Question: Please make the directions ledgeble -- Need help with the Red Last year (2016), Monty Condos installed a mechanized elevator for its tenants. The owner

Please make the directions ledgeble -- Need help with the Red

Please make the directions ledgeble -- Need help with the Red

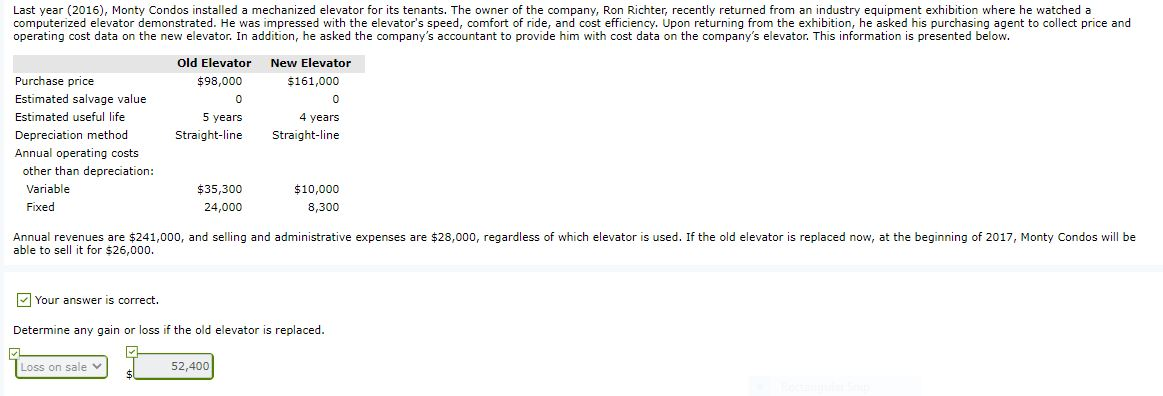

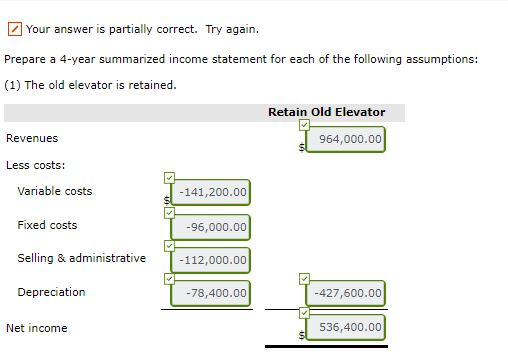

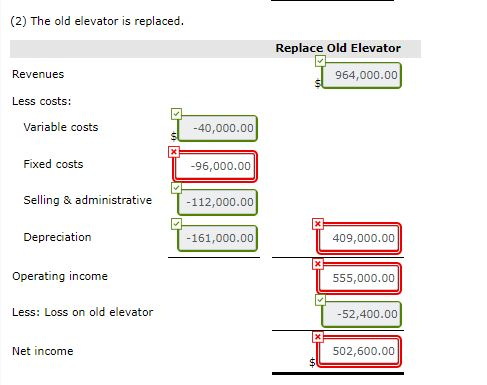

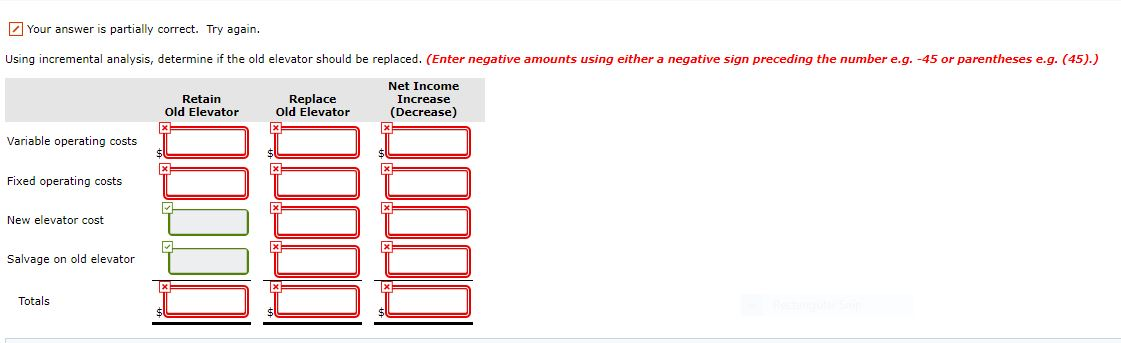

Last year (2016), Monty Condos installed a mechanized elevator for its tenants. The owner of the company, Ron Richter, recently returned from an industry equipment exhibition where he watched a computerized elevator demonstrated. He was impressed with the elevator's speed, comfort of ride, and cost efficiency. Upon returning from the exhibition, he asked his purchasing agent to collect price and operating cost data on the new elevator. In addition, he asked the company's accountant to provide him with cost data on the company's elevator. This information is presented below. Old Elevator $98,000 0 5 years Straight-line New Elevator $161,000 0 4 years Straight-line Purchase price Estimated salvage value Estimated useful life Depreciation method Annual operating costs other than depreciation: Variable Fixed $35,300 24,000 $10,000 8,300 Annual revenues are $241,000, and selling and administrative expenses are $28,000, regardless of which elevator is used. If the old elevator is replaced now, at the beginning of 2017, Monty Condos will be able to sell it for $26,000. Your answer is correct. Determine any gain or loss if the old elevator is replaced. Loss on sale 52,400 Your answer is partially correct. Try again. Prepare a 4-year summarized income statement for each of the following assumptions: (1) The old elevator is retained. Retain Old Elevator Revenues 964,000.00 Less costs: Variable costs -141,200.00 Fixed costs -95,000.00 Selling & administrative -112,000.00 Depreciation -78,400.00 -427,600.00 Net income 536,400.00 (2) The old elevator is replaced. Replace Old Elevator 964,000.00 Revenues Less costs: Variable costs -40,000.00 Fixed costs -96,000.00 Selling & administrative -112,000.00 Depreciation -161,000.00 409,000.00 Operating income 555,000.00 Less: Loss on old elevator -52,400.00 X Net income 502,600.00 Your answer is partially correct. Try again. Using incremental analysis, determine if the old elevator should be replaced. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Retain old Elevator Replace old Elevator Net Income Increase (Decrease) Variable operating costs Fixed operating costs x X New elevator cost Salvage on old elevator Totals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts