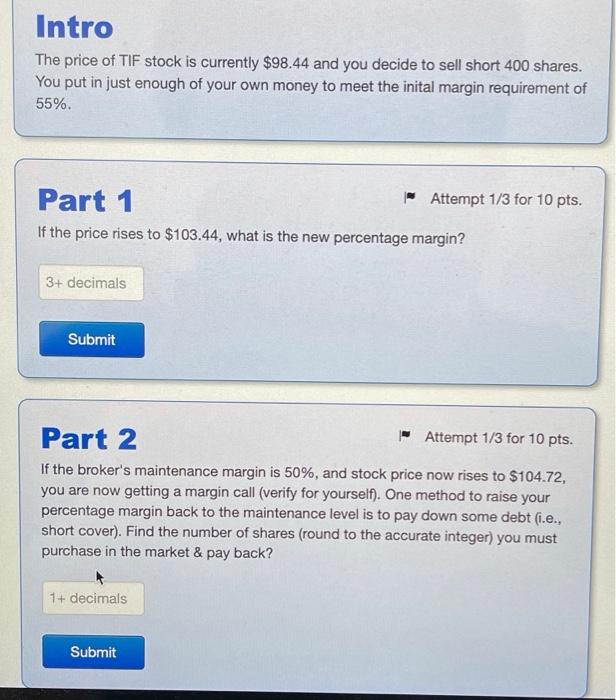

Question: please need help solving this! thank you :) Intro The price of TIF stock is currently $98.44 and you decide to sell short 400 shares.

Intro The price of TIF stock is currently $98.44 and you decide to sell short 400 shares. You put in just enough of your own money to meet the inital margin requirement of 55% Part 1 - Attempt 1/3 for 10 pts. If the price rises to $103.44, what is the new percentage margin? 3+ decimals Submit Part 2 - Attempt 1/3 for 10 pts. If the broker's maintenance margin is 50%, and stock price now rises to $104.72, you are now getting a margin call (verify for yourself). One method to raise your percentage margin back to the maintenance level is to pay down some debt (i.e., short cover). Find the number of shares (round to the accurate integer) you must purchase in the market & pay back? 1+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts