Question: Please mark the following as either True or False (1 point each) The cost of capital provides us with an indication of how the market

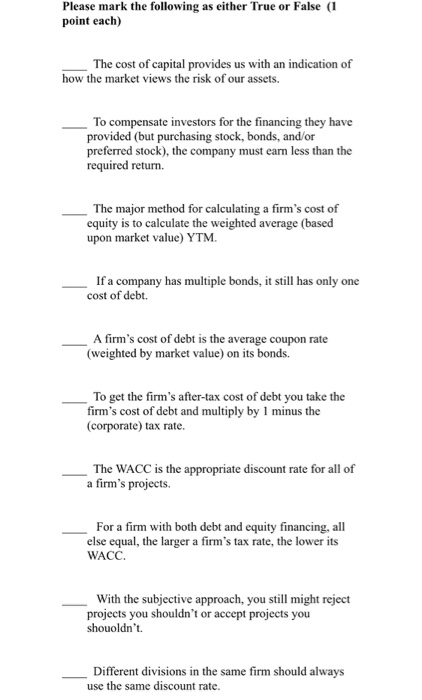

Please mark the following as either True or False (1 point each) The cost of capital provides us with an indication of how the market views the risk of our assets. To compensate investors for the financing they have provided (but purchasing stock, bonds, and/or preferred stock), the company must earn less than the required return. The major method for calculating a firm's cost of equity is to calculate the weighted average (based upon market value) YTM. If a company has multiple bonds, it still has only one cost of debt. A firm's cost of debt is the average coupon rate (weighted by market value) on its bonds. To get the firm's after-tax cost of debt you take the firm's cost of debt and multiply by 1 minus the (corporate) tax rate. The WACC is the appropriate discount rate for all of a firm's projects. For a firm with both debt and equity financing, all else equal, the larger a firm's tax rate, the lower its WACC. With the subjective approach, you still might reject projects you shouldn't or accept projects you shouoldn't Different divisions in the same firm should always use the same discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts