Question: Please need emergency help, Please answer both questions Topic: FCF and ROPI valuations [30 * 2 = 60 marks] Milano, Inc. has the following actual

Please need emergency help, Please answer both questions

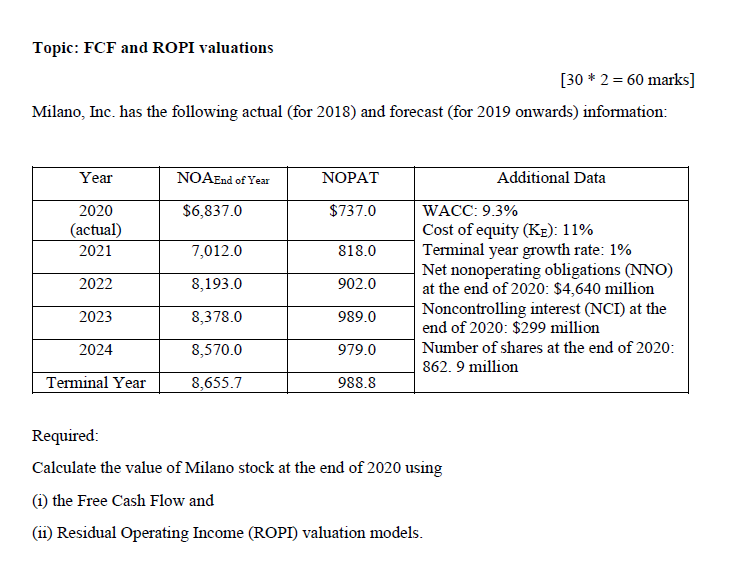

Topic: FCF and ROPI valuations [30 * 2 = 60 marks] Milano, Inc. has the following actual (for 2018) and forecast (for 2019 onwards) information: Year NOAEnd of Year NOPAT Additional Data $6,837.0 $737.0 2020 (actual) 2021 7,012.0 818.0 2022 8,193.0 902.0 WACC: 9.3% Cost of equity (Kg): 11% Terminal year growth rate: 1% Net nonoperating obligations (NNO) at the end of 2020: $4,640 million Noncontrolling interest (NCI) at the end of 2020: $299 million Number of shares at the end of 2020: 862. 9 million 2023 8,378.0 989.0 2024 8,570.0 979.0 Terminal Year 8,655.7 988.8 Required: Calculate the value of Milano stock at the end of 2020 using (1) the Free Cash Flow and (11) Residual Operating Income (ROPI) valuation models

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts