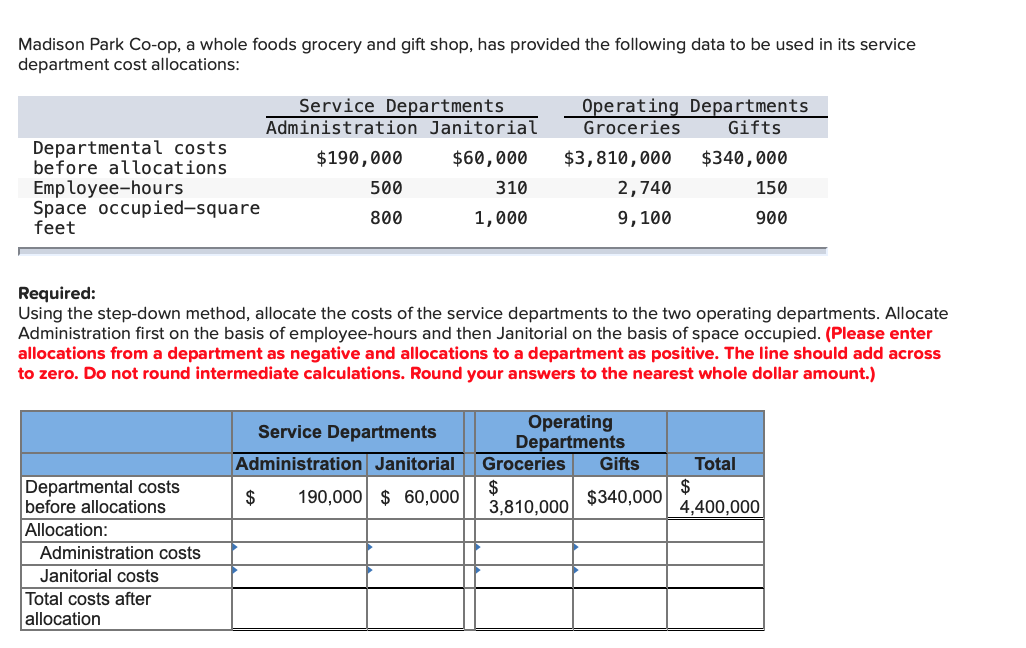

Question: Please need help on these 3 questions Madison Park Clo-op, a whole foods grocery and gift shop, has provided the following data to be used

Please need help on these 3 questions

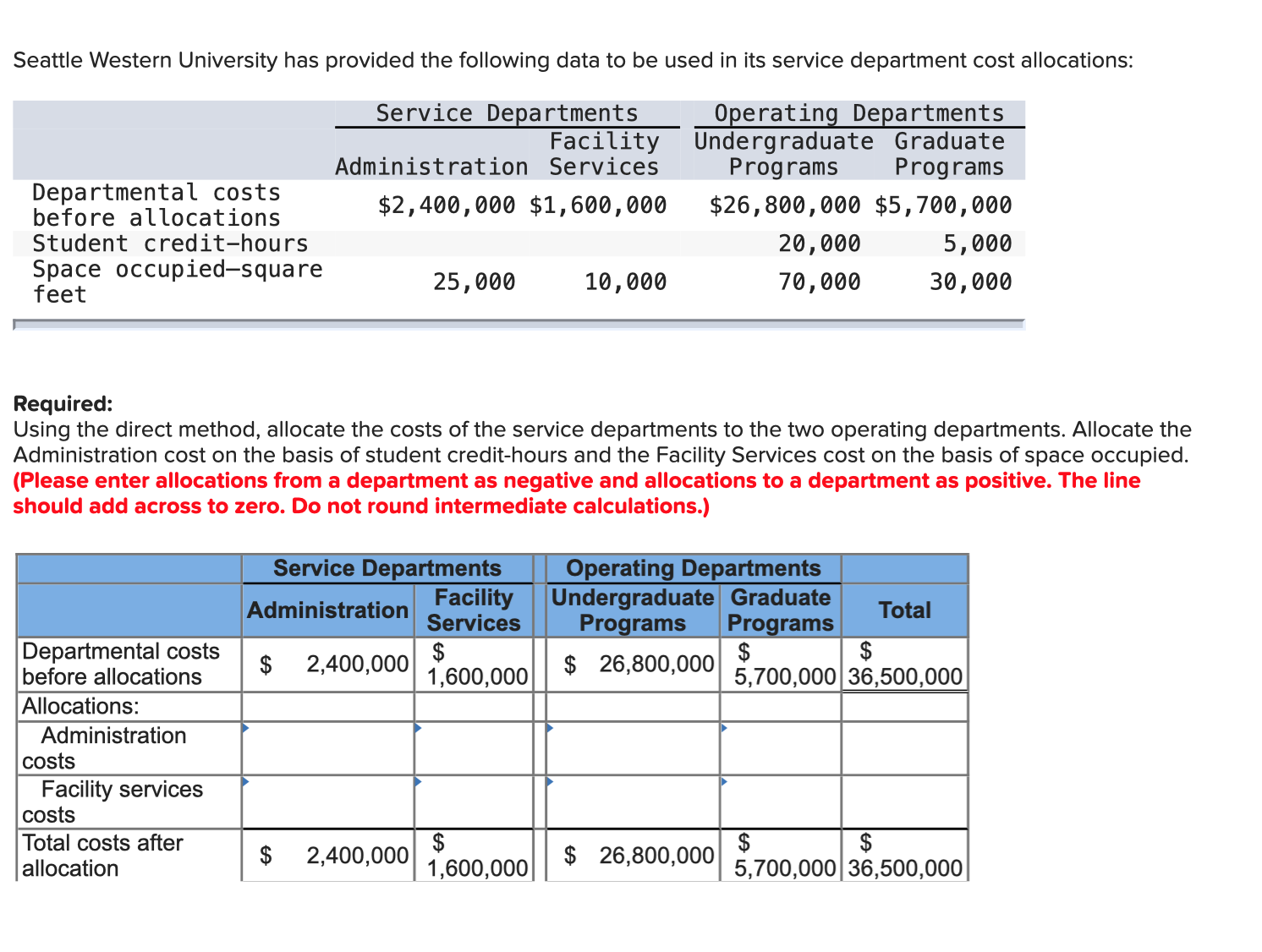

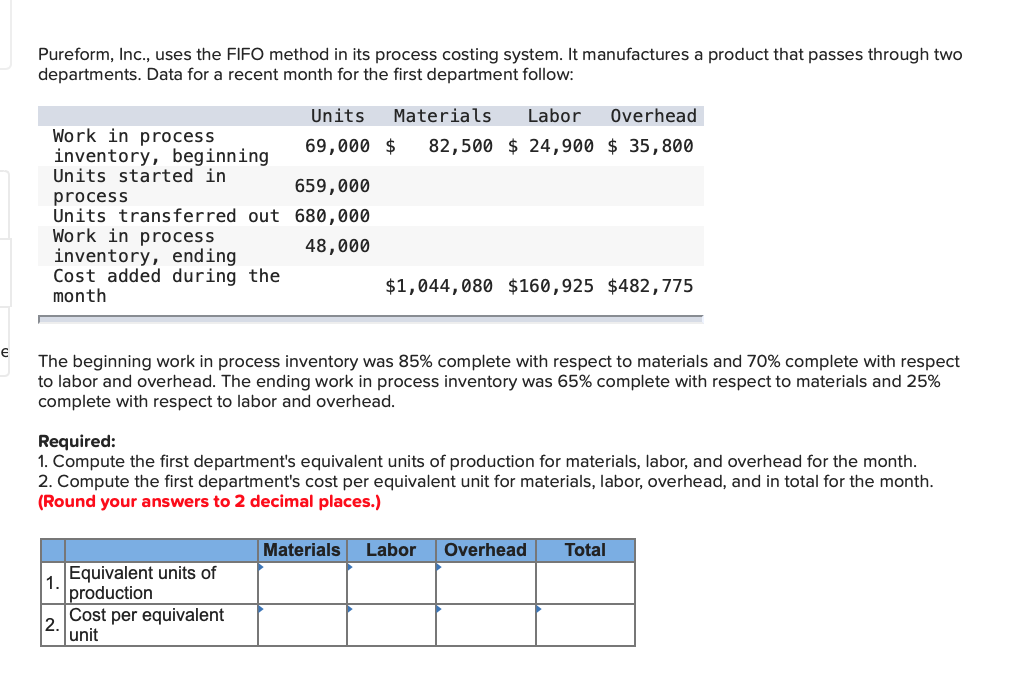

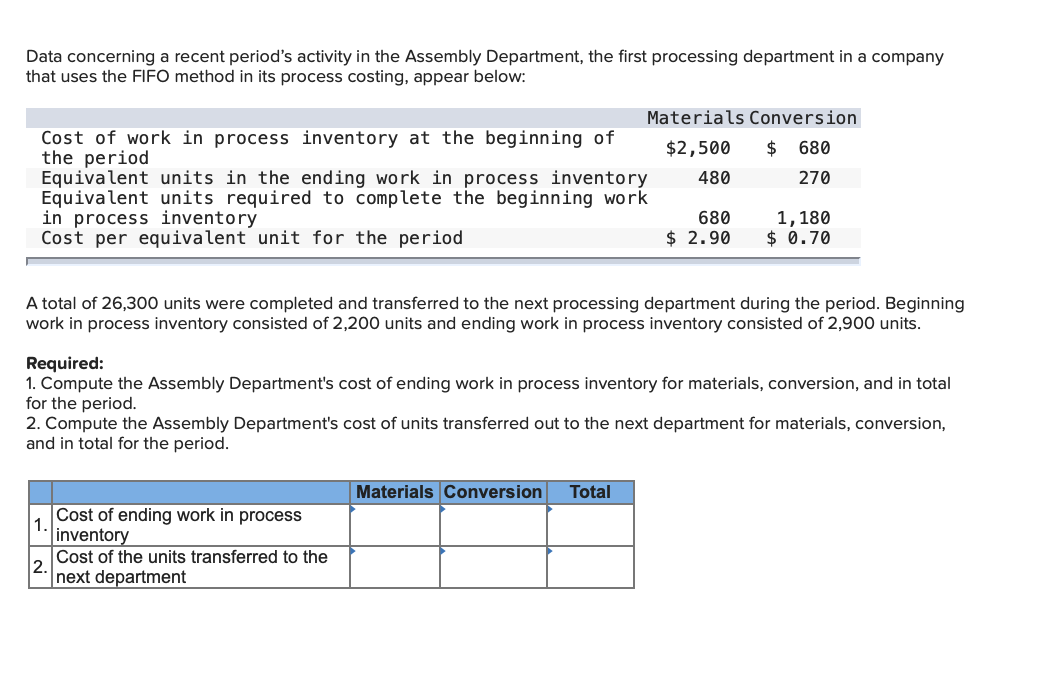

Madison Park Clo-op, a whole foods grocery and gift shop, has provided the following data to be used in its service department cost allocations: Service Departments Operating Departments Administration Janitorial Groceries Gifts Departmental. costs , , , , before allocations $198,.IIB $68,888 $3,818,888 $348,8II Employeehours 560 318 2,748 150 15%;? CCUP1Ed'5q"are an 1,009 9, 109 9II ' Required: Using the step-d own method, allocate the costs of the service departments to the two operating departments. Allocate Administration rst on the basis of employee-hours and then Janitorial on the basis of space occupied. (Please enter allocations from a department as negative and allocations to a department as positive. The line should add across to zero. Do not round intermediate calculations. Round your answers to the nearest IIiwl'lole dollar amount.) Departmental costs $ $ before allocations 5 190.000 5 50.000| 3,310,000 $340900 4,400,000 Allocation: Administration costs Janitorial costs Total costs after allocation Seattle Western University has provided the following data to be used in its service department cost allocations: Service Departments Oge rating Depa rtments Facility Undergraduate Graduate Administration Services Programs Programs Eggggmgga: $2,400,000 $1,500,000 $26,800,000 $5,700,000 Student credithours 20,000 5,000 $22533 ccu91Ed'5q\"are 25,000 10,000 70,000 30,000 ' Required: Using the direct method. allocate the costs of the service departments to the two operating departments. Allocate the Administration cost on the basis of student credithours and the Facility Services cost on the basis of space occupied. (Please enter allocations from a department as negative and allocations to a department as positive. The line should add across to zero. Do not round intermediate calculations.) Departmental costs $ $ $ before allocations $ 2'400'000 1,600,000' $ 26'800'000 5,700,000 36,500,000 Allocations: Administration costs Facility services costs Total costs after $ $ $ allocation $ 2'400'000 1,600,000 $ 26300300 5,700,000 36,500,000 Pureform, Inc., uses the FIFO method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: Units Materials Labor Overhead Work in process inventory, beginning 69, 000 $ 82,500 $ 24,900 $ 35, 800 Units started in process 659, 000 Units transferred out 680,000 Work in process inventory, ending 48, 000 Cost added during the month $1, 044, 080 $160,925 $482, 775 The beginning work in process inventory was 85% complete with respect to materials and 70% complete with respect to labor and overhead. The ending work in process inventory was 65% complete with respect to materials and 25% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Compute the first department's cost per equivalent unit for materials, labor, overhead, and in total for the month. (Round your answers to 2 decimal places.) Materials Labor Overhead Total Equivalent units of production 2. Cost per equivalent unitData concerning a recent period's activity in the Assembly Department, the rst processing department in a company that uses the FIFO method in its process costing, appear below: Materials Conversion Cost of work in process inventory at the beginning of $2 588 $ 68. l . the period Equivalent units in the ending work in process inventory 480 276 Equivalent units required to complete the beginning work in process inventory 688 1,18. Cost per equivalent unit for the period $ 2.90 $ 0.76 ' A total of 26,300 units were completed and transferred to the next processing department during the period. Beginning work in process inventory consisted of 2,200 units and ending work in process inventory consisted of 2,900 units. Required: 1. Compute the Assembly Department's cost of ending work in process inventory for materials, conversion, and in total for the period. 2. Compute the Assembly Department's cost of units transferred out to the next department for materials, conversion, and in total for the period. Cost of ending work in process invento 2 Cost of the units transferred to the ' next den = rtment