Question: please mimic the example below. try to do it similar to the one below using excel Chapter 8 Stock Valuation 8.1 Dividend Discount Model Problem

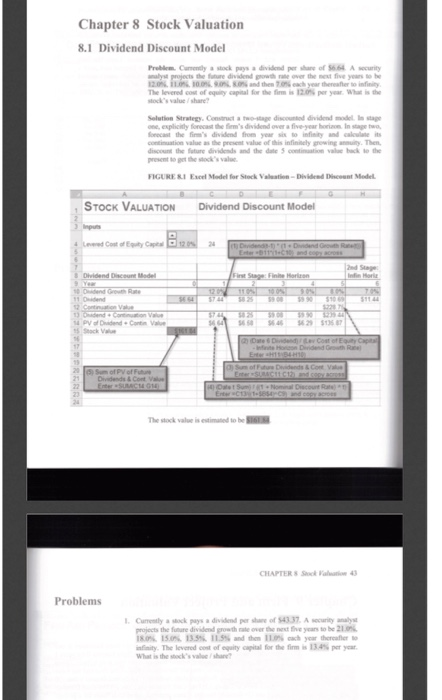

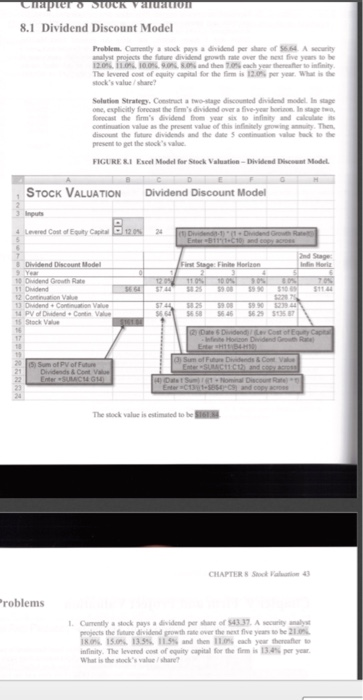

Chapter 8 Stock Valuation 8.1 Dividend Discount Model Problem Cary stock pus divided of 566 A curity lyst projects the future dividend growth over the next five years to be 12.09 110 109 and the 70% ach year theher to infinity The leweed cost of equity capital for the firm is 120 per year. What is the kalueshare! Solution Strategy Construct a two-stage discounted dividend modella stage on, explicitly for the firm's divided over a year h i ns forecast the firm's dividend from your site and clean it continuation value the p o siny rowing . Then discount the future dividends and the date con le back to the FIGURE I El Model for Stock V i deo Model STOCK VALUATION Dividend Discount Model Dividend Discount Model V D onde Con V E HDR 14H10 Dadds Con V of Didenda Conta POSES The stock value is estimated to be 16 CHAPTER 3 Problems 1. Currently ask a divendr e projects the foure divided on the o IX. 15.0 13.5 11.5% and then infinity. The levered cost of uity What is the stock's valshan of 543 37. A city ther the years to be 21.0 ch year thereafter for the firms 13.4% per year. Ciprums SLK VALOT 8.1 Dividend Discount Model Problem. Currently wock dividend per share of 566 A alyst projects the future dividend growth rate over the next five years to be 12.06. 11. 10. and then each year them to infinity The levered cost of equity capital for the firm is 12.0 per year. What is the stock's valueshare? Solution Strategy Construct i on de model is stage one, explicitly forecast the firm's divided over the who l e forecast the firm's dividend from year si o infinity and see continuation value the pret value of this inter net . Then discount the future dividends and the date contin u e back to the present to get the stock's value FIGURERI E Model for Stock Val -Dived at STOCK VALUATION Dividend Discount Model 3 Input CC1224 3 Dividend Discount Model Owend Gowth Rate Pad.Com 15 Stock Ve De Donde Cost of Ey Cats - Derded Sum of Fu n ds & Con V Sum of PV of Future Suomi The stock value is estimated to the 16 CHAPTER 13 Problems Camely a stock pasa dende 1437 A yat projects the dividend growth rate over the w e athe 2.0 18.0 15.0 13.5 11.5 andh e ach you there to infinity. The levered cost of equity capital for the firm 13.0 per year What is the stock's valueshare CHAPTER 8 Stock Valuation 3 Problems 1. Currently a stock pays a dividend per share of $43.37 A security analyst projects the future dividend growth rate over the next five years to be 21.0 18.0% 15.0%. 13.5% 11.5% and then 10% each year thereafter to infinity. The levered cost of equity capital for the firm is 13.4% per year. What is the stock's value/share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts