PLEASE NEED HELP ASAP! 7-15

with the steps to each question if possible!

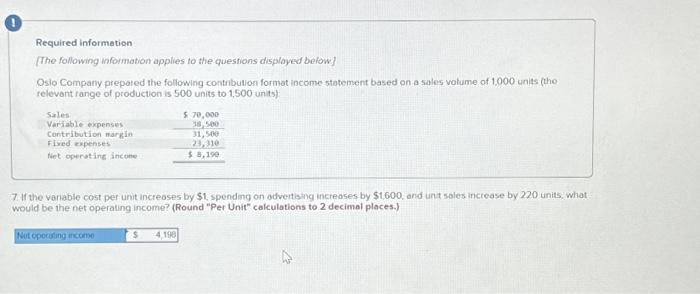

Required information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,600, and unit sales increase by 220 units, what would be the net operating income? (Round "Per Unit" calculations to 2 decimal places.) Net operating income $70,000 38,500 31,500 23,310 $ 8,190 $ 4,198

8. what is break even point in units sales?

9. what is break even point in dollar sales?

10. how many units must be sold to achieve a target profit of $18,900?

11. what is the margin of safety dollars? what is the margin of safety percentage?

12. what is the degree of operating leverage?

13. using the degree of operating leverage, what is the estimate percent increase in net operating income that would result from a 5% increase in unit sales?

14. assuming that the amount of the companies total variable expenses in total fixed expenses were reversed. In other words, assume that the total variable expenses or 23,310 and the total fixed expenses are 38,500. Under this scenario in the show me, the total sales remain the same, what is the degree of operating leverage?

15. Assume that the amount of the companies total Verbois measures in total for suspense is reversed. In other words, assume that the total value expenses or 23,310 and the total six expenses are 38,500. Using the degree of operating leverage, what is the estimated percent increase in net operating income of 5% increase in unit sales?

Required information [The following information applies to the questions displayed below] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,600, and unt sales increase by 220 units, what would be the net operating income? (Round "Per Unit" calculations to 2 decimal places.)