Question: Please make the answer clear and simple i) Suppose you are thinking of purchasing the stock of ABC, Inc. and you expect it to pay

Please make the answer clear and simple

Please make the answer clear and simple

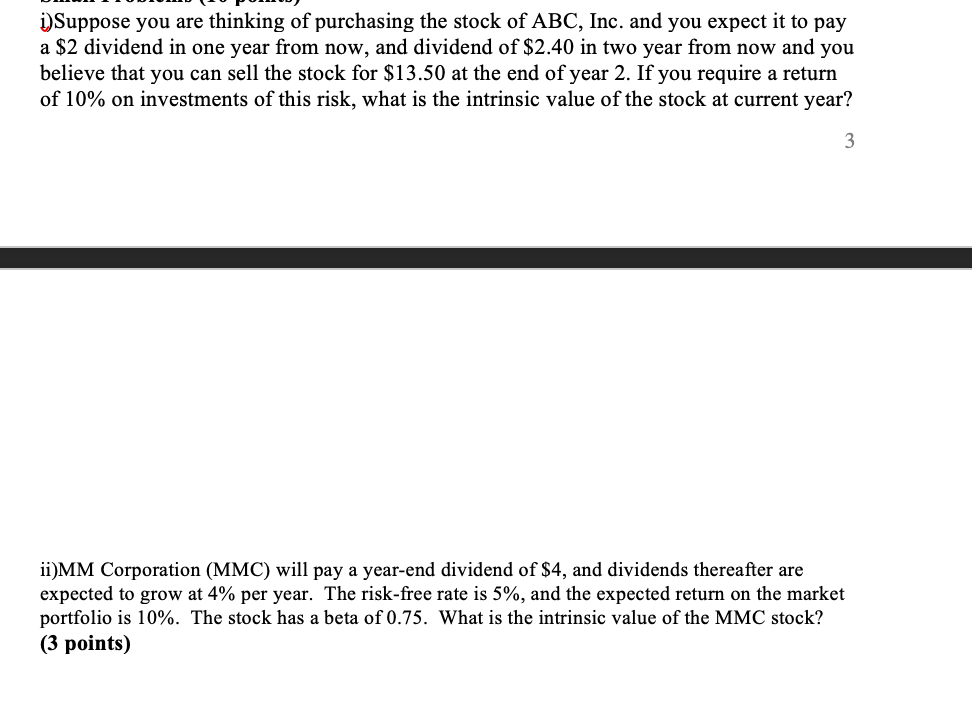

i) Suppose you are thinking of purchasing the stock of ABC, Inc. and you expect it to pay a $2 dividend in one year from now, and dividend of $2.40 in two year from now and you believe that you can sell the stock for $13.50 at the end of year 2. If you require a return of 10% on investments of this risk, what is the intrinsic value of the stock at current year? 3 ii)MM Corporation (MMC) will pay a year-end dividend of $4, and dividends thereafter are expected to grow at 4% per year. The risk-free rate is 5%, and the expected return on the market portfolio is 10%. The stock has a beta of 0.75. What is the intrinsic value of the MMC stock? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts