Question: Please need help with excel functions and can you please explain how we would get the begining balances like if there is a function i

Please need help with excel functions and can you please explain how we would get the begining balances like if there is a function i need to do to get those. Also the cells go all the way down to 120 for the last part of the question. Tha

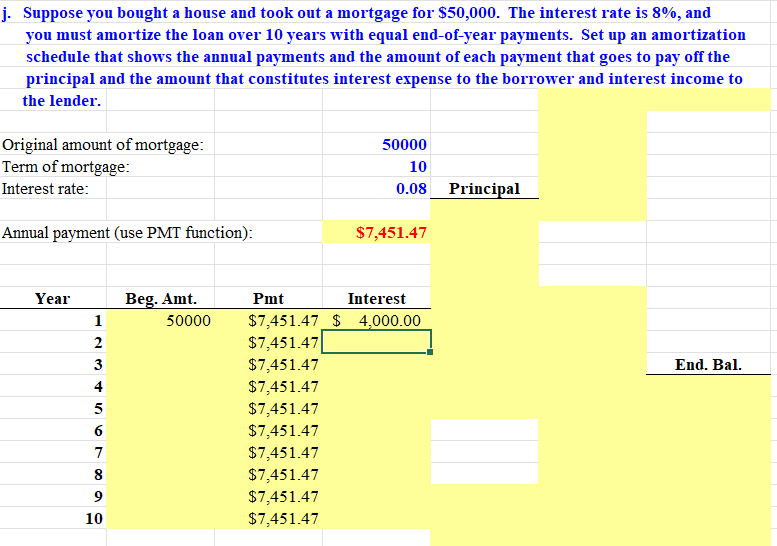

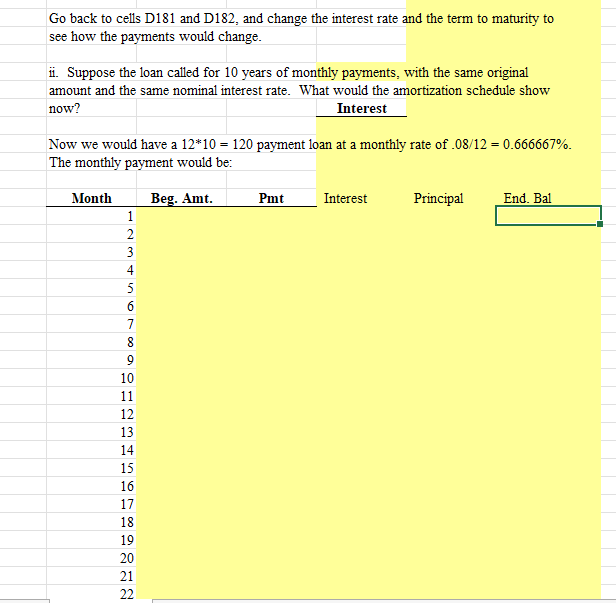

j. Suppose you bought a house and took out a mortgage for $50,000. The interest rate is 8%, and you must amortize the loan over 10 years with equal end-of-year payments. Set up an amortization schedule that shows the annual payments and the amount of each payment that goes to pay off the principal and the amount that constitutes interest expense to the borrower and interest income to the lender. Original amount of mortgage: Term of mortgage: Interest rate: 50000 10 0.08 Principal Annual payment (use PMT function): $7,451.47 Year Beg. Amt. 50000 AN End. Bal. 1 2 3 4 5 6 7 8 9 10 Pmt Interest $7,451.47 $ 4,000.00 $7,451.471 $7,451.47 $7,451.47 $7,451.47 $7,451.47 $7,451.47 $7,451.47 $7,451.47 $7,451.47 Extensions: i. Create a graph that shows how the payments are divided between interest and principal repayment over time. Principal Go back to cells D181 and D182, and change the interest rate and the term to maturity to see how the payments would change. . Suppose the loan called for 10 years of monthly payments, with the same original amount and the same nominal interest rate. What would the amortization schedule show now? Interest Now we would have a 12*10 = 120 payment loan at a monthly rate of 08/12 = 0.666667%. The monthly payment would be: Month Beg. Amt. Pmt Interest Principal End. Bal 2 3 5 6 OD 0 au 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts