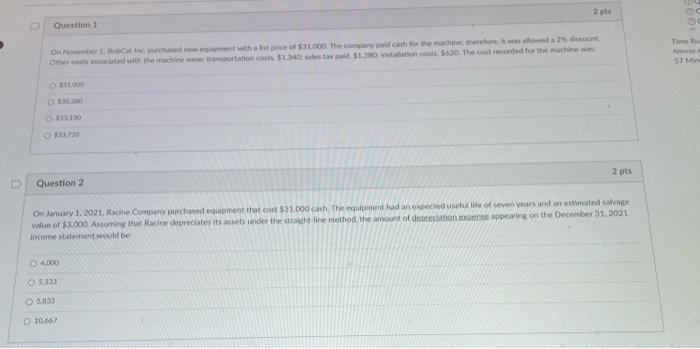

Question: PLEASE NEED HELP with these 2 pts Question 1 on November twee with of $31.000. The company for them therefore, we dont Othered with the

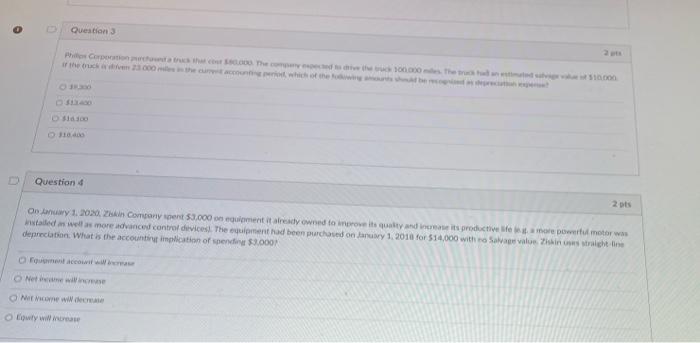

2 pts Question 1 on November twee with of $31.000. The company for them therefore, we dont Othered with the machine were transportation costs $1340 Males tax paid 51.300 instalation cost 5620 The cost recorded for the machine was The A 12 M $1.000 3.300 100 21 Question 2 On January 1, 2021, Racine Cominany purchased equipment that cost $31.000 cath. The print had an expected us to ve years and animated sales walue of $1.000 Amintha Racine depreciates its assets under the straight line method the amount of detection exces appearing on the December 31, 2021 Income statement would be 4.000 O5333 583 10.08 Question Photo The 100.000 the 10.000 D. D Question 4 2 os Ondary 1.2020. in Companyent 51.000 mentity owned to investy and increase its productive more powerful motor installed as well as more advanced control devices. The read been purchased on January 1, 2016 for $14,000 with no Salve value in straight line depreciation. What is the account implication of spending $3.0001 Oferent accorif Warma Net Vince come wW deca Origly will increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts