Question: Please make the answer clear and precise and show all workings. Need answer ASAP. 7 A company is considering a new 6-year project that will

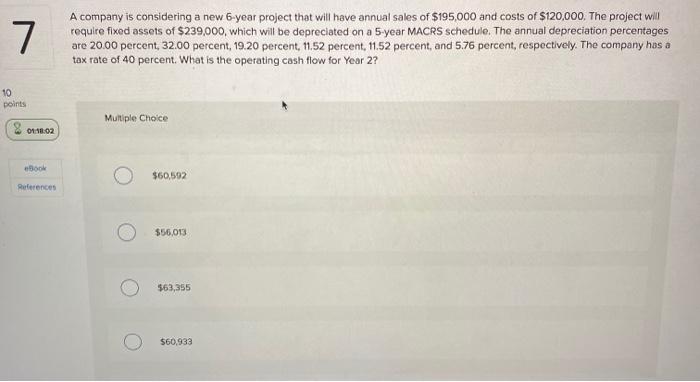

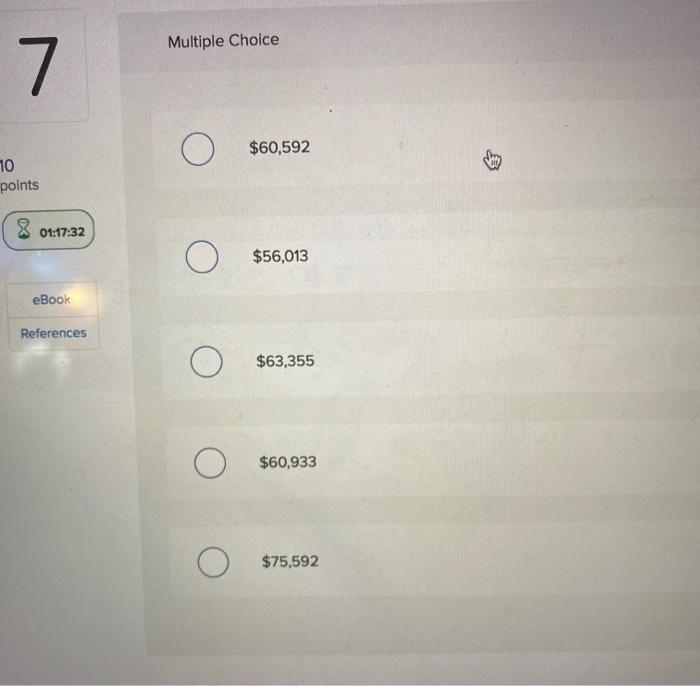

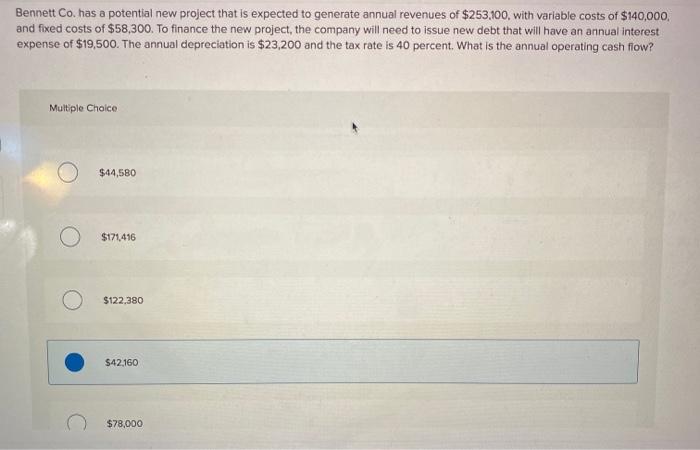

7 A company is considering a new 6-year project that will have annual sales of $195,000 and costs of $120,000. The project will require fixed assets of $239,000, which will be depreciated on a 5-year MACRS schedule. The annual depreciation percentages are 20.00 percent, 32.00 percent, 19.20 percent, 11.52 percent, 11.52 percent, and 5.76 percent, respectively. The company has a tax rate of 40 percent. What is the operating cash flow for Year 2? 10 points Multiple Choice 01.02 500W $60,592 References $56,013 $63,355 $60,933 Multiple Choice 7 $60,592 10 points 8 01:17:32 O O $56,013 eBook References $63,355 $60,933 $75,592 Bennett Co. has a potential new project that is expected to generate annual revenues of $253,100, with variable costs of $140,000 and fixed costs of $58,300. To finance the new project, the company will need to issue new debt that will have an annual interest expense of $19,500. The annual depreciation is $23,200 and the tax rate is 40 percent. What is the annual operating cash flow? Multiple Choice $44,580 $171,416 $122.380 $42.160 $78,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts