Question: please me do this in excel Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell

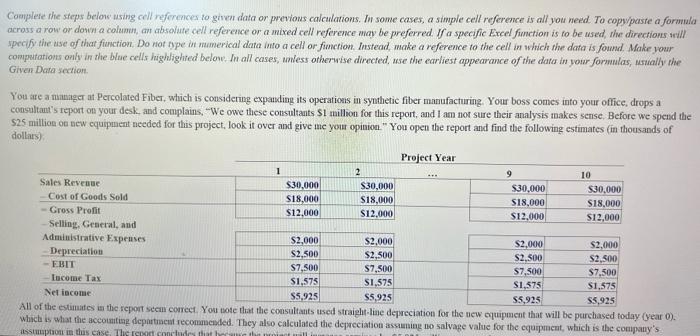

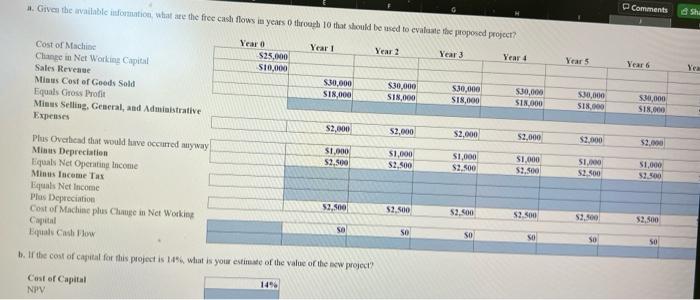

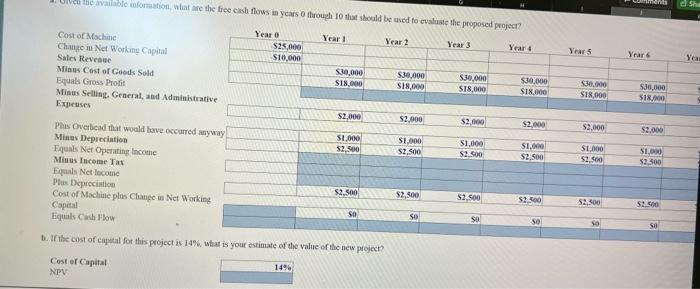

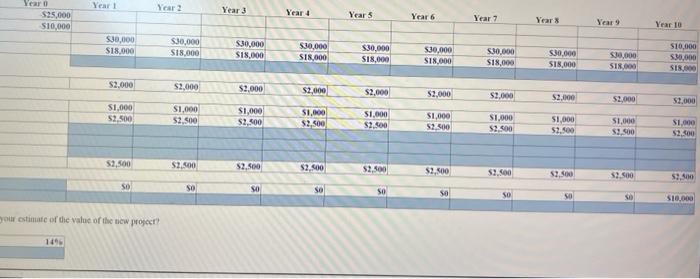

Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of their function. Do not rype in mumerical data into a cell or fimetion. Instead, make a reference to the cell in which the data is fowl. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section You are a manger at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultants report on your desk, and complains. "We owe these consultants S1 million for this report, and I am not sure their analysis makes sense. Before we spend the 525 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dollars) Project Year 2 9 10 Sales Revenue $30,000 $30,000 $30,000 $30,000 Cost of Goods Sold $18.000 $18,000 $18,000 $18,000 Gross Profit $12.000 S12.000 $12.000 SI2,000 Selling. General, and Administrative Expenses $2.000 $2.000 $2,000 $2,000 Depreciation $2,500 $2,500 $2.500 $2,500 EBIT $7,500 $7,500 $7,500 $7,500 Income Tax $1,575 S1,575 S1,575 $1,575 Net income $5,925 $5,925 S5,925 $5,925 All of the estimates in the report scom correct. You wote that the consultants used straight line depreciation for the new equipment that will be purchased today (year 0). which is what the accounting department recommended. They also calculated the depreciation assuming no salvage value for the equipment, which is the company's station in this case. This is concludes that he 1 EN Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? Comments G She Year 1 Year 2 Year $25.000 $10,000 Year 3 Year 4 Year 5 Year Yer 530.000 $18,000 $30,000 S18,000 530,000 S18,000 $30,000 SIN.000 $30,000 $18.000 $30,000 SI8.000 $2,000 $2,000 Cost of Machine Clinge in Net Working Capital Sales Revenue Minus Cost of Goods Sold Equals Gross Profile Minus Selling, General, and Administrative Expenses Plus Overhead that would have occurred wayway Minne Depreciation Equals Net Operating Income Minus Income Tax Equals Net Income Plus Depreciation Cost of Machine plus Clunge in Net Working Capital Equashow $2.000 53,000 $2,000 $2.000 $1,000 52.500 $1.000 $2.500 $1,000 $3.500 $1,000 $3.500 SINO $2.500 51.000 53,500 $2,500 $2.500 52.500 57.500 $2.500 SO SO so So SO b. If the cost of capital for this project is 14% what is your estimate of the value of the new project? Cost of Capital NIV 1496 a She Year 5 Year Yea $30.000 SIN.000 50,000 $18.000 Ulvie Valable information, what are the free cash flows in years through 10 lat should be used to evaluate the proposed project? Year Year! Year 2 Cost of Machine Year 3 Year 4 $25,000 Change in Net Working Capital $10,000 Sales Revesse $30,000 Minas Cost of Goods Sold $30.000 SJ0,000 $30,000 SIN.000 $18,000 S18,000 SIN.000 Equals Gross Profit Minus Selling, General, and Administrative Expenses $2,000 $2,000 $2,000 $2,000 Plus Overhead that would have occurred away $1,000 $1,000 51.000 S1.000 Mines Depreciation $2.500 $1.500 $2.500 $2.500 Equals Net Operating Income Minus Income Tax uns Net Income Plus Depreciation $2,500 $2.500 $2.500 S1.500 Cost of Machine ples Change in Net Working Capital SO SO SO Equals Cash Flow $2.000 $1.000 $1,000 $2.500 SI. $2,500 52,500 $2.500 38 SO 1. Ir the cost of capital for this project is 14%. What is your estimate of the value of new project? Cost of Capital NPV 1496 Year Year! Year 2 000'STS Year 3 Year Year 5 Year 6 Year 7 Year Year 9 $10,000 Year 10 50,000 S18.000 $30,000 S18.000 $30,000 S18.000 $30,000 SI8,000 $30,000 $18,000 $30,000 S18.000 $30,000 $18,000 $30.000 S18,000 30,000 $18,000 $10,000 53,000 SIS.000 S2.000 $2,000 $2,000 $2,000 $2,000 $2,000 $1.000 $2.000 $2,000 52.000 $1.000 52.500 S1,000 $2.500 S1,000 $2,300 TS S1,100 $2.500 $1.000 $2.500 $1,000 52.500 S1.000 $2.500 $1,000 $2.500 SI. $1,000 $3,500 $2.500 52,500 $2.500 $2.500 $3,500 $2.500 $2,500 88 $9.500 $1.500 0055 S. SO SO SO So OS OS 05 OS OS S10,000 our estimate of the value of the tow proget? 1414 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used the directions will specify the use of their function. Do not rype in mumerical data into a cell or fimetion. Instead, make a reference to the cell in which the data is fowl. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section You are a manger at Percolated Fiber, which is considering expanding its operations in synthetic fiber manufacturing. Your boss comes into your office, drops a consultants report on your desk, and complains. "We owe these consultants S1 million for this report, and I am not sure their analysis makes sense. Before we spend the 525 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dollars) Project Year 2 9 10 Sales Revenue $30,000 $30,000 $30,000 $30,000 Cost of Goods Sold $18.000 $18,000 $18,000 $18,000 Gross Profit $12.000 S12.000 $12.000 SI2,000 Selling. General, and Administrative Expenses $2.000 $2.000 $2,000 $2,000 Depreciation $2,500 $2,500 $2.500 $2,500 EBIT $7,500 $7,500 $7,500 $7,500 Income Tax $1,575 S1,575 S1,575 $1,575 Net income $5,925 $5,925 S5,925 $5,925 All of the estimates in the report scom correct. You wote that the consultants used straight line depreciation for the new equipment that will be purchased today (year 0). which is what the accounting department recommended. They also calculated the depreciation assuming no salvage value for the equipment, which is the company's station in this case. This is concludes that he 1 EN Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? Comments G She Year 1 Year 2 Year $25.000 $10,000 Year 3 Year 4 Year 5 Year Yer 530.000 $18,000 $30,000 S18,000 530,000 S18,000 $30,000 SIN.000 $30,000 $18.000 $30,000 SI8.000 $2,000 $2,000 Cost of Machine Clinge in Net Working Capital Sales Revenue Minus Cost of Goods Sold Equals Gross Profile Minus Selling, General, and Administrative Expenses Plus Overhead that would have occurred wayway Minne Depreciation Equals Net Operating Income Minus Income Tax Equals Net Income Plus Depreciation Cost of Machine plus Clunge in Net Working Capital Equashow $2.000 53,000 $2,000 $2.000 $1,000 52.500 $1.000 $2.500 $1,000 $3.500 $1,000 $3.500 SINO $2.500 51.000 53,500 $2,500 $2.500 52.500 57.500 $2.500 SO SO so So SO b. If the cost of capital for this project is 14% what is your estimate of the value of the new project? Cost of Capital NIV 1496 a She Year 5 Year Yea $30.000 SIN.000 50,000 $18.000 Ulvie Valable information, what are the free cash flows in years through 10 lat should be used to evaluate the proposed project? Year Year! Year 2 Cost of Machine Year 3 Year 4 $25,000 Change in Net Working Capital $10,000 Sales Revesse $30,000 Minas Cost of Goods Sold $30.000 SJ0,000 $30,000 SIN.000 $18,000 S18,000 SIN.000 Equals Gross Profit Minus Selling, General, and Administrative Expenses $2,000 $2,000 $2,000 $2,000 Plus Overhead that would have occurred away $1,000 $1,000 51.000 S1.000 Mines Depreciation $2.500 $1.500 $2.500 $2.500 Equals Net Operating Income Minus Income Tax uns Net Income Plus Depreciation $2,500 $2.500 $2.500 S1.500 Cost of Machine ples Change in Net Working Capital SO SO SO Equals Cash Flow $2.000 $1.000 $1,000 $2.500 SI. $2,500 52,500 $2.500 38 SO 1. Ir the cost of capital for this project is 14%. What is your estimate of the value of new project? Cost of Capital NPV 1496 Year Year! Year 2 000'STS Year 3 Year Year 5 Year 6 Year 7 Year Year 9 $10,000 Year 10 50,000 S18.000 $30,000 S18.000 $30,000 S18.000 $30,000 SI8,000 $30,000 $18,000 $30,000 S18.000 $30,000 $18,000 $30.000 S18,000 30,000 $18,000 $10,000 53,000 SIS.000 S2.000 $2,000 $2,000 $2,000 $2,000 $2,000 $1.000 $2.000 $2,000 52.000 $1.000 52.500 S1,000 $2.500 S1,000 $2,300 TS S1,100 $2.500 $1.000 $2.500 $1,000 52.500 S1.000 $2.500 $1,000 $2.500 SI. $1,000 $3,500 $2.500 52,500 $2.500 $2.500 $3,500 $2.500 $2,500 88 $9.500 $1.500 0055 S. SO SO SO So OS OS 05 OS OS S10,000 our estimate of the value of the tow proget? 1414

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts