Question: please need help on this I am sorry I forgot to add the tables and exhibit 10-10 automobile depreciation limits Required information [The following iffomation

![following iffomation applies to the questions displayed below] Lina purchased a new](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fb91fe1a57a_94166fb91fda78e2.jpg)

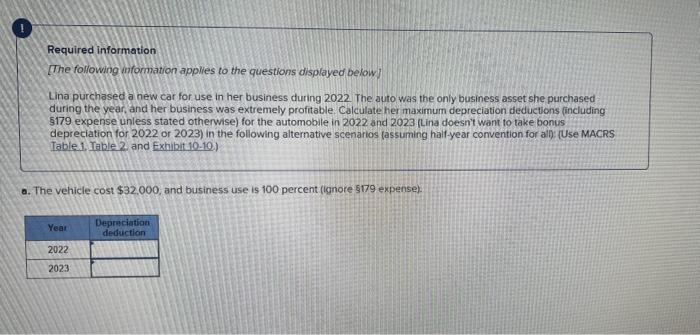

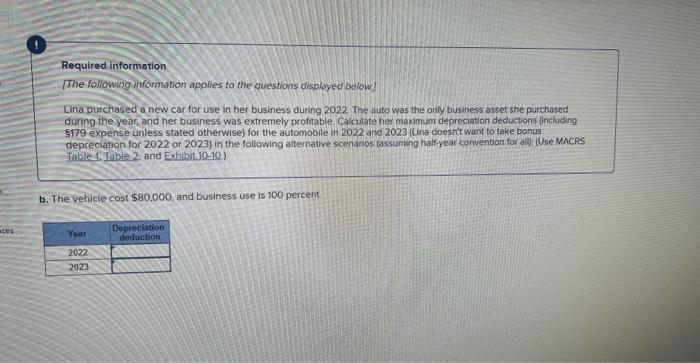

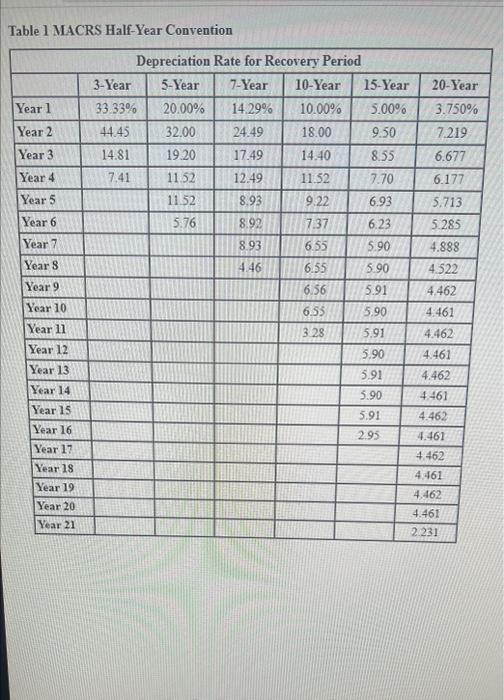

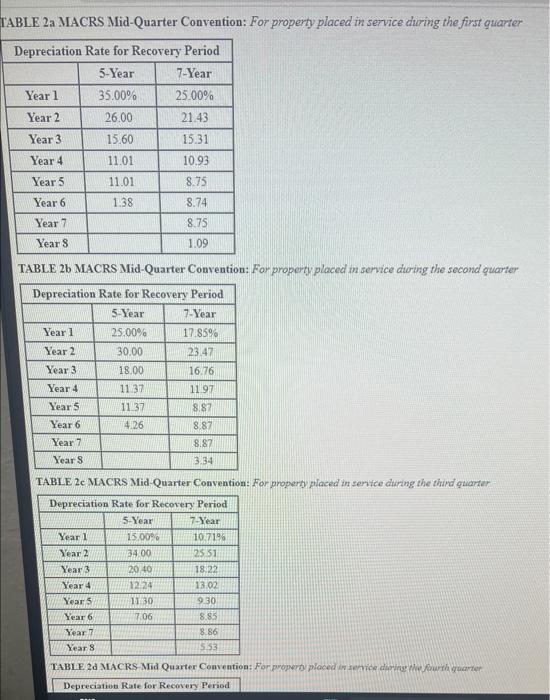

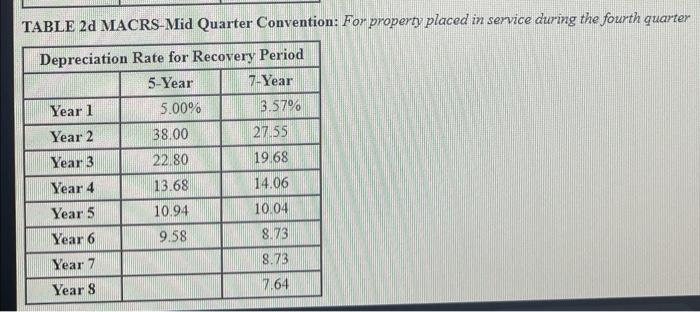

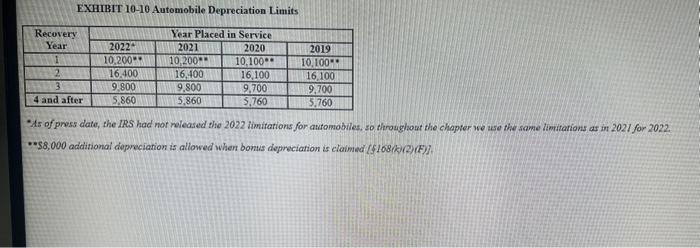

Required information [The following iffomation applies to the questions displayed below] Lina purchased a new car for use in her business during 2022. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including 5179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesnt want to take bonus depreciation for 2022 or 2023 ) in the following alternative scenarios (assuming half-year convention for alj) (Use MACRS Table 1. Table 2 and Exhibit 10-10) a. The vehicle cost $32.000, and business use is 100 percent (ignore $179 expense). Required information [The-following information applies to the questions displayed be/ow] Lina purchased a new car for use in her business during 2022. The auto was the only business asset she purchased during the year, and her business was extremely profinable. Calculate her maximum depreciation deductions fincluding $179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesnit want to take bonus depreciation for 2022 or 2023 ) in the following alternative scenanos (assuming half-year convention for a d) (Use MACFS Table 1. Table 2 and Exhibit 10-10.) b. The vehicie cost $80,000, and business use is 100 percent Required information [The following information applies to the questions displayed below] Lina purchased a new car for use in her business during 2022. The duto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductons (including $179 expense unless stated otherwise) for the automobile in 2022 and 2023 (Lina doesit want to take bonas depreciation for 2022 or 2023 ) in the following alternative scenarios (assuming has -year convention for alh; (Use MaCRS Table 1. Table 2, and Exhibit 10-10.) c, The vehicle cost $80,000, and she used it 80 percent for business. Table 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first guarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service dioring the second quarter TABIE 2c MACRS Mid-Quarter Convention: For propery placed in sentce wuring the thind quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter EXHIBIT 10-10 Automobile Depreciation Limits -As of press date, the IRS had nor released the 2022 limitations for automobiles, so throughout the chapter we we the same Limitarions as in 2021 for 2022. *"S8,000 additional depreciation is allowed when bomis depreciation is claimnd (\$108(k)(2)/F)]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts