Question: Please make sure your answer is correct. Capital Structure and Unlevered Beta Estimates for Comparable Firms If Ideko's unlevered cost of capital is at the

Please make sure your answer is correct.

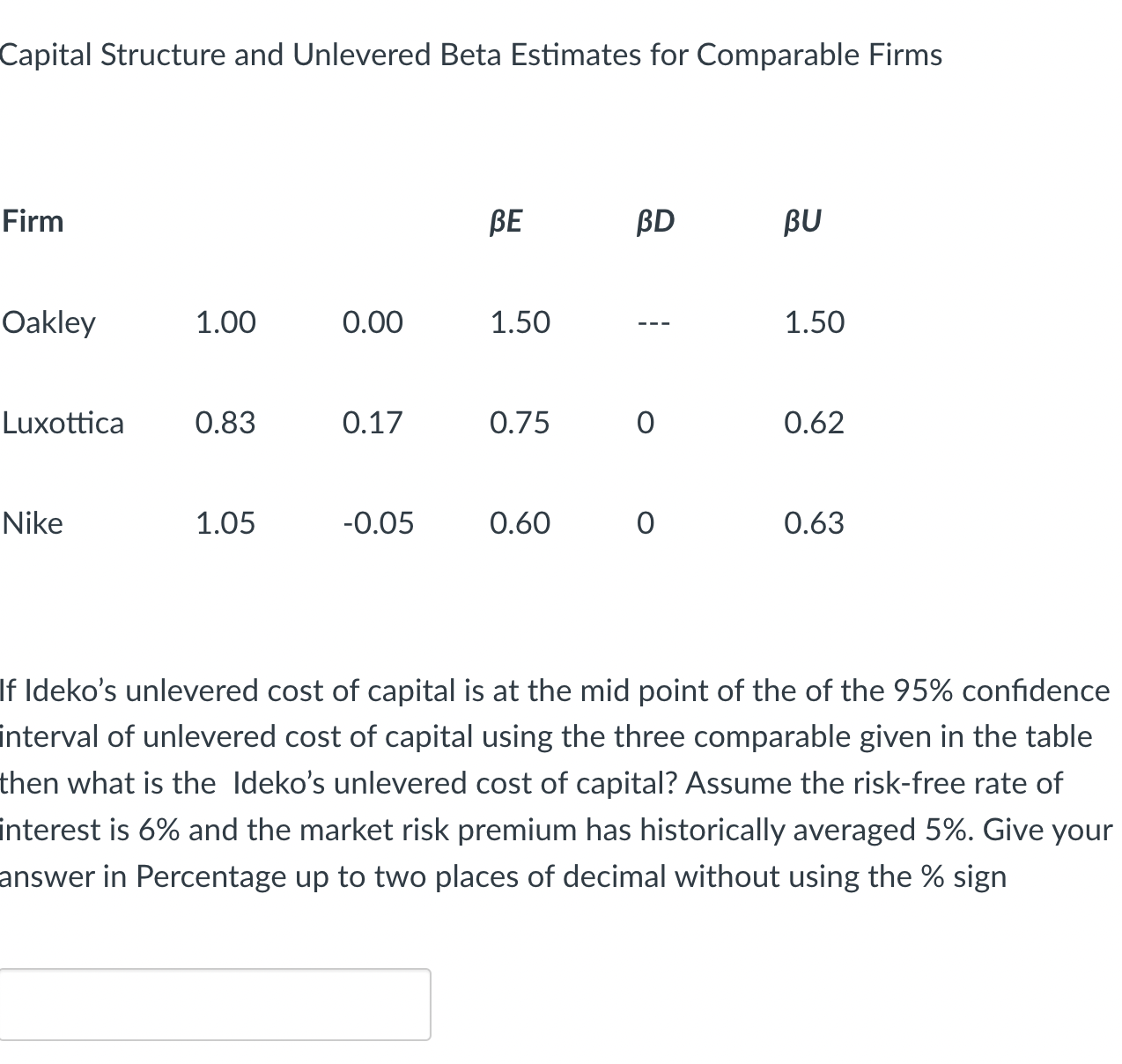

Capital Structure and Unlevered Beta Estimates for Comparable Firms If Ideko's unlevered cost of capital is at the mid point of the of the 95% confidence interval of unlevered cost of capital using the three comparable given in the table then what is the Ideko's unlevered cost of capital? Assume the risk-free rate of interest is 6% and the market risk premium has historically averaged 5%. Give your answer in Percentage up to two places of decimal without using the \% sign

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock