 1,026 & & 1,063 \\ \hline Current portion of debt and finance leases & & 1,459 & & 1,502 \\ \hline Total current liabilities & & 27,592 & & 26,709 \\ \hline Debt and finance leases, net of current portion & & 872 & & 1,597 \\ \hline Deferred revenue, net of current portion & & 3,021 & & 2,804 \\ \hline Other long-term liabilities & & 6,924 & & 5,330 \\ \hline Total liabilities & & 38,409 & & 36,440 \\ \hline \multicolumn{5}{|l|}{ Commitments and contingencies (Note 9) } \\ \hline Redoemable noncontrolling interests in subsidiaries & & 288 & & 409 \\ \hline \multicolumn{5}{|l|}{ Equity } \\ \hline \multicolumn{5}{|l|}{ Stockholders' equity } \\ \hline \begin{tabular}{l} Preferred stock; $0.001 par value; 100 shares authorized; \\ no shares issued and outstanding \end{tabular} & & - & & - \\ \hline \begin{tabular}{l} Common stock; $0.001 par value; 6,000 shares authorized; \\ 3,174 and 3,164 shares issued and outstanding as of \\ June 30,2023 and December 31,2022 , respectively \end{tabular} & & 3 & & 3 \\ \hline Additional paid-in capital & & 33,436 & & 32,177 \\ \hline Accumulated other comprehensive (loss) & & (410) & & (361) \\ \hline Retained eamings & & 18,101 & & 12,885 \\ \hline Total stockholders' equity & & 51,130 & & 44,704 \\ \hline Noncontrolling interests in subsidiaries & & 764 & & 785 \\ \hline Total liabilities and equity & 5 & 90,591 & S & 82,338 \\ \hline \end{tabular} The accompanying notes are an integral part of these consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts