Question: Please need an answer for c, d, e and f. Question 1 (33 marks) A firm is considering two investment projects, Gamma and Kappa. These

Please need an answer for c, d, e and f.

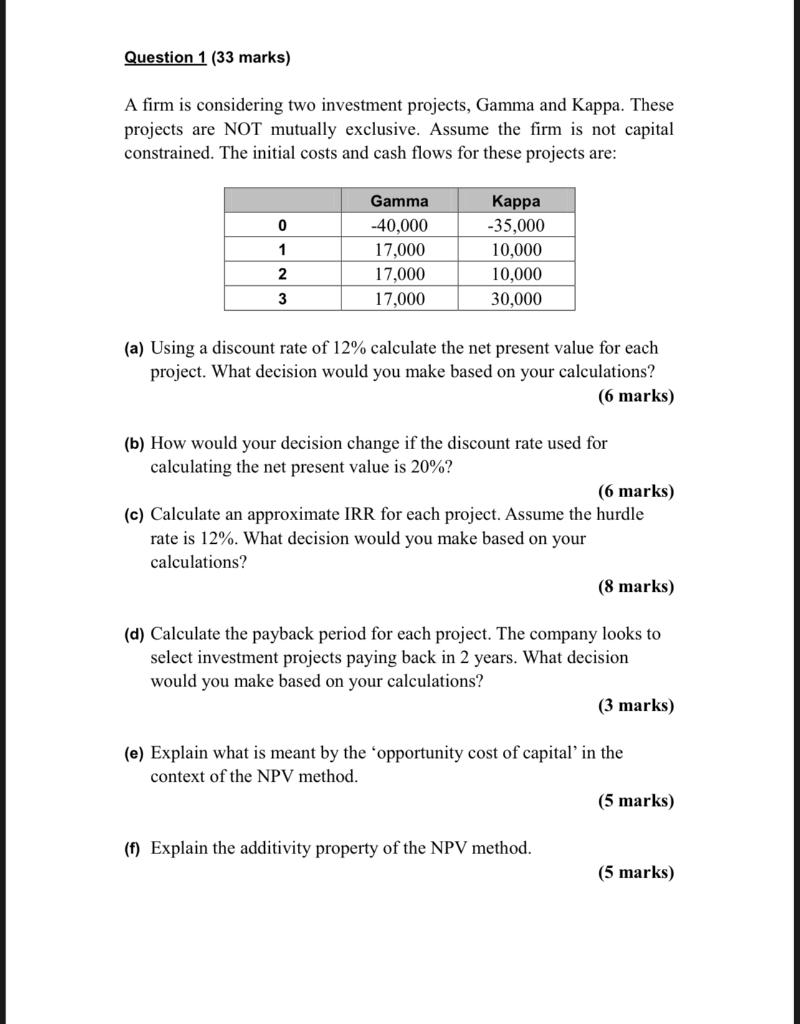

Question 1 (33 marks) A firm is considering two investment projects, Gamma and Kappa. These projects are NOT mutually exclusive. Assume the firm is not capital constrained. The initial costs and cash flows for these projects are: (a) Using a discount rate of 12% calculate the net present value for each project. What decision would you make based on your calculations? (6 marks) (b) How would your decision change if the discount rate used for calculating the net present value is 20% ? (c) Calculate an approximate IRR for each project. Assume the hurdle rate is 12%. What decision would you make based on your calculations? (8 marks) (d) Calculate the payback period for each project. The company looks to select investment projects paying back in 2 years. What decision would you make based on your calculations? (3 marks) (e) Explain what is meant by the 'opportunity cost of capital' in the context of the NPV method. (5 marks) (f) Explain the additivity property of the NPV method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts