Question: Please match Companies 1-9 using the ratios below (Exhibit 1, 2, 3 & 4) to their respective characteristics outlined below. Please note each characteristic can

Please match Companies 1-9 using the ratios below (Exhibit 1, 2, 3 & 4) to their respective characteristics outlined below. Please note each characteristic can ONLY be matched to 1 company.

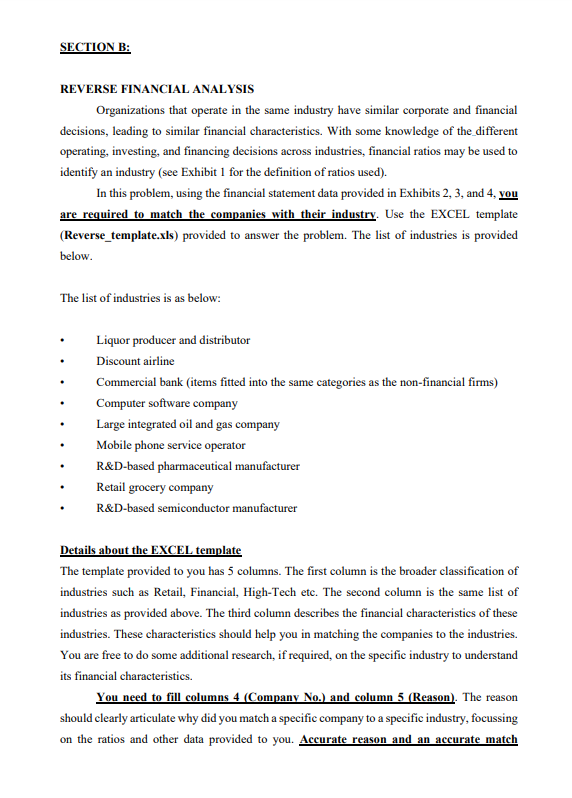

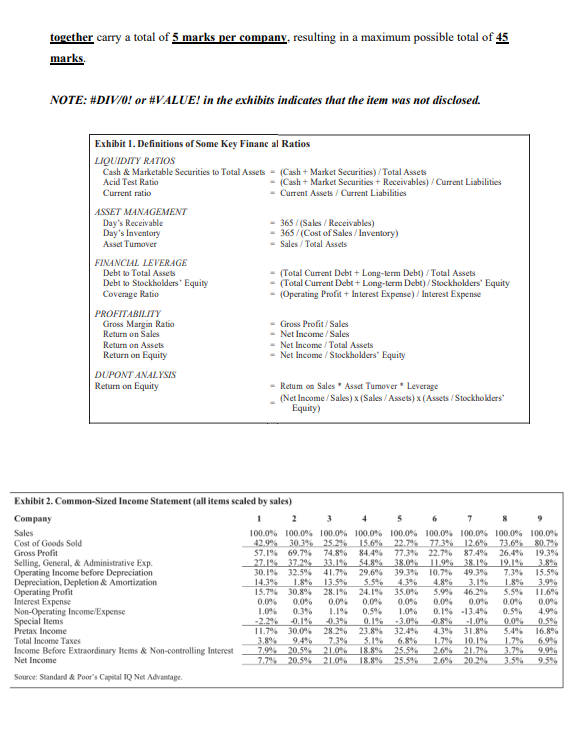

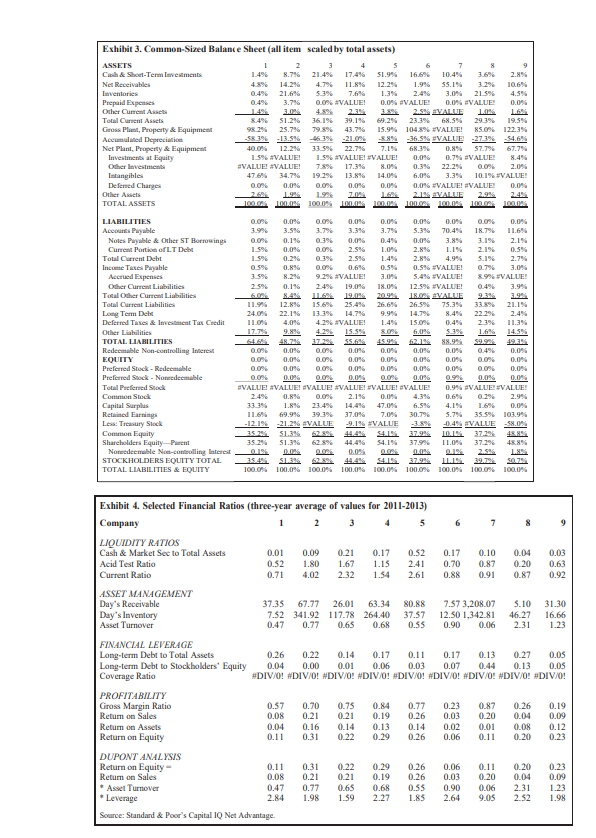

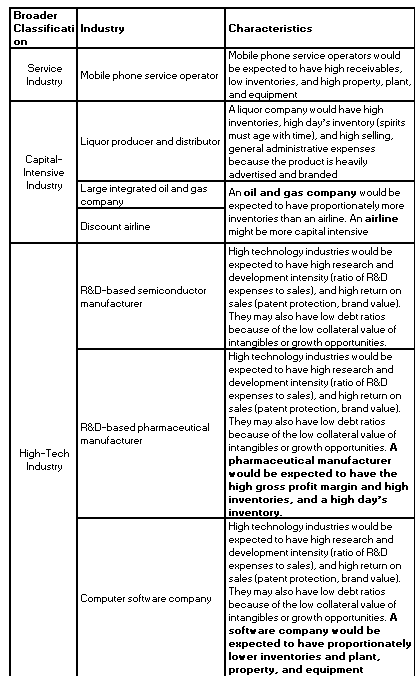

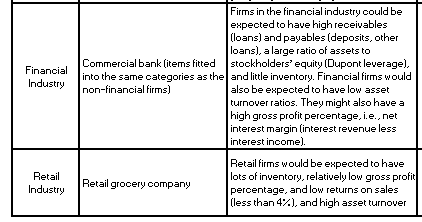

REVERSE FINANCIAL ANALYSIS Organizations that operate in the same industry have similar corporate and financial decisions, leading to similar financial characteristics. With some knowledge of the_different operating, investing, and financing decisions across industries, financial ratios may be used to identify an industry (see Exhibit 1 for the definition of ratios used). In this problem, using the financial statement data provided in Exhibits 2,3, and 4, you are required to match the companies with their industry. Use the EXCEL template (Reverse_template.xls) provided to answer the problem. The list of industries is provided below. The list of industries is as below: Details about the EXCEL template The template provided to you has 5 columns. The first column is the broader classification of industries such as Retail, Financial, High-Tech etc. The second column is the same list of industries as provided above. The third column describes the financial characteristics of these industries. These characteristics should help you in matching the companies to the industries. You are free to do some additional research, if required, on the specific industry to understand its financial characteristics. You need to fill columns 4 (Company No.) and column 5 (Reason). The reason should clearly articulate why did you match a specific company to a specific industry, focussing on the ratios and other data provided to you. Accurate reason and an accurate match togethercarryatotalof5markspercompany,resultinginamaximumpossibletotalof45 marks. NOTE: \#DIV/0! or \#VALUE! in the exhibits indicates that the item was not disclosed. REVERSE FINANCIAL ANALYSIS Organizations that operate in the same industry have similar corporate and financial decisions, leading to similar financial characteristics. With some knowledge of the_different operating, investing, and financing decisions across industries, financial ratios may be used to identify an industry (see Exhibit 1 for the definition of ratios used). In this problem, using the financial statement data provided in Exhibits 2,3, and 4, you are required to match the companies with their industry. Use the EXCEL template (Reverse_template.xls) provided to answer the problem. The list of industries is provided below. The list of industries is as below: Details about the EXCEL template The template provided to you has 5 columns. The first column is the broader classification of industries such as Retail, Financial, High-Tech etc. The second column is the same list of industries as provided above. The third column describes the financial characteristics of these industries. These characteristics should help you in matching the companies to the industries. You are free to do some additional research, if required, on the specific industry to understand its financial characteristics. You need to fill columns 4 (Company No.) and column 5 (Reason). The reason should clearly articulate why did you match a specific company to a specific industry, focussing on the ratios and other data provided to you. Accurate reason and an accurate match togethercarryatotalof5markspercompany,resultinginamaximumpossibletotalof45 marks. NOTE: \#DIV/0! or \#VALUE! in the exhibits indicates that the item was not disclosed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts