Question: please need answer in 15 mins now pls. all 3 pls Bosio Inc.'s perpetual preferred stock sells for $137.50 per share, and it pays an

please need answer in 15 mins now pls. all 3 pls

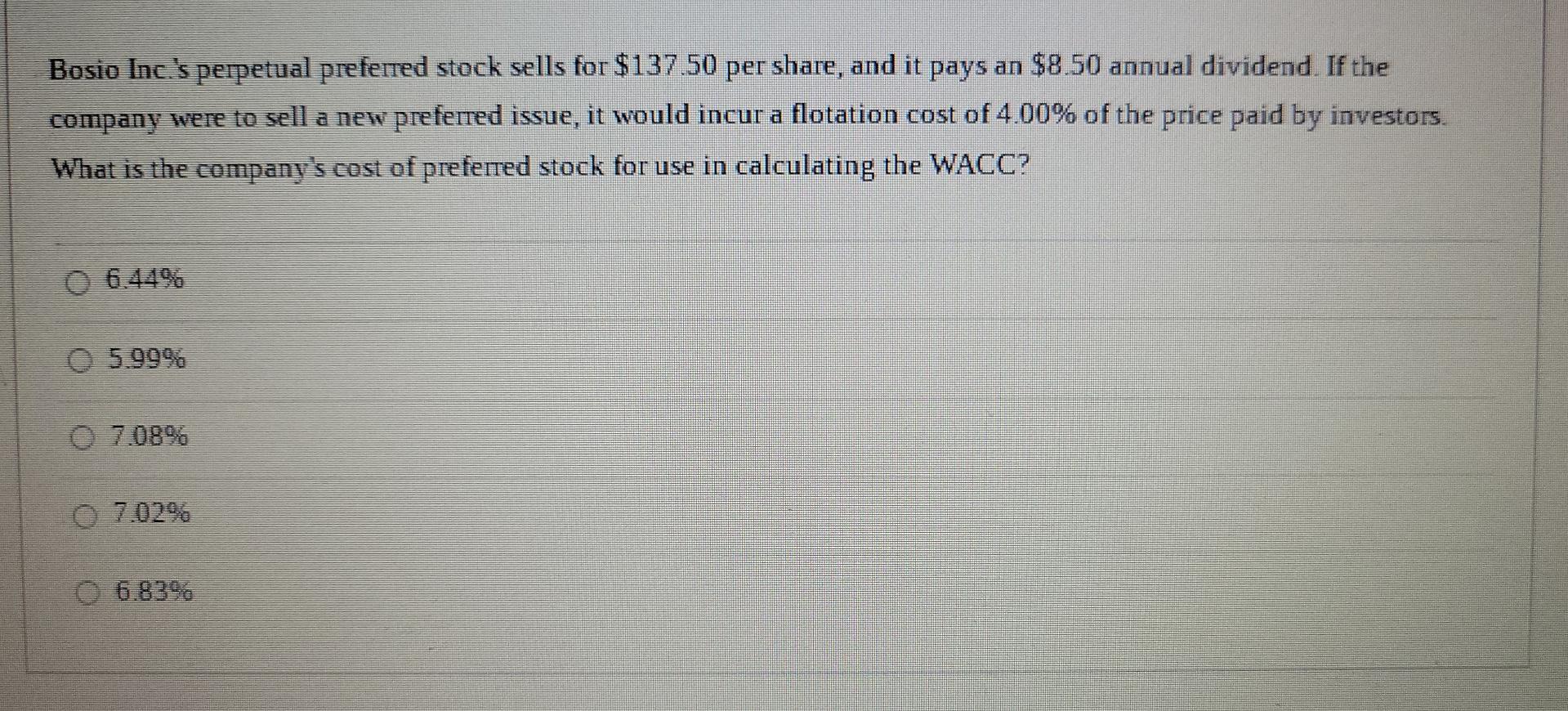

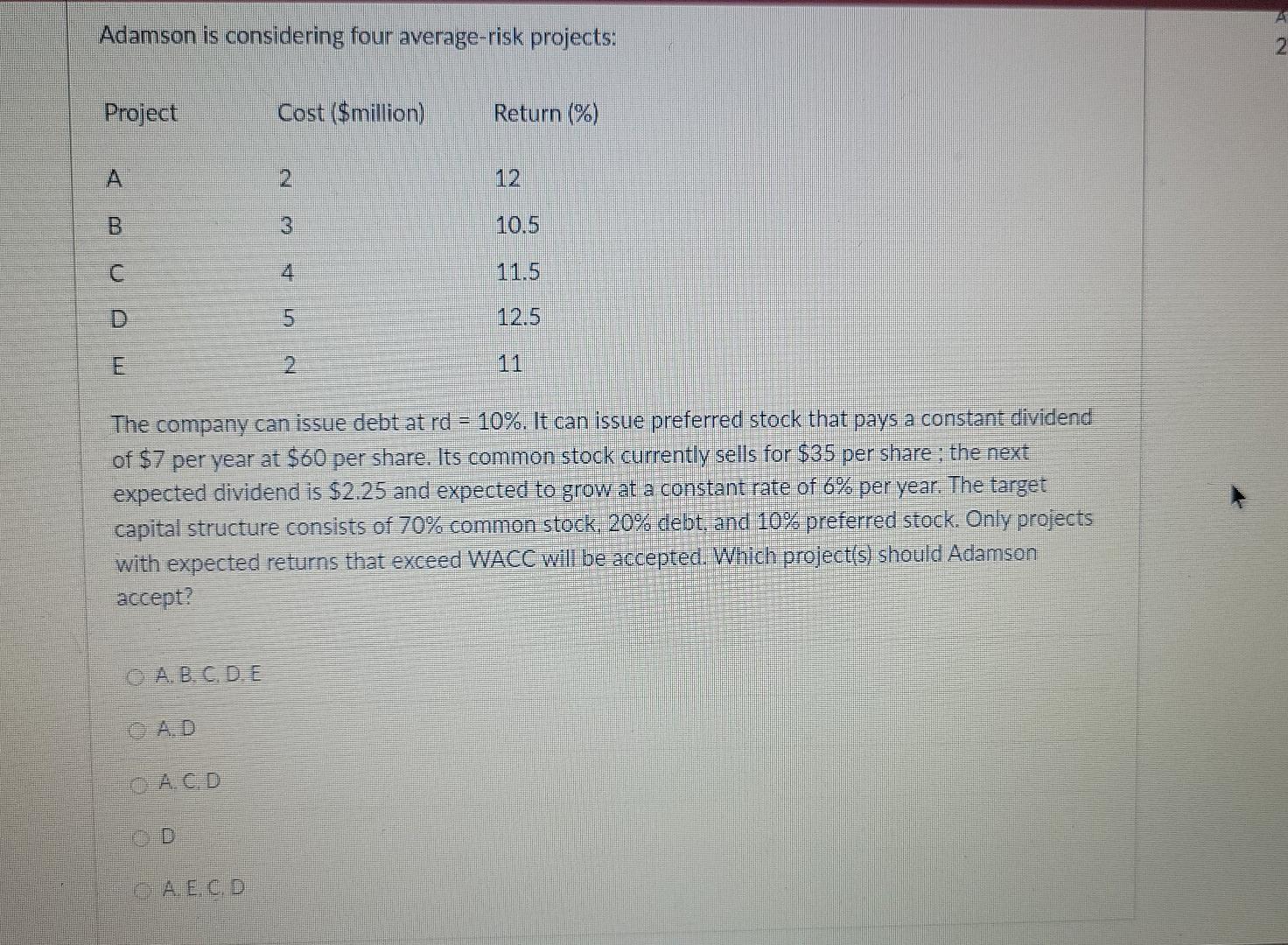

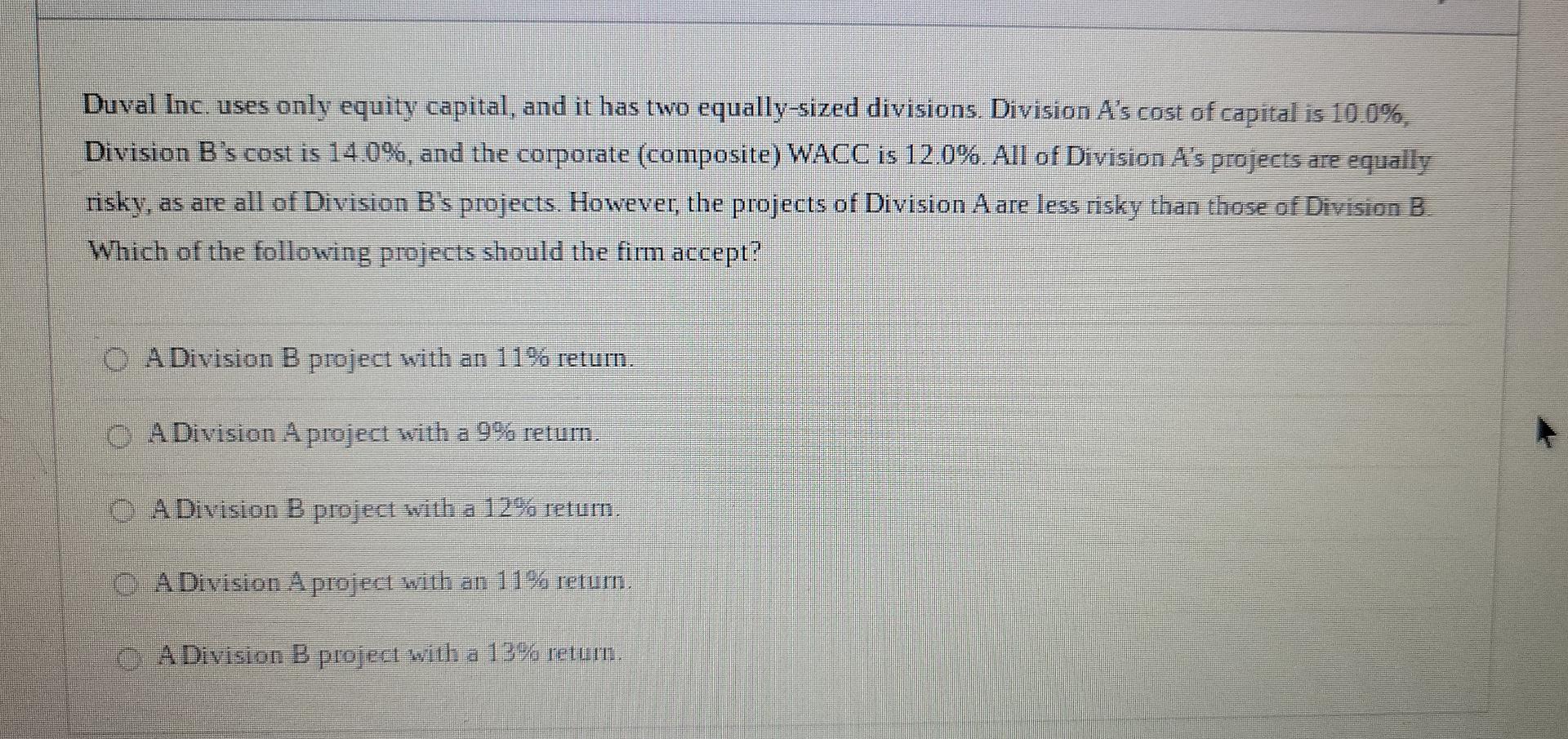

Bosio Inc.'s perpetual preferred stock sells for $137.50 per share, and it pays an $8.50 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 4.00% of the price paid by investors. What is the company's cost of preferred stock for use in calculating the WACC? 07.08% 07.02% Adamson is considering four average-risk projects: Project Cost ($million) Return (%) 2 10.5 5 12.5 2 = The company can issue debt at rd 10%. It can issue preferred stock that pays a constant dividend of $7 per year at $60 per share. Its common stock currently sells for $35 per share; the next expected dividend is $2.25 and expected to grow at a constant rate of 6% per year. The target capital structure consists of 70% common stock, 20% debt, and 10% preferred stock. Only projects with expected returns that exceed WACC will be accepted. Which project(s) should Adamson accept? CA.B.C.DE OACD CD CA.E.C.D A BUDE A WN 3 4 A 2 Duval Inc. uses only equity capital, and it has two equally-sized divisions. Division A's cost of capital is 10.0%, Division B's cost is 14.0%, and the corporate (composite) WACC is 12.0%. All of Division A's projects are equally risky, as are all of Division B's projects. However, the projects of Division A are less risky than those of Division B. Which of the following projects should the firm accept? A Division B project with an 11% return. A Division A project with a 9% return. A Division B project with a 12% return. A Division A project with an 11% return. A Division B project with a 13% return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts