Question: Please make the response detailed and easy to read, thanks. Show all calculations a. Indicate clearly what Rex would report on the income statement for

Please make the response detailed and easy to read, thanks. Show all calculations

a. Indicate clearly what Rex would report on the income statement for the year ended December 31, 2021 related to the options.

b. Indicate clearly what Rex would report on the balance sheet as of December 31, 2021 related to the options. Show what section of the balance sheet the options would be recorded on.

c. Assume instead of exercising the options on 12/31/24, the options expired. Prepare the journal entry for the expiration.

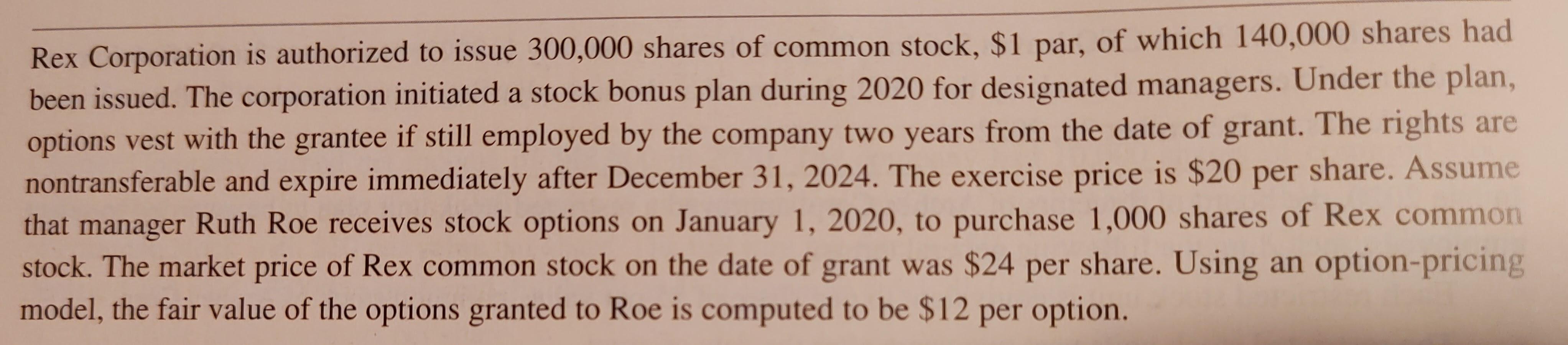

Rex Corporation is authorized to issue 300,000 shares of common stock, $1 par, of which 140,000 shares had been issued. The corporation initiated a stock bonus plan during 2020 for designated managers. Under the plan, options vest with the grantee if still employed by the company two years from the date of grant. The rights are nontransferable and expire immediately after December 31, 2024. The exercise price is $20 per share. Assume that manager Ruth Roe receives stock options on January 1, 2020, to purchase 1,000 shares of Rex common stock. The market price of Rex common stock on the date of grant was $24 per share. Using an option-pricing model, the fair value of the options granted to Roe is computed to be $12 per option. Rex Corporation is authorized to issue 300,000 shares of common stock, $1 par, of which 140,000 shares had been issued. The corporation initiated a stock bonus plan during 2020 for designated managers. Under the plan, options vest with the grantee if still employed by the company two years from the date of grant. The rights are nontransferable and expire immediately after December 31, 2024. The exercise price is $20 per share. Assume that manager Ruth Roe receives stock options on January 1, 2020, to purchase 1,000 shares of Rex common stock. The market price of Rex common stock on the date of grant was $24 per share. Using an option-pricing model, the fair value of the options granted to Roe is computed to be $12 per option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts