Question: * Please need assistance. Thank you! Acquisition Data: The parent acquired 8 0 % of the subsidiary company on January 1 ^ ( st )

Please need assistance. Thank you!

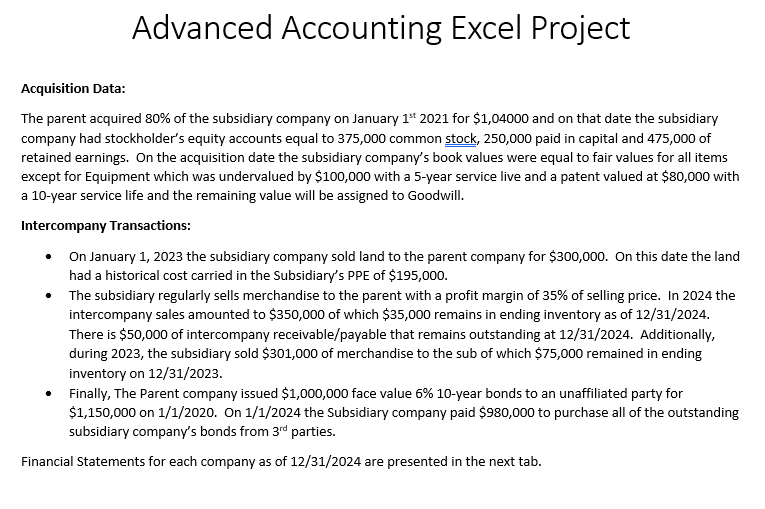

Acquisition Data: The parent acquired of the subsidiary company on January st for $ and on that date the subsidiary company had stockholder's equity accounts equal to common stock, paid in capital and of retained earnings. On the acquisition date the subsidiary company's book values were equal to fair values for all items except for Equipment which was undervalued by $ with a year service live and a patent valued at $ with a year service life and the remaining value will be assigned to Goodwill. Intercompany Transactions: On January the subsidiary company sold land to the parent company for $ On this date the land had a historical cost carried in the Subsidiary's PPE of $ The subsidiary regularly sells merchandise to the parent with a profit margin of of selling price. In the intercompany sales amounted to $ of which $ remains in ending inventory as of There is $ of intercompany receivablepayable that remains outstanding at Additionally, during the subsidiary sold $ of merchandise to the sub of which $ remained in ending inventory on Finally, The Parent company issued $ face value year bonds to an unaffiliated party for $ on On the Subsidiary company paid $ to purchase all of the outstanding subsidiary company's bonds from rd parties. Financial Statements for each company as of are presented in the next tab.

Income Statement Sales Cost of Goods Sold Gross Profit Operating Expenses Bond Interest Income Bond Interest Expense Equity Income Net Income Statement of Retained Earnings BOY Retained Earnings Net Income Dividends Ending Retained Earnings Balance Sheet Assets Cash Accounts Receivable Inventory Equity Investment Investment in Bonds net Land PPE net Total Assets Liabilities & Stockholder's Equity Accounts Payable Other Current Liabilities Bonds Payable net LongTerm Liabilities Common Stock APIC Retained Earnings Total Liab. & Stockholder's Equity

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock