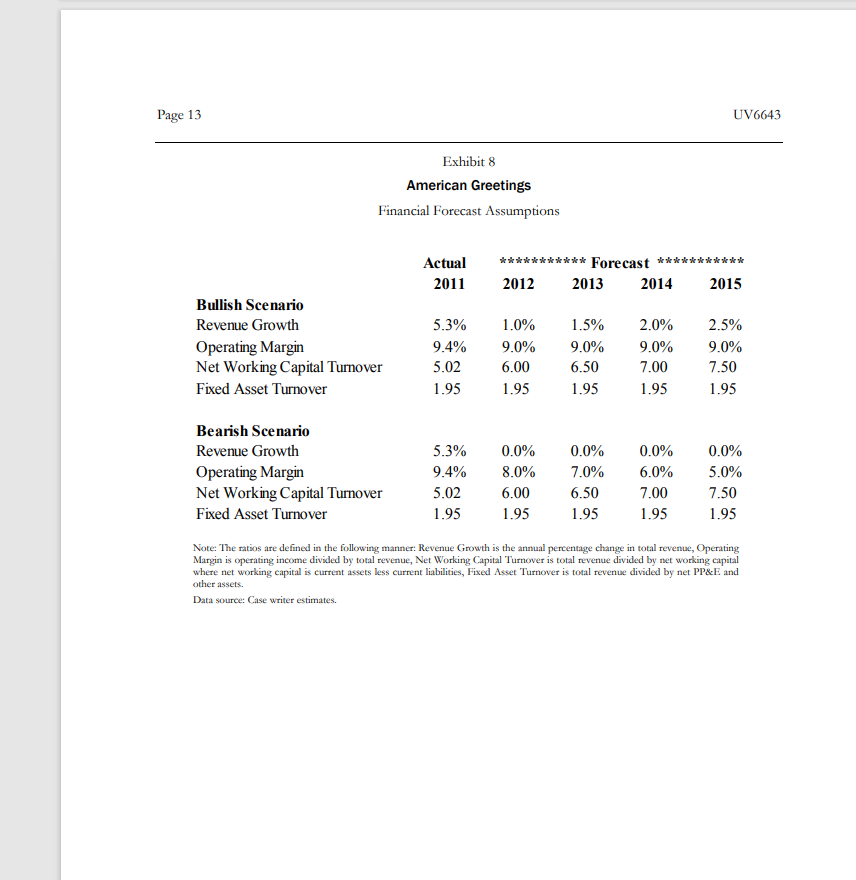

Question: Please model cash flows for AG for fiscal year 2012 through 2015 based on the two sets of ratios in case Exhibit 8. Based on

Please model cash flows for AG for fiscal year 2012 through 2015 based on the two sets of ratios in case Exhibit 8. Based on discounted cash flows associated with the forecast, what is the implied enterprise value of AG and the corresponding stock price?

Page 13 UV6643 Exhibit 8 American Greetings Financial Forecast Assumptions Actual 2011 *********** Forecast *********** 2012 2013 2014 2015 Bullish Scenario Revenue Growth Operating Margin Net Working Capital Turnover Fixed Asset Turnover 5.3% 9.4% 5.02 1.95 1.0% 9.0% 6.00 1.95 1.5% 9.0% 6.50 1.95 2.0% 9.0% 7.00 1.95 2.5% 9.0% 7.50 1.95 Bearish Scenario Revenue Growth Operating Margin Net Working Capital Turnover Fixed Asset Turnover 5.3% 9.4% 5.02 1.95 0.0% 8.0% 6.00 1.95 0.0% 7.0% 6.50 1.95 0.0% 6.0% 7.00 1.95 0.0% 5.0% 7.50 1.95 Note: The ratios are defined in the following manner: Revenue Growth is the annual percentage change in total revenue, Operating Margin is operating income divided by total revenue, Net Working Capital Turnover is total revenue divided by net working capital where net working capital is current assets less current liabilities, Fixed Asset Turnover is total revenue divided by net PP&E and other assets. Data source: Case writer estimates. Page 13 UV6643 Exhibit 8 American Greetings Financial Forecast Assumptions Actual 2011 *********** Forecast *********** 2012 2013 2014 2015 Bullish Scenario Revenue Growth Operating Margin Net Working Capital Turnover Fixed Asset Turnover 5.3% 9.4% 5.02 1.95 1.0% 9.0% 6.00 1.95 1.5% 9.0% 6.50 1.95 2.0% 9.0% 7.00 1.95 2.5% 9.0% 7.50 1.95 Bearish Scenario Revenue Growth Operating Margin Net Working Capital Turnover Fixed Asset Turnover 5.3% 9.4% 5.02 1.95 0.0% 8.0% 6.00 1.95 0.0% 7.0% 6.50 1.95 0.0% 6.0% 7.00 1.95 0.0% 5.0% 7.50 1.95 Note: The ratios are defined in the following manner: Revenue Growth is the annual percentage change in total revenue, Operating Margin is operating income divided by total revenue, Net Working Capital Turnover is total revenue divided by net working capital where net working capital is current assets less current liabilities, Fixed Asset Turnover is total revenue divided by net PP&E and other assets. Data source: Case writer estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts