Question: please make this by hand with equation and the simple explanation or interpretation HW ADD2 Food Inc. is in the food packaging business. It re-balances

please make this by hand with equation and the simple explanation or interpretation

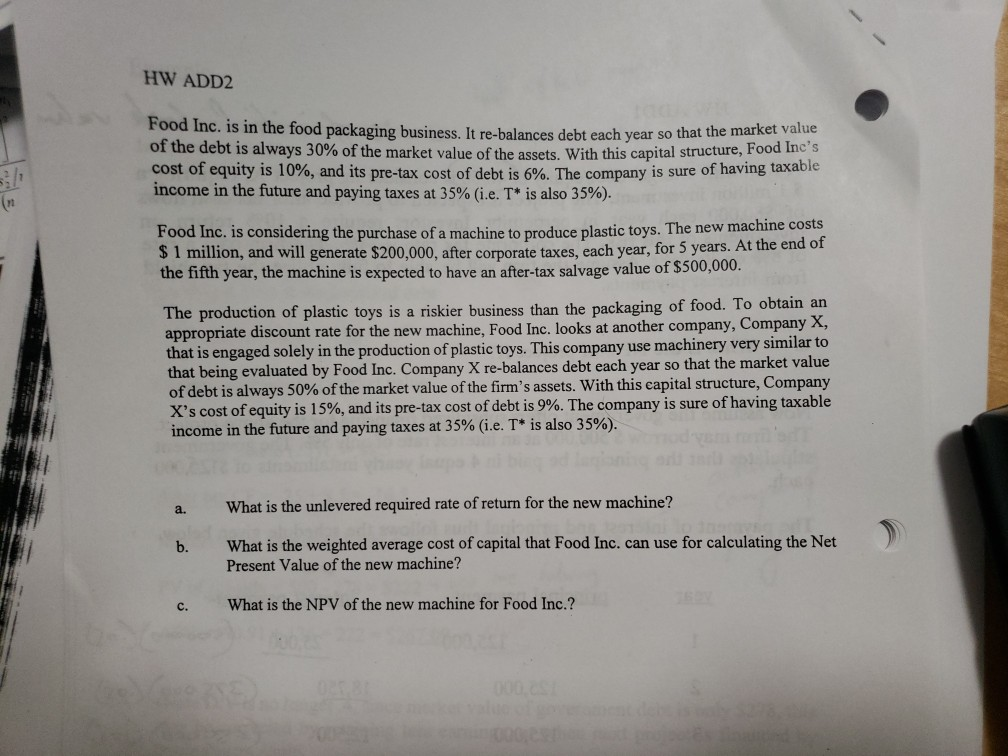

HW ADD2 Food Inc. is in the food packaging business. It re-balances debt each year so that the market value of the debt is always 30% of the market value of the assets. With this capital structure Food Inc's cost of equity is 10%, and its pre-tax cost of debt is 6%. The company is sure of having taxable income in the future and paying taxes at 35% (ie. Tis also 35%). Food Inc. is considering the purchase of a machine to produce plastic toys. The new machine costs $ 1 million, and will generate $200,000, after corporate taxes, each year, for 5 years. At the end o the fifth year, the machine is expected to have an after-tax salvage value of $500,000. The production of plastic toys is a riskier business than the packaging of food. To obtain an appropriate discount rate for the new machine, Food Inc. looks at another company, Company X, that is engaged solely in the production of plastic toys. This company use machinery very similar to that being evaluated by Food Inc. Company X re-balances debt each year so that the market value of debt is always 50% of the market value of the firm's assets, with this capital structure, company X's cost of equity is 15%, and its pre-tax cost of debt is 9%. The company is sure of having taxable income in the future and paying taxes at 35% (i.e. T* is also 35%). a. What is the unlevered required rate of return for the new machine? b. What is the weighted average cost of capital that Food Inc. can use for calculating the Net Present Value of the new machine? c. What is the NPV of the new machine for Food Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts