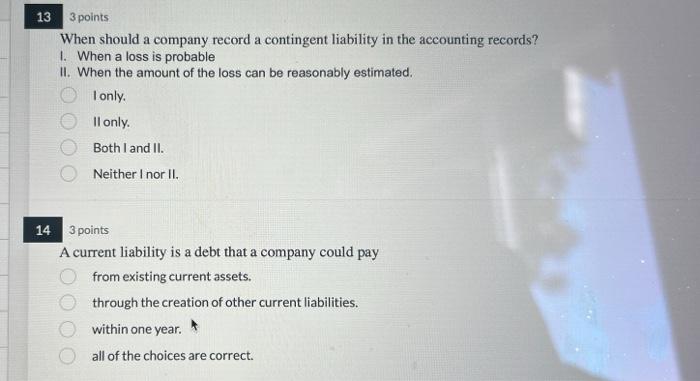

Question: please need help with all four When should a company record a contingent liability in the accounting records? I. When a loss is probable II.

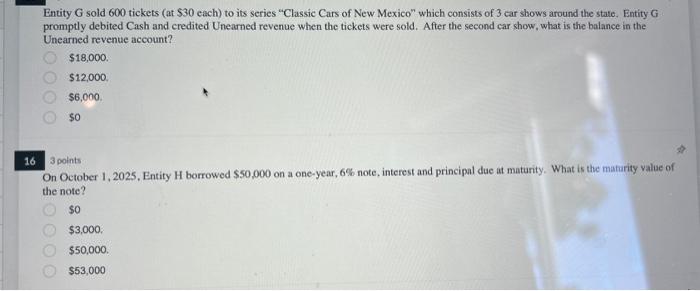

When should a company record a contingent liability in the accounting records? I. When a loss is probable II. When the amount of the loss can be reasonably estimated. Ionly. II only. Both I and II. Neither I nor II. 3 points A current liability is a debt that a company could pay from existing current assets. through the creation of other current liabilities. within one year. all of the choices are correct. Entity G sold 600 tickets (at $30 each) to its series "Classic Cars of New Mexico" which consists of 3 car shows around the state. Entity G promptly debited Cash and credited Unearned revenue when the tickets were sold. After the second car show, what is the balance in the Unearned revenue account? $18,000.$12,000.$6,000$0 3 points On October 1,2025 , Entity H borrowed $50,000 on a one-year, 6% note, interest and principal due at maturity. What is the maturity value of the note? so $3,000. $50,000. $53,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts