Question: please need help asap please! thank you, i will upvote Gaynor Manufacturing. Inc, has a manufacturing machine that needs attention. (Click the icon to view

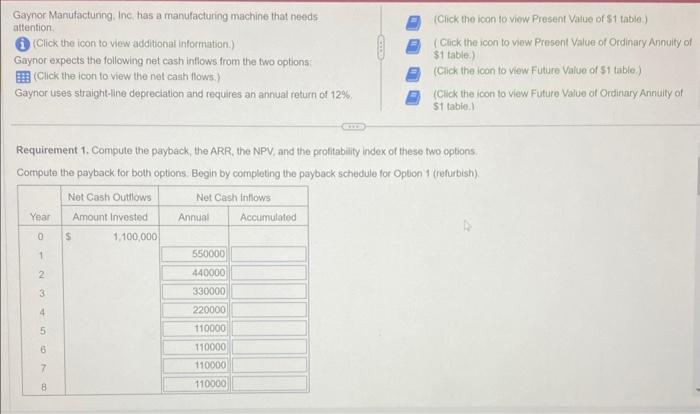

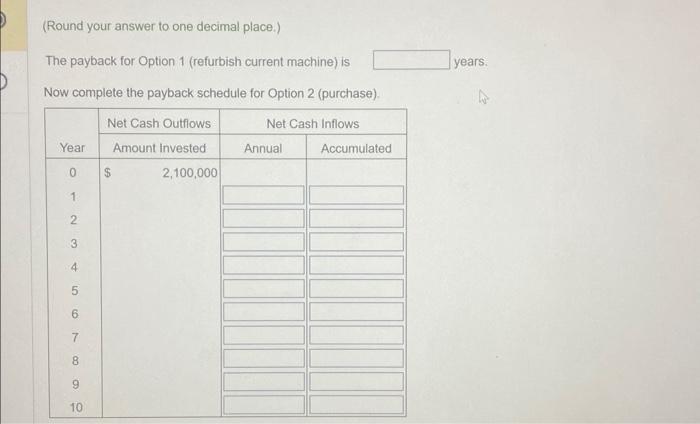

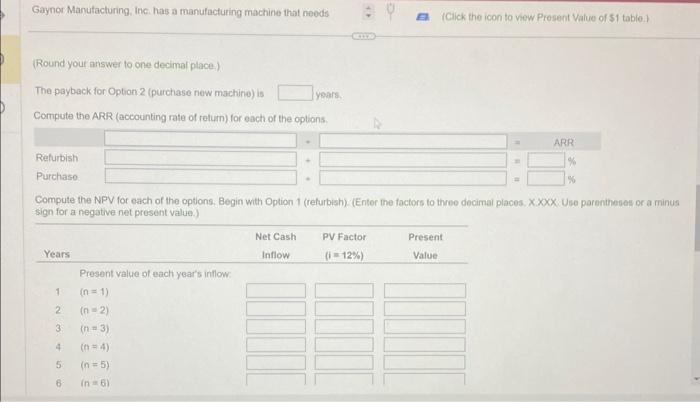

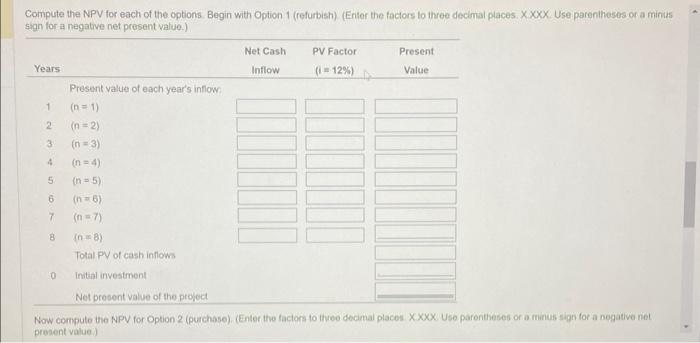

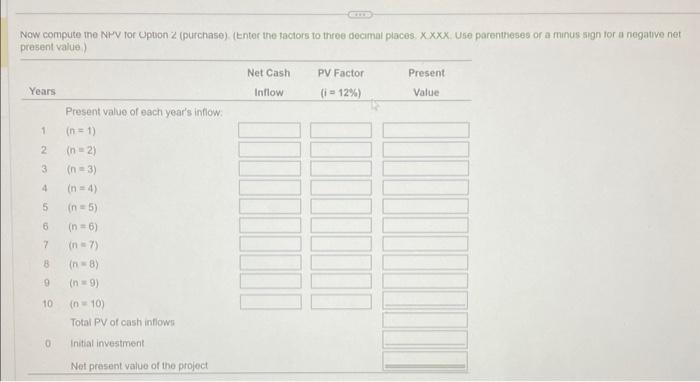

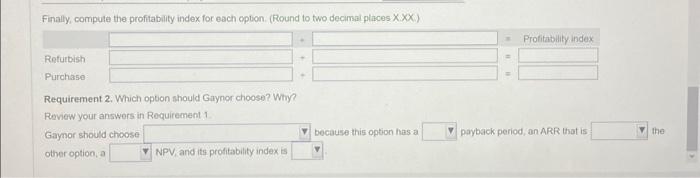

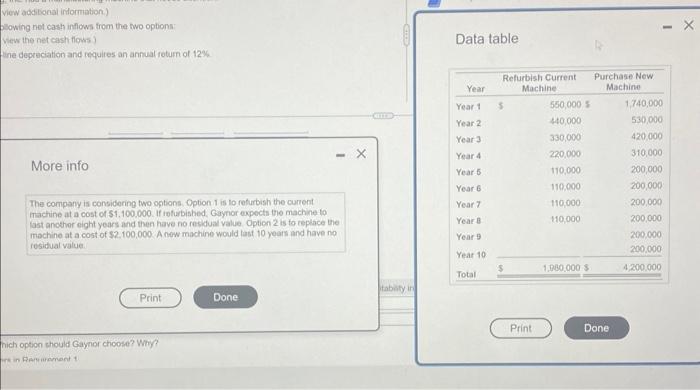

Gaynor Manufacturing. Inc, has a manufacturing machine that needs attention. (Click the icon to view additional information.) (Click the icon to view Present Value of $1 table.) Gaynor expects the following net cash inflows from the two options: ( Click the icon to vew Present Value of Ordinary Annuity of \$1 table.) (Click the icon to view the net cash flows.) (Click the icon to view Future Value of $1 table.) Gaynor uses 5 traight-line depreciation and requires an annual return of 12%. (Click the icon to view Future Value of Ordinary Arinuity of St tabie.l Requirement 1. Compute the payback, the ARR, the NPV, and the profitabilty index of these two options. Compute the payback for both options: Begin by completing the payback schedule for Option 1 (refurbish). (Round your answer to one decimal place.) The payback for Option 1 (refurbish current machine) is years. Now complete the payback schedule for Option 2 (purchase). (Round your answer to one decimal place.) The payback for Option 2 (purchase new machine) is years. Compute the ARR (accounting rate of roturn) for each of the ootions. Compute the NPV for each of the options. Begin with Option 1 (refurbish) (Enter the factors to three decimal places. XXXX Use parenthesses or a minus sign for a negative net present value.) Now compute the NPV for Option 2 (purchase). (Enter the factors to three cecimal places XXXX. Uso parentheses or a minus sign for a nogative net present value.) Now compute the NTV for Upton 2 (purchase) (tenter the tactors to three decimat places. XXX. Use parentheses of a minus sign for a negative net present value) Requirement 2. Which option should Gaynor choose? Why? Review your answors in Requirement 1 Gaymor should choose because this option has a payback period, an ARR that is other option, a NPV, and its.profitability index is view additonal information.) plowing net cash inflows from the two options: Wew the net cash flows? Fine depreciation and requites an annual foturn of 12% More info The company is considering two ogtions. Option. 1 is lo returbish the current irachine at a cost of 51.100,000. If iofurbisbed, Gaynor expects the machine to last anothor eight years and then have no residual value. Opticn 2 is to replace the machine at a cost of $2,100,000. A now machine would last 10 years and have no residual value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts