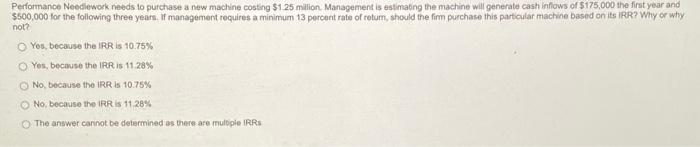

Question: Please need help fast! Performance Neediework needs to purchase a new machine costing $1.25 mllion. Management is estima6ng the machine will generate cash inflows of

Performance Neediework needs to purchase a new machine costing $1.25 mllion. Management is estima6ng the machine will generate cash inflows of $175,000 the first year and $500,000 for the following three years. If management requires a minimum 13 percent rate of retum, should the firm purchase this particular machine based on its iRR? Why or wty not? Yes, because the IRR is 10.75% Yes, becawse the IRR is 11.28% No, because the IRR is 10.75% No, because the IRR is 11.28% The answer cannot be determined os there are mulbpie IRRs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts