Question: please need accurate answer for this question i will upvote your answer if correct thank you so much Note please provide answer for all 4

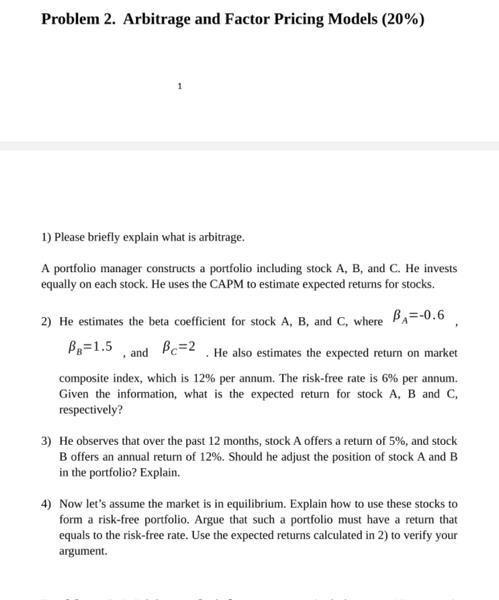

Problem 2. Arbitrage and Factor Pricing Models (20%) 1) Please briefly explain what is arbitrage. A portfolio manager constructs a portfolio including stock A, B, and C. He invests equally on each stock. He uses the CAPM to estimate expected returns for stocks. 2) He estimates the beta coefficient for stock A, B, and C, where B2=-0.6 Bp=1.5 and Be=2 He also estimates the expected return on market composite index, which is 12% per annum. The risk-free rate is 6% per annum. Given the information, what is the expected return for stock A, B and C. respectively? 3) He observes that over the past 12 months, stock A offers a return of 5%, and stock B offers an annual return of 12%. Should he adjust the position of stock A and B in the portfolio? Explain. 4) Now let's assume the market is in equilibrium. Explain how to use these stocks to form a risk-free portfolio. Argue that such a portfolio must have a return that equals to the risk-free rate. Use the expected returns calculated in 2) to verify your argument

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts